Balance Sheet Template

- DOCUMENTS

- GUIDANCE

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

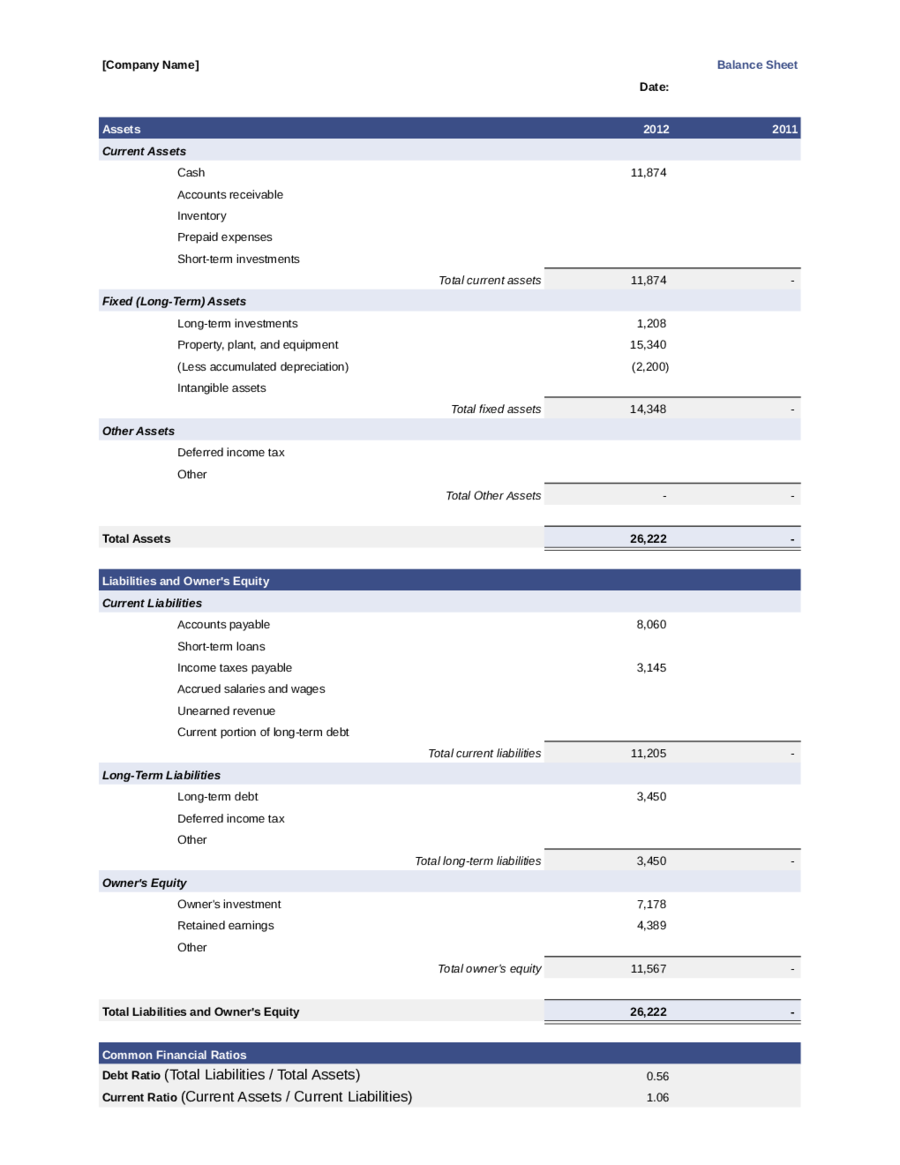

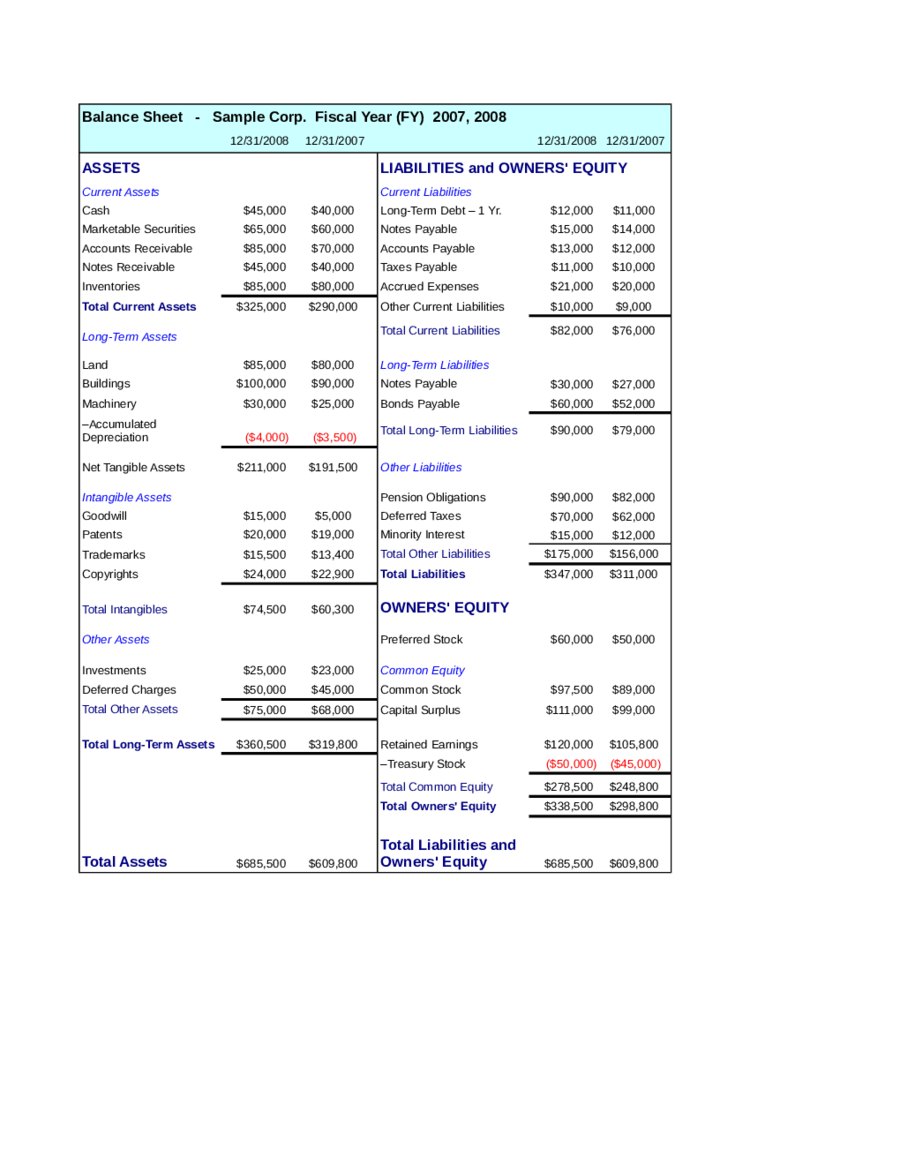

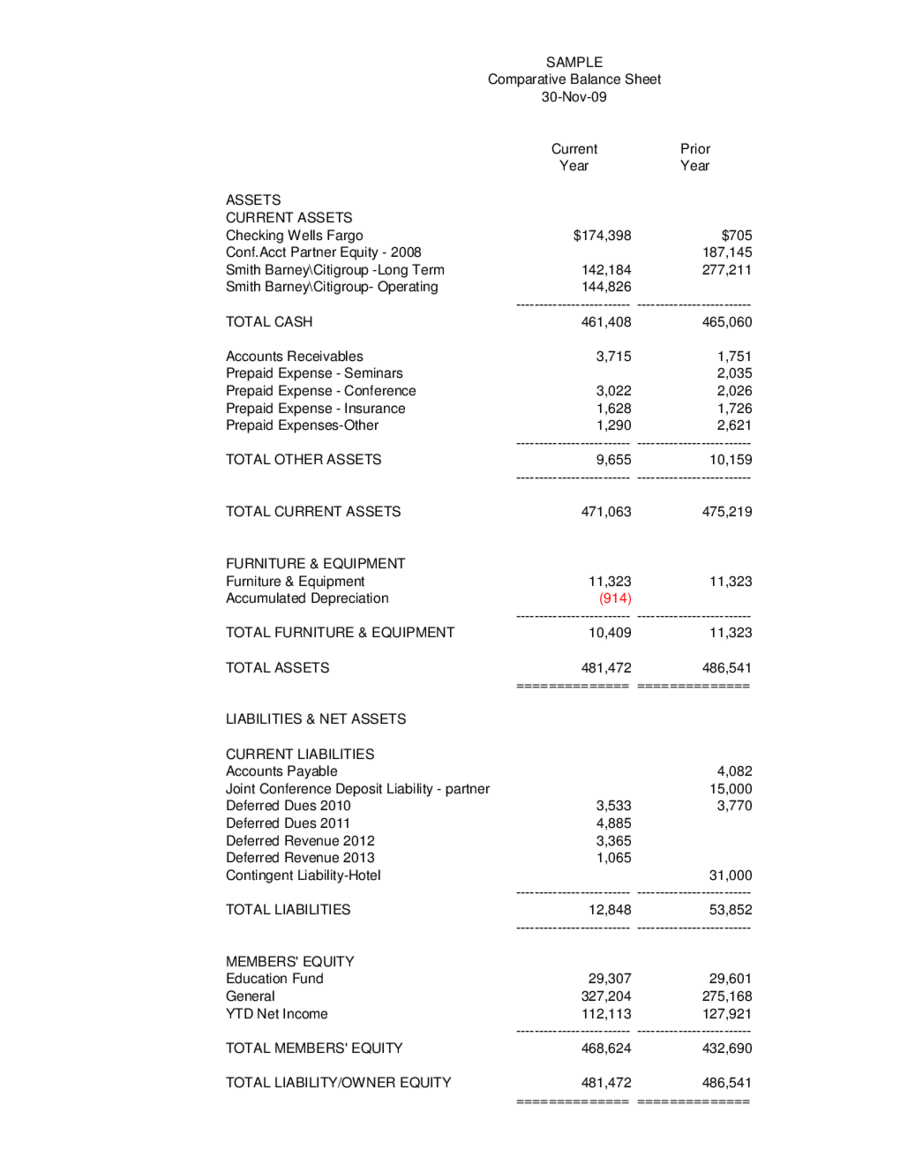

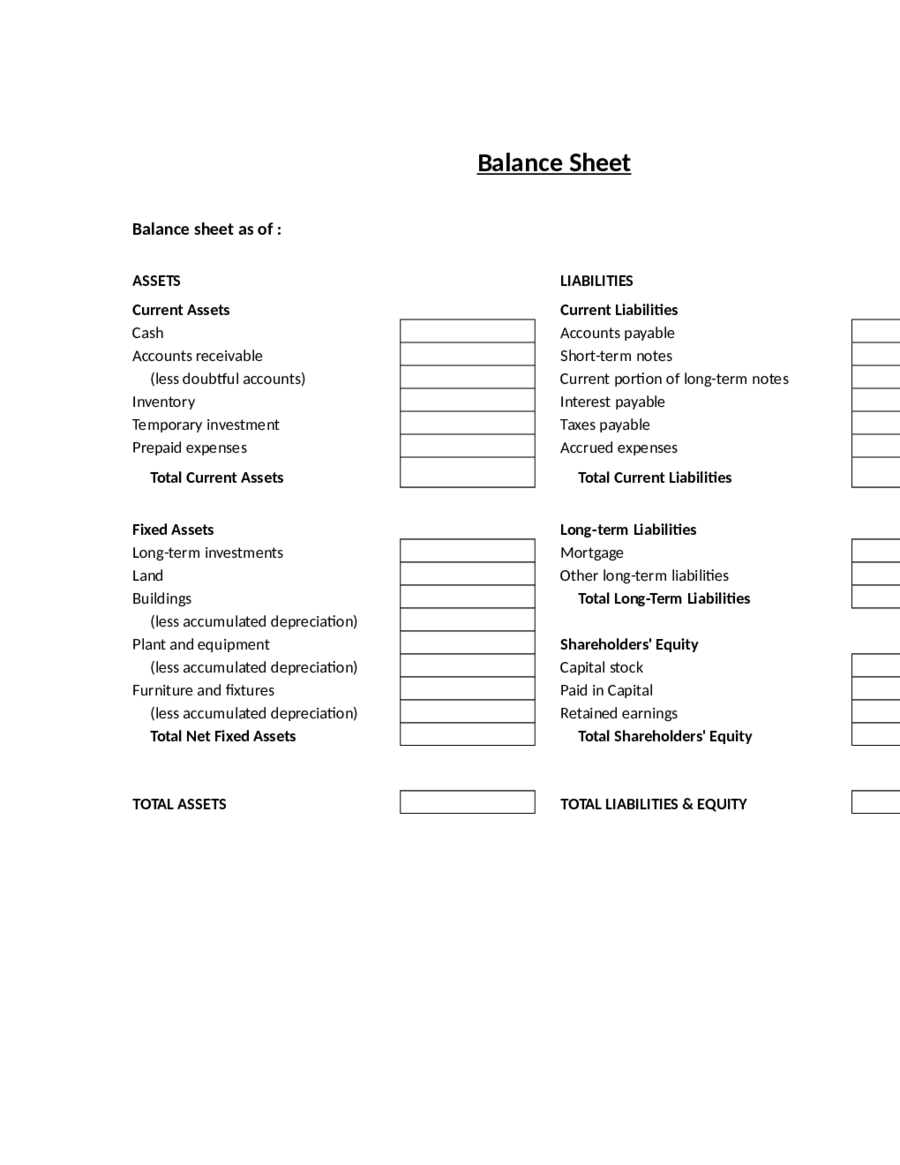

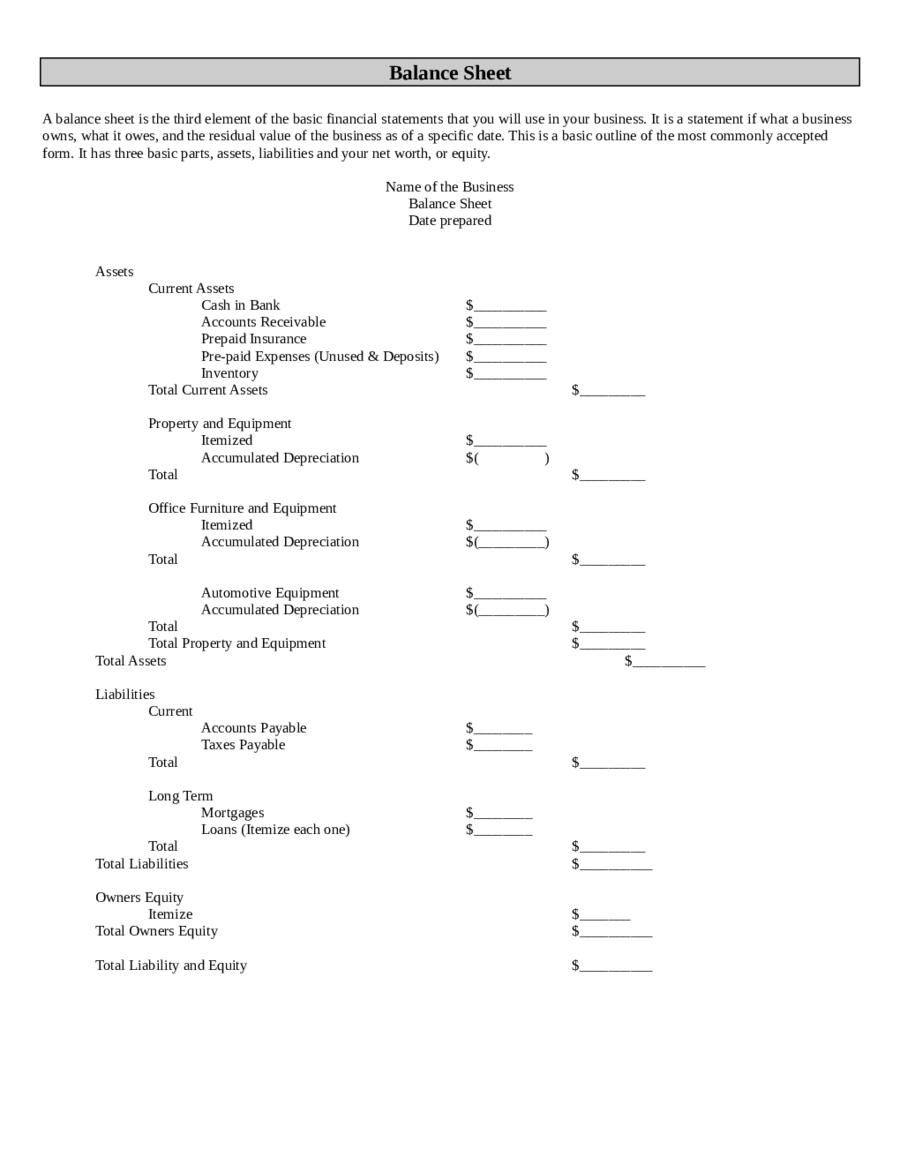

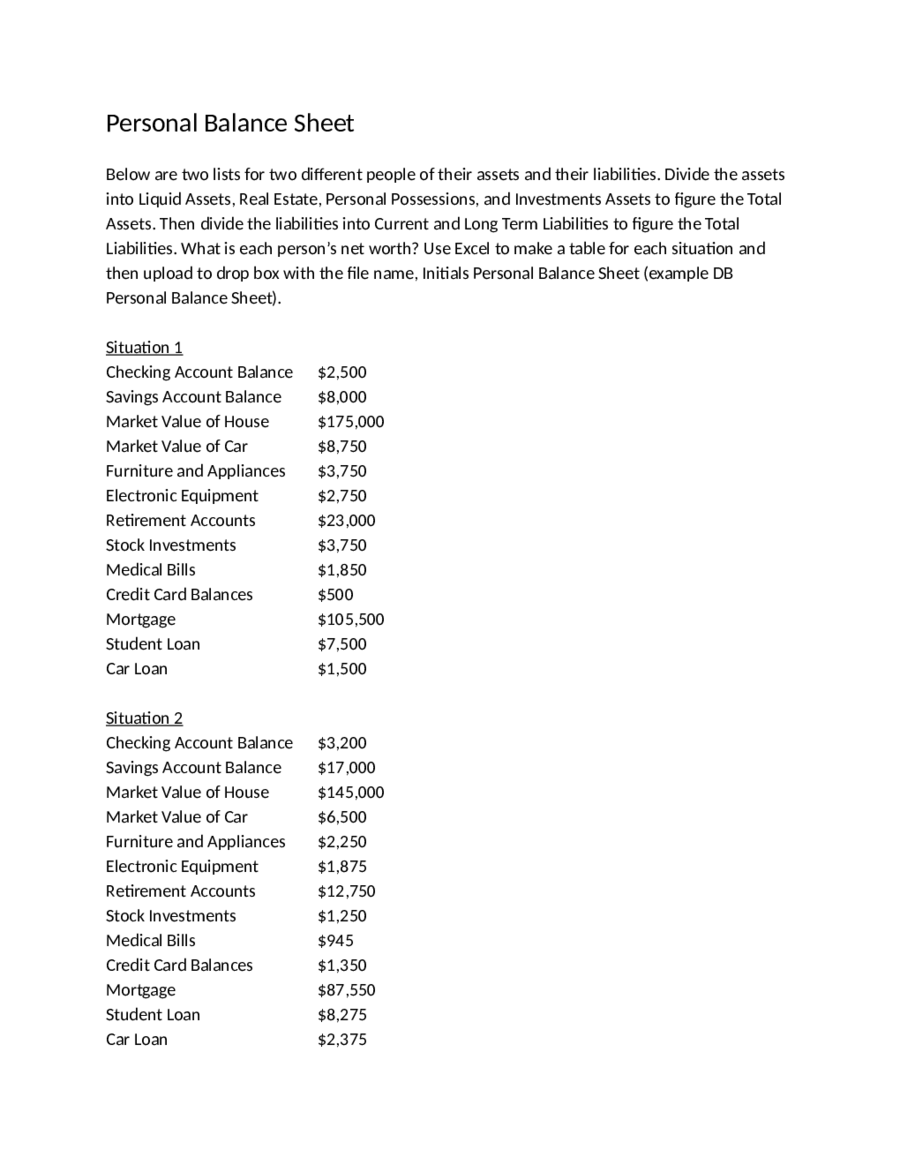

Edit & Download

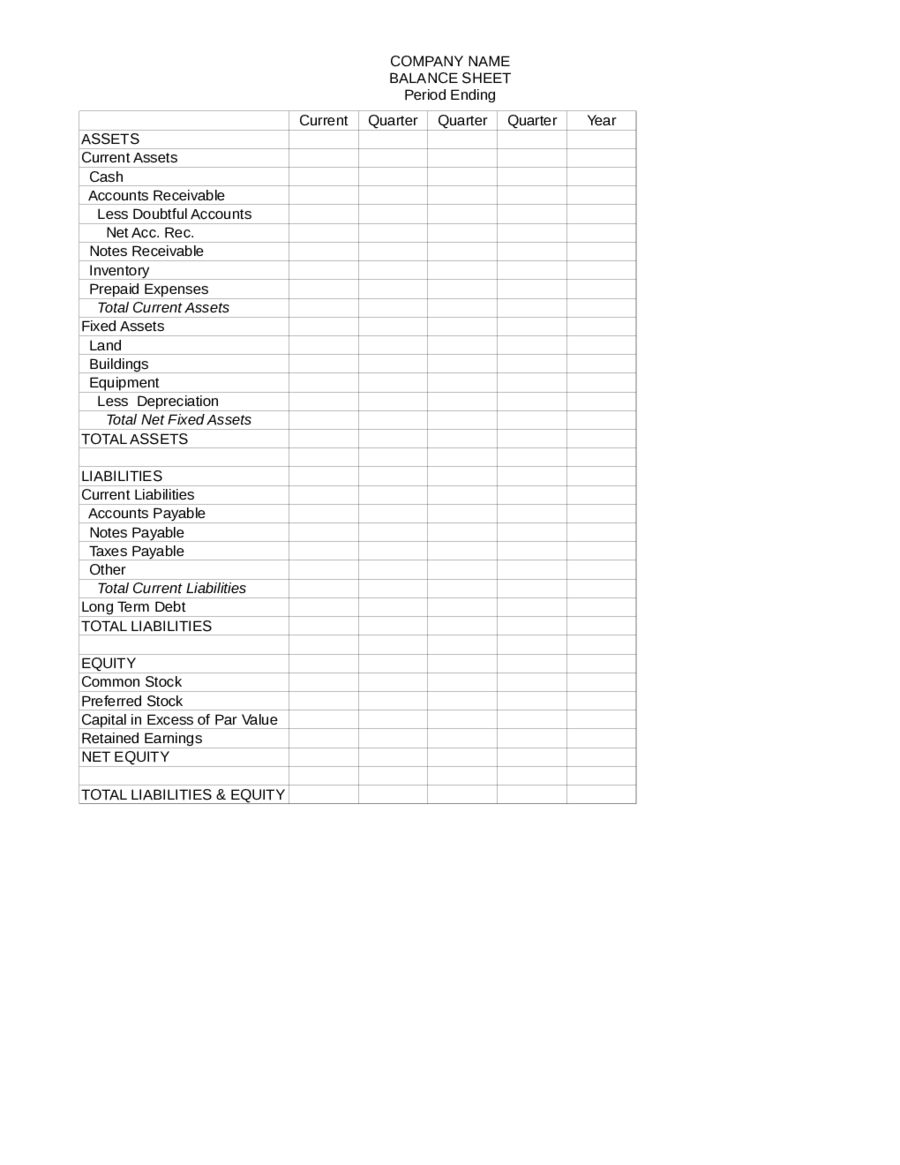

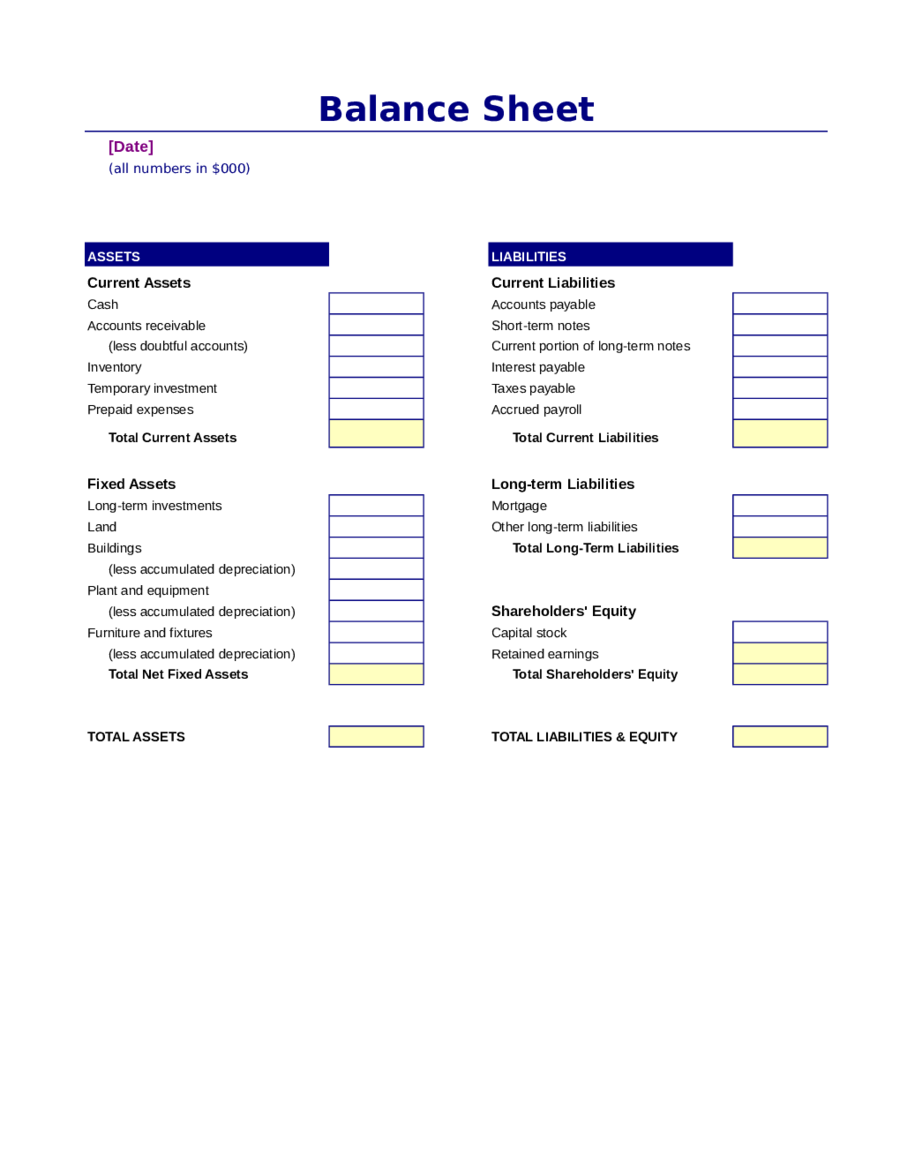

If you are an owner of a company or you are the accountant of the same it is important you must have a proper balance sheet of your organisation. It is evident that without balance sheet organisations will not be able to fulfil certain obligations required to run a business. In present business context, the importance of balance sheet has increased in a significant way and it is also true that the same is helping the companies for the smooth running of their businesses.Since balance sheets are very important so it is also crucial that balance sheet format should be proper and perfect. You might lack perfection in framing the proper balance sheet format or a standard balance sheet. But you need not worry as there are numbers of professional websites available online which are offering free balance sheet template. All you need to do is to avail these templates and serve your purpose.

Balance sheet definition

The simple definition of balance sheet states that it is the statement which involves the financial affairs of a company that too in a given period of time. It is also known as statement of financial position and it can be for an organisation or also for an individual. Usually there are four crucial financial statements available and used in the context of business, but balance sheet is the only one which applies to a specific point of time for a business in a calendar year. Balance sheets are mainly calculated at the interval of every quarter, every six months or at the interval of a fiscal year, as per the organisation’s demands.So one has to be very professional and maintain proper balance sheet format to make the best out of it. But it might be difficult for the corporate account managers or for the accountants to get the proper structure of the same. In this context professional templates can be really very helpful as they have the proper format and are even editable. So it is better not to waste time in making them by yourself, instead try the balance sheet template to serve your purpose in a better way.Purpose of a balance sheet

The basic purpose of a balance sheet is to offer a detailed idea regarding the financial strength of the company or its position. It is mainly done by demarcating the total assets owned by the given company and any given amounts that it indebted to banks or to the corporate lenders. (For an instance it may be the amount of the equity also)It is important to note that balance sheet does not show the exact results, and even if the balance of accounts from different time frames is shown, a final conclusion cannot be drawn.How balance sheet works?

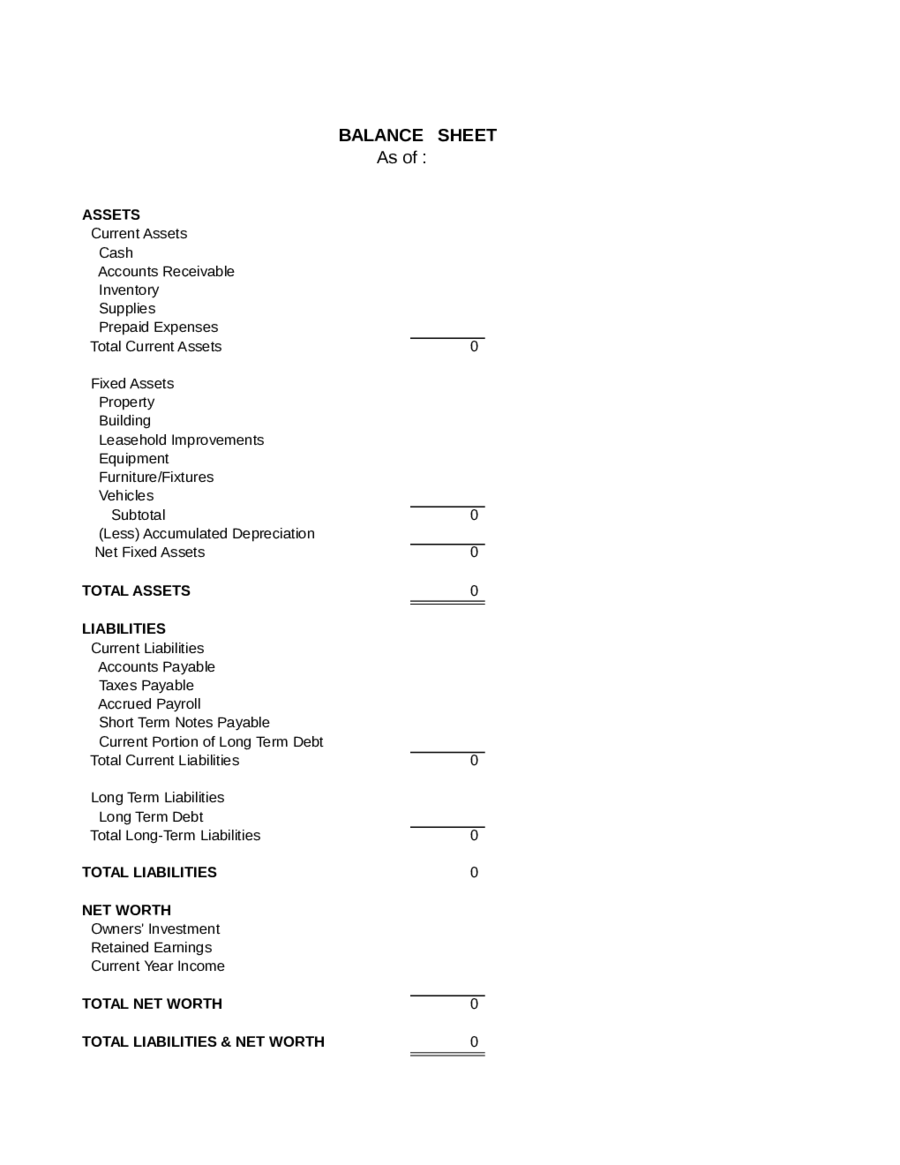

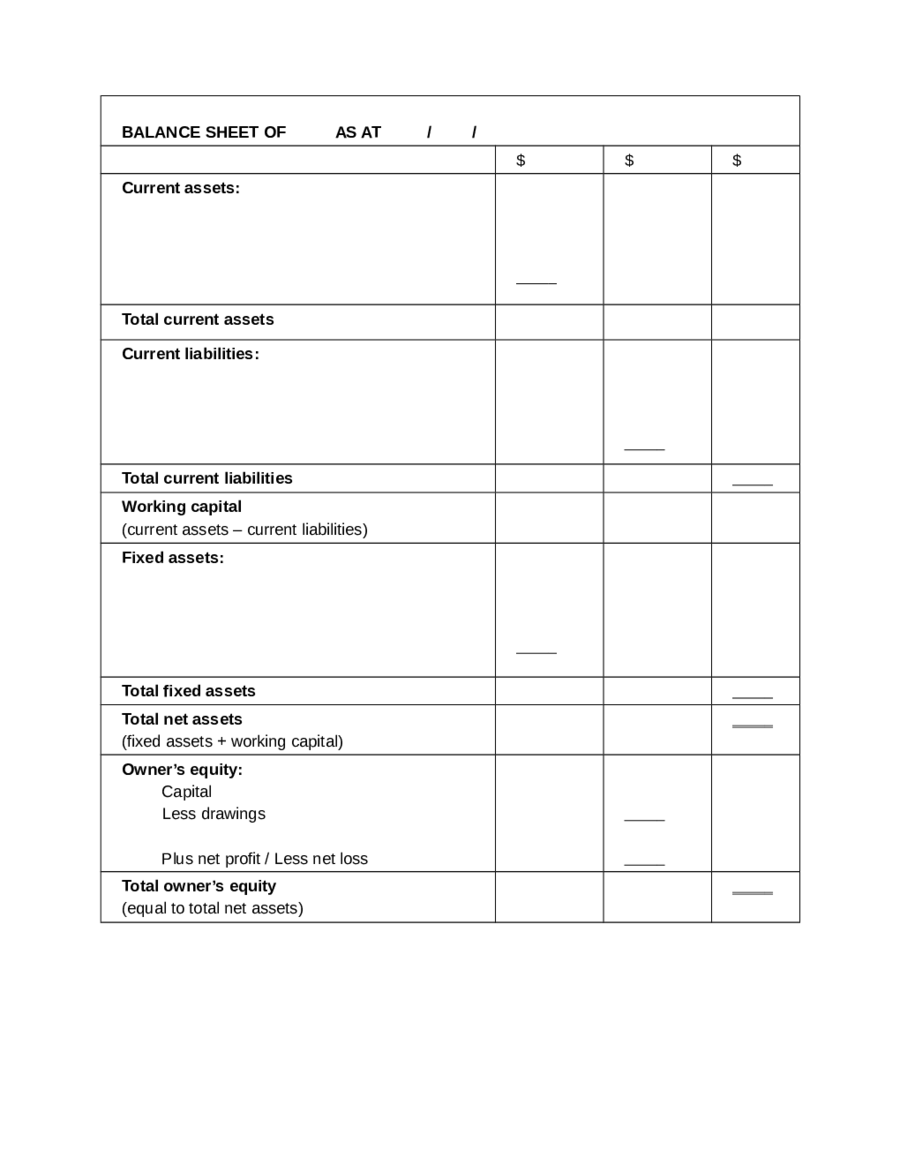

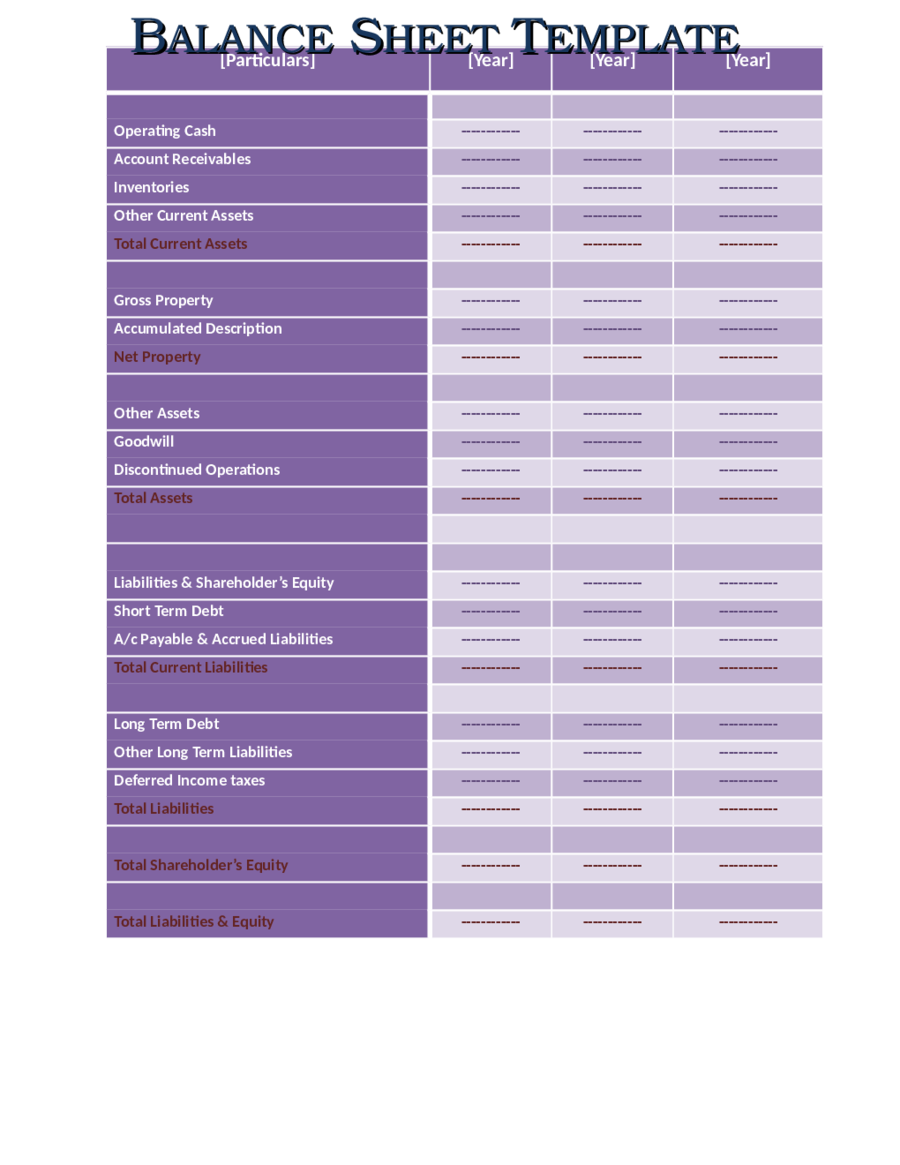

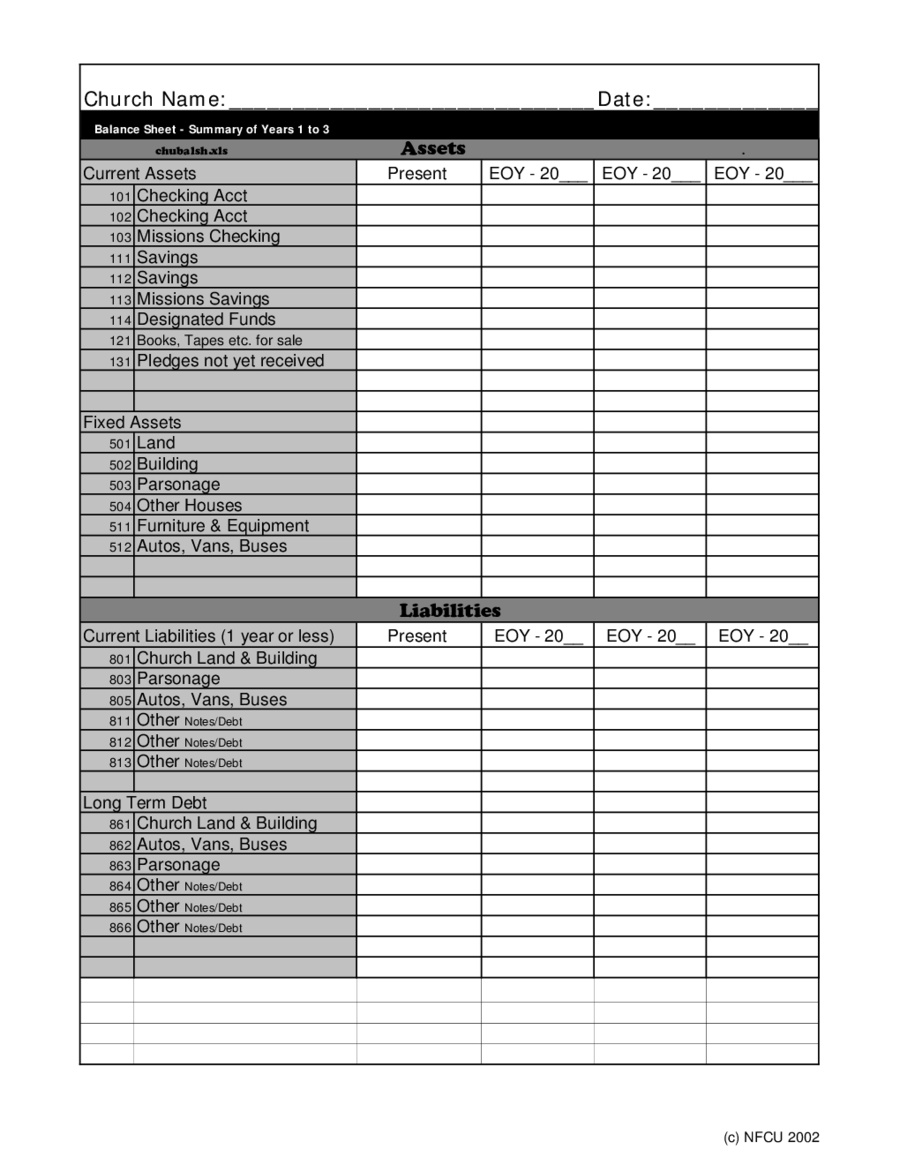

This is the most important aspect which is very crucial to understand in order to form the balance sheet. Usually these documents have two sides and they must be equal or balanced to each other, then only it will be a perfect balance sheet document. Evidently the logic behind this is even simpler than it actually seems and it is: an organisation must pay for its assets through borrowing capital from different investors, financial institutions or from lenders.Let’s consider an example:Suppose an organisation named ABC takes out a loan of £5,000 from any given financial institution, so the assets of this organisation will increase by £5,000, but at the same time the liabilities will also increase by £5,000. In this way it effectively balances the accounts of the given organisation.Formula behind framing the balance sheet is-Assets= Equity + LiabilitiesWhat are the types of balance sheet?

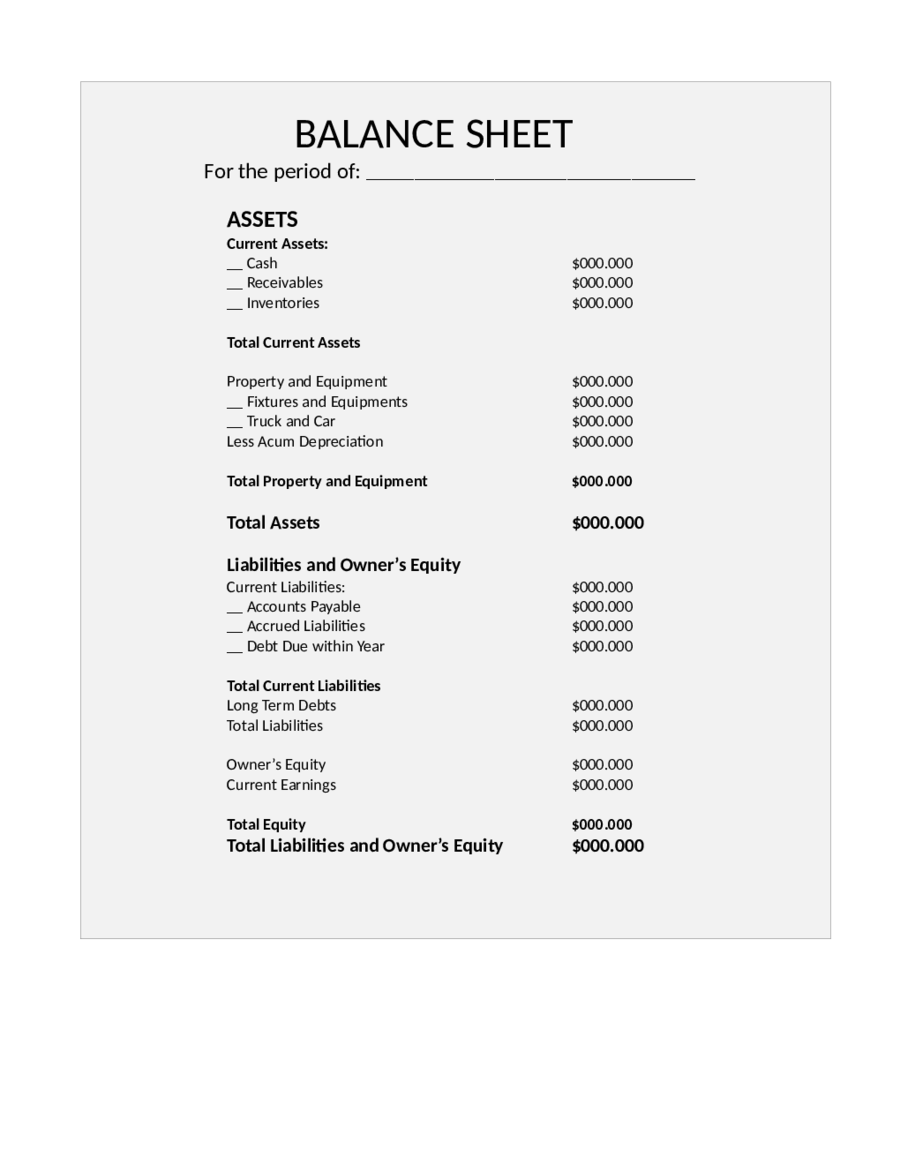

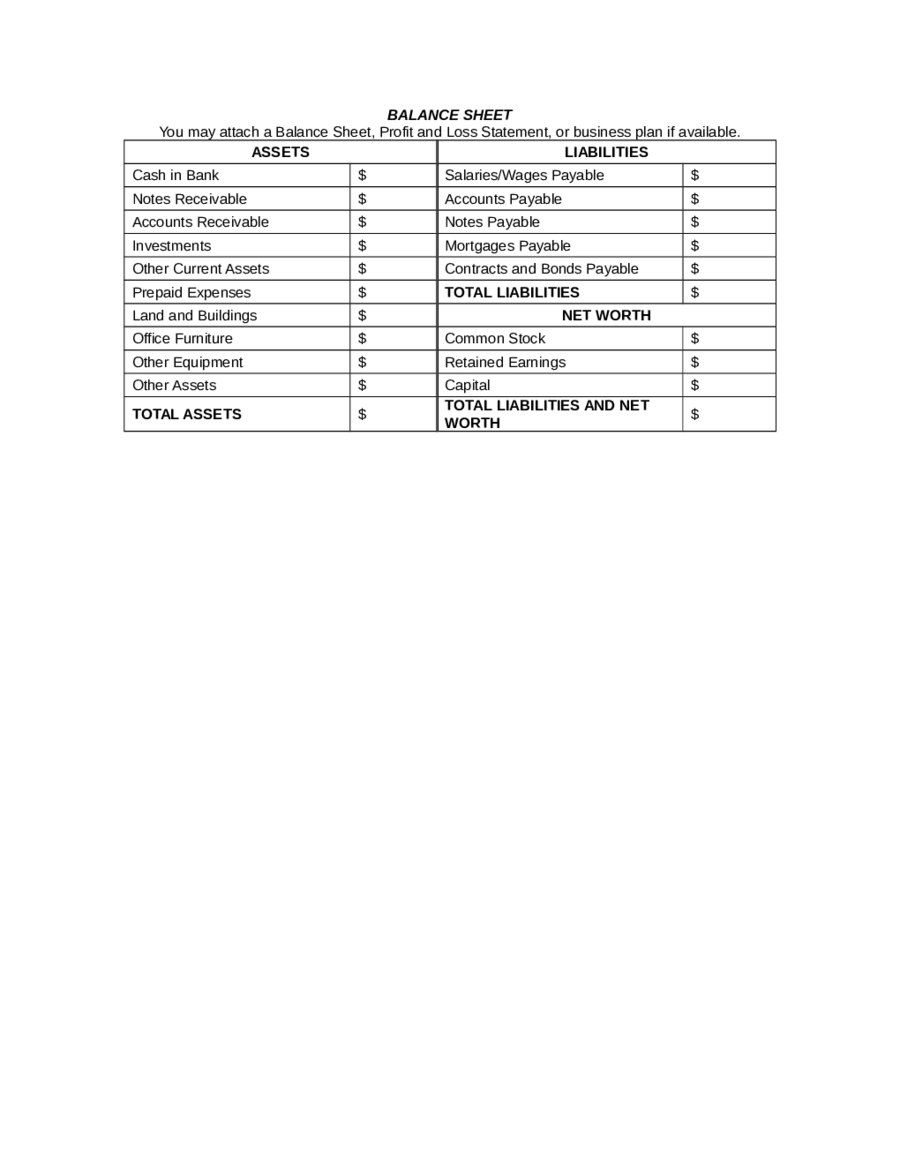

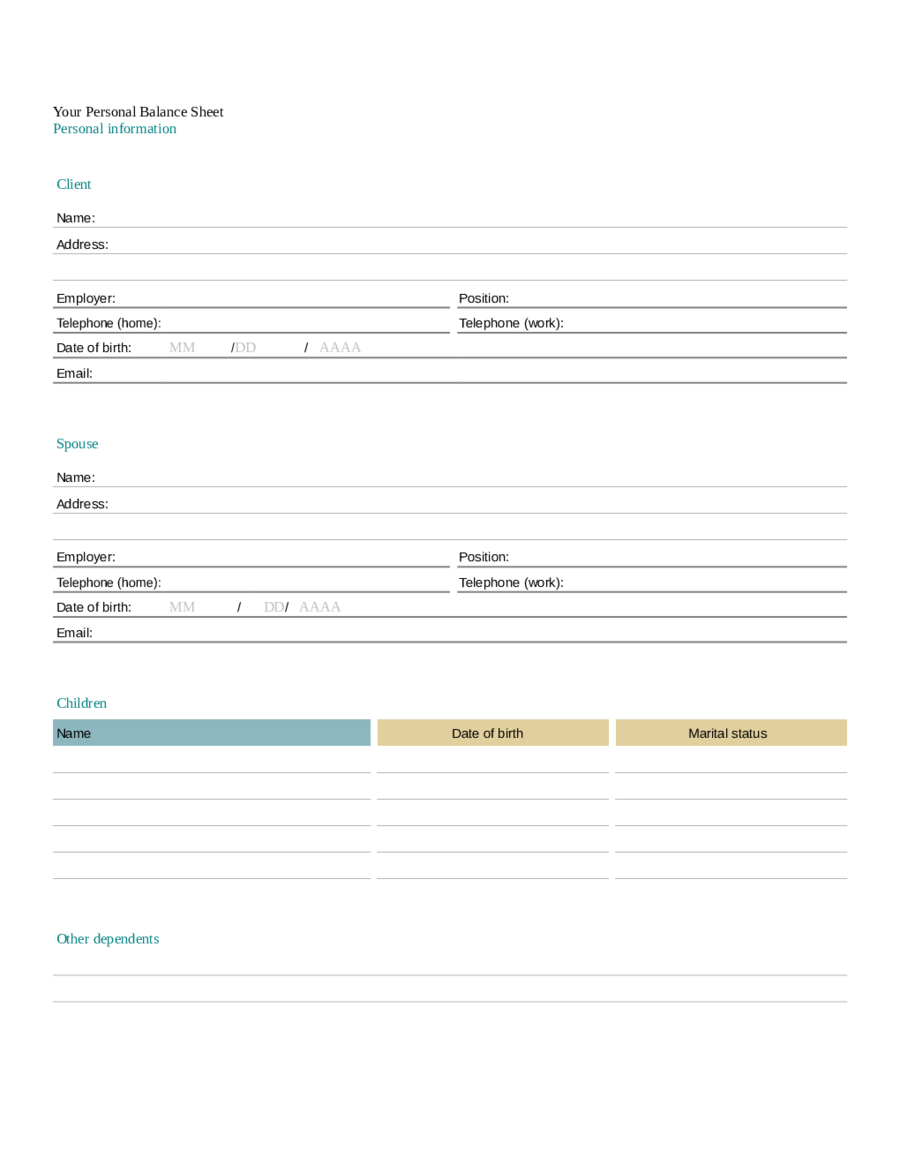

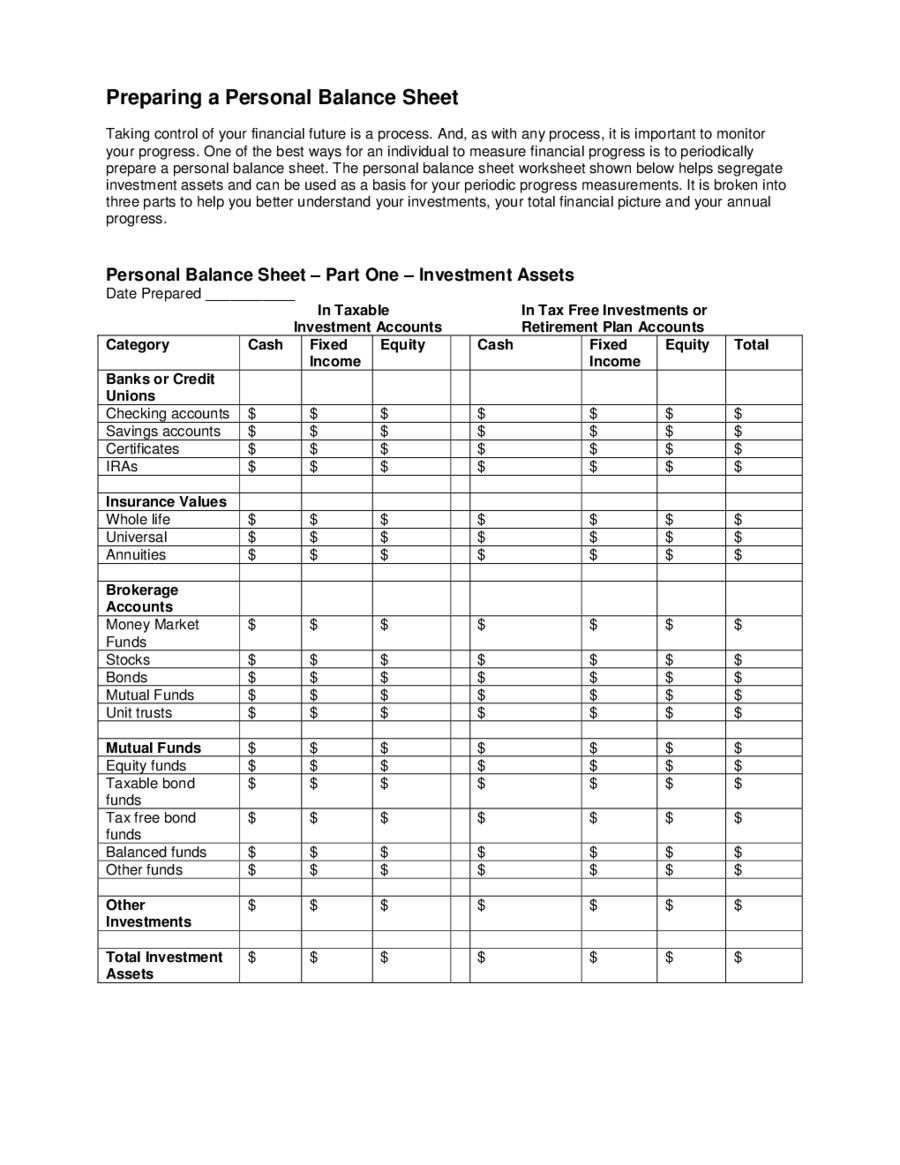

It is already explained that balance sheet précises assets of an individual or an organisation along with the liabilities and assets of the same at a given point of time. Mainly there are two types of balance sheet available and they are account form and report form. It is true and relevant also that large businesses seek for complex balance sheets whereas small companies or individuals usually have simple balance sheets.Personal balance sheet

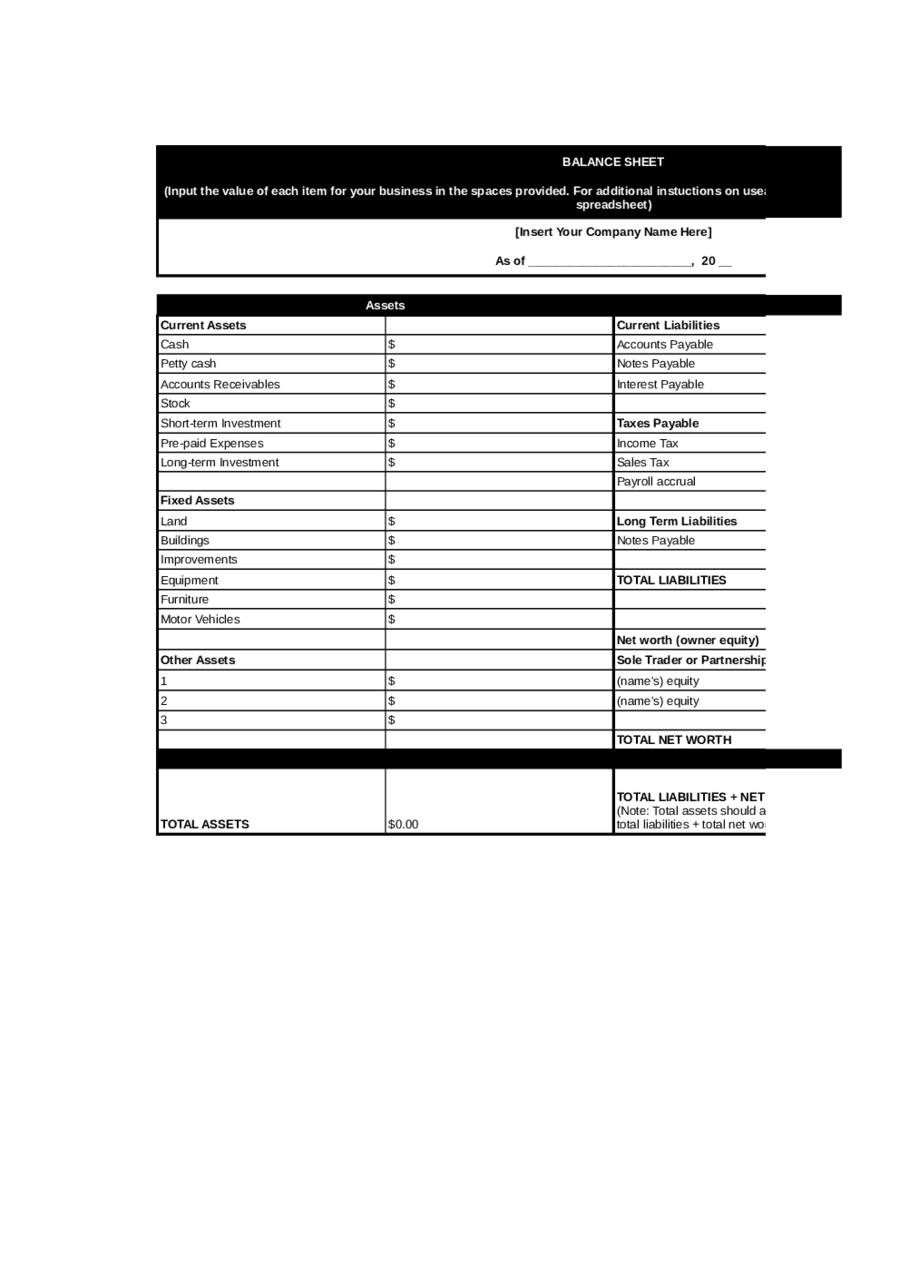

This type of balance sheet mainly includes current assets like saving and checking accounts, current liabilities like mortgage debt, loan debt or due, long-term assets like real estate and common stock, etc. It is important to note that personal net worth is actually the difference between an individual’s total liabilities and assets.Small Business balance sheet

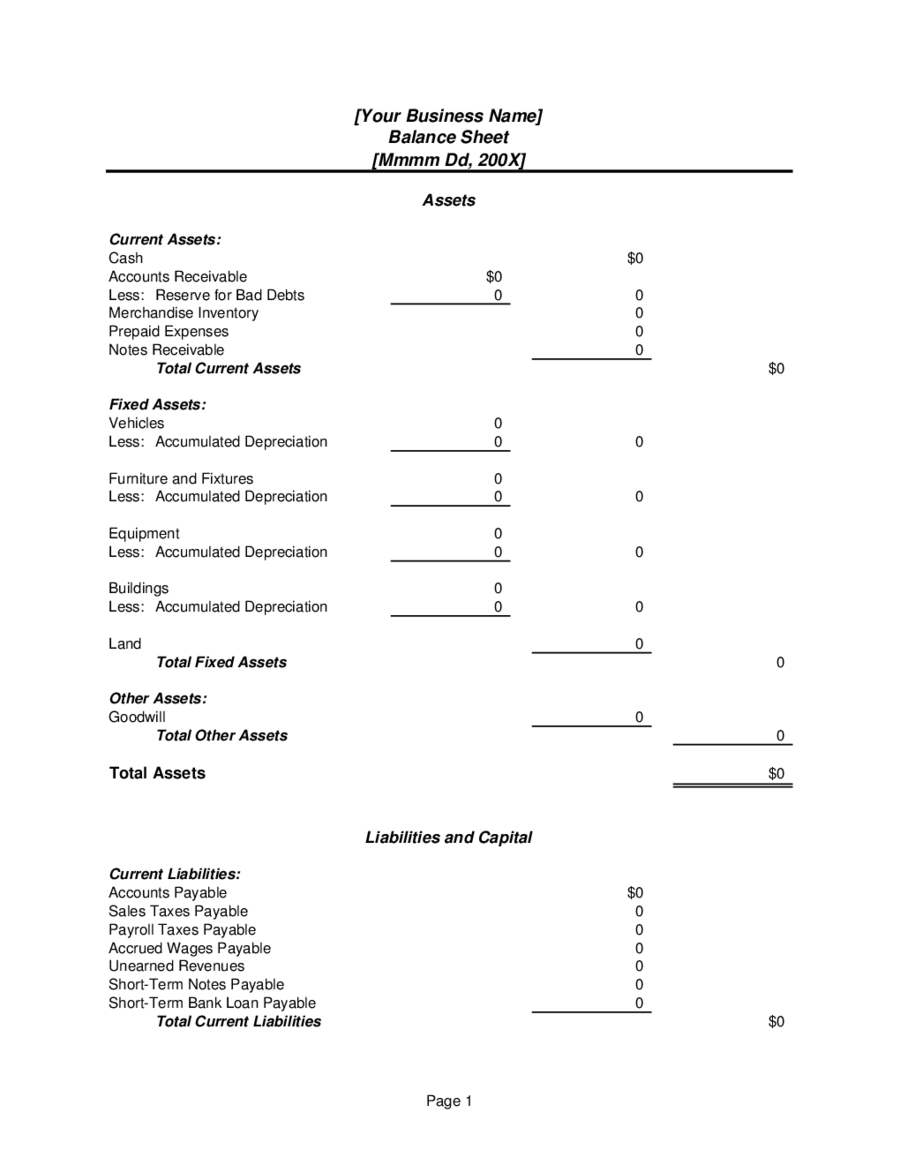

This type of balance sheet mainly contains assets such as accounts receivable, cash, inventory, intangible assets like patents, fixed assets like buildings, equipment, land, liabilities like accrued expenses, long-term debt and accounts payable. Equity of small businesses is actually the change between total assets and liabilities.It’s better to try out ready-made balance sheet templates available online, if not then you can also use balance sheet example available in websites to check how effective they are. It will save your precious time and also it will offer you with clutter-free appearance to your balance sheet.What are key factors of a balance sheet?

There are three key factors of a balance sheet and they are explained below:Assets

In accounting language assets can be explained as anything which is tangible or intangible and which has the ability to be owned to generate value and also which can be held to attain positive financial value. In case of balance sheet assets are a clear indication of an organisation’s holding and it also contributes to its overall value. There are certain things which are very important for assets and they are:- Accounts receivable from different sources

- Equipment

- Cash on hand

- Inventory

- Reimbursable expenses

Liability

These are actually the amount of capital which is mainly owned by the companies. Usually liabilities include money borrowed to strengthen business activities. In addition to that it also lists general debt and accounts payable. Liabilities also contain certain things which are of great importance and they are:- Taxes Payable

- Current loans payable

- Credit card payable

- Accounts payable

- Long term loans payable

Equity

Equity refers to the money which can be considered as the net assets. It can also be explained as owner’s claim on the assets of a business and it also depicts assets which remain after deducting liabilities. Examples of equities can be:- Retained earnings

- Owner’s capital

What is a balance sheet used for?

The most important uses of a balance sheet is to provide financial information about any given organisation or business. These documents help the owner of small business to quickly get a hold over their financial strength and capabilities. It also helps to identify and analyse different trends, specifically in the area of payables and receivables.Along with the income statements, the balance sheets are considered as the most basic elements in offering financial reporting to potential lenders like vendors, investors and banks who consider that how much credit to offer to the applicant firm.Balance sheet example or proper balance sheet format also answers to some important questions such as:- Is the company in a position to expand?

- Is it important for the company to initiate quick steps to bolster cash reserves?

- Is there are some debt left uncollectable?

- Can the receivables be collected aggressively?

- Is it possible for the business to handle flows of revenues and expenses and normal financial ebbs easily?

How to read a balance sheet?

Balance sheet is a polaroid of a financial health of a business on a given day. It explains in detail that what the business owes, what it owns and to whom the money belongs to. There are certain steps to read a balance sheet and they are:Step 1: First step suggest calculation of assets- You should know that the assets are everything which is possessed by the corporation

- Then you should compute the worth of your inventor money and equipment

- It is important to mention or include money that are allocated as account receivable

- Then you have to note the total amount of capital held in investments

- You can also contemplate pre-paid expenditures as assets

- One of the most important things to note in this step is that intangibles which cannot be sold such as patents, trademarks and brands, they are not assets.

- The reader must recognize that even fractional possession of anything makes it an asset

- The final one in this step is to list all the assets on one side of balance sheet template to add them collectively

- One should comprehend that liability signifies the debts of the company

- It is crucial to from columns on balance sheet for short-term and long-term liability

- Then you are required to do the calculation of accounts payable or the debts which the company owes to different companies.

- Also calculate any mortgages, interest due or loans

- Finally list all your liabilities just nest to assets

- In order to get ownership equity subtract liability from assets and you should keep in mind that assets always equal liability and equity

- The you have to calculate current ratio in order to evaluate the how much capital a company can spare for its growth and development

- Also, compute quick ration in order to analyse the finances of the company if it has stopped making sales

Balance sheet analysis

In simple words balance sheet analysis states that it is an analysis of liabilities, assets and equity of a business. The analysis of balance sheet takes place at a regular interval of time; it might be annually or quarterly. This analysis is mainly used for stemming exact figures regarding assets, revenue, and liabilities of the firm. Balance sheet analysis is also very helpful for the shareholders, investors, financial institutions, investment bankers, etc., as it helps them to validate profitability of investment for a given organisation.What is a balance sheet template?

Balance sheet templates are the most important thing one can choose to make an effective balance sheet. These templates are mainly available online and they are available with various formats. Users can choose the one which suits their requirements. One of the best things about balance sheet templates is that they are customised in such a way so that they can be edited and can be downloaded in Microsoft word format.Most of them have tried these professional templates and they have received assistance in great way. It is evident that there are lots of technical things to be added in the format of balance sheet so it is not possible for everyone to sit and add each of them. Thus, getting an online free balance sheet template can be best choice to serve the purpose in a more sophisticated and professional manner. Related Categories

SWOT Analysis TemplateBusiness Letterhead TemplatesMeeting Agenda TemplateMeeting Minutes TemplateWork Breakdown Structure TemplateCost Benefit AnalysisGantt ChartProject Charter TemplateProject Proposal TemplateFax Cover Sheet TemplateEmployee Evaluation FormCash Receipts Journal TemplateRequest for Proposal TemplateResearch Proposal Template