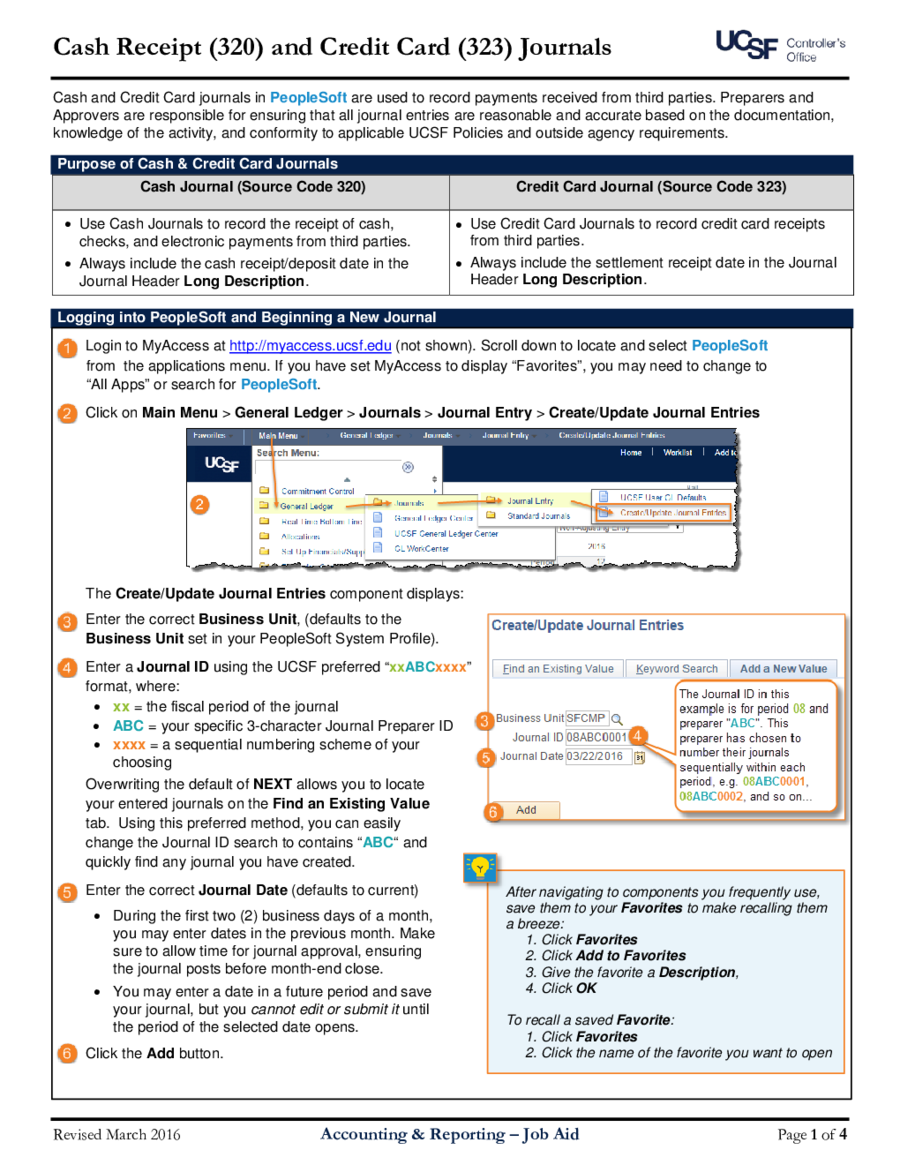

Cash Receipts Journal Template

- DOCUMENTS

- GUIDANCE

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Are you handling your accounts? If yes then it is needless to say that you heard about Cash Receipts Journal. It is evident that cash can be difficult to track if it is not properly accounted for, and organizations may also face incidents of theft or misplaced money. In this context, it is crucial to mention that cash receipts journals are one of the most vital and essential parts of accounting and they also known as specialized accounting journal. The primary purpose of cash receipt accounting journal is to track different transactions such as cash received, credited sales, debited money, etc.It might happen that sometimes you get confused with Cash Receipts Journal format as there are lots of technical things to be involved and finally end up in a mess. But now you don’t have to worry anymore as you can have Cash Receipts Journal Template online and you can serve your purpose in a much better way. You can also get different Cash Receipts Journal Sample from professional websites.

What is a Cash Receipts Journal?

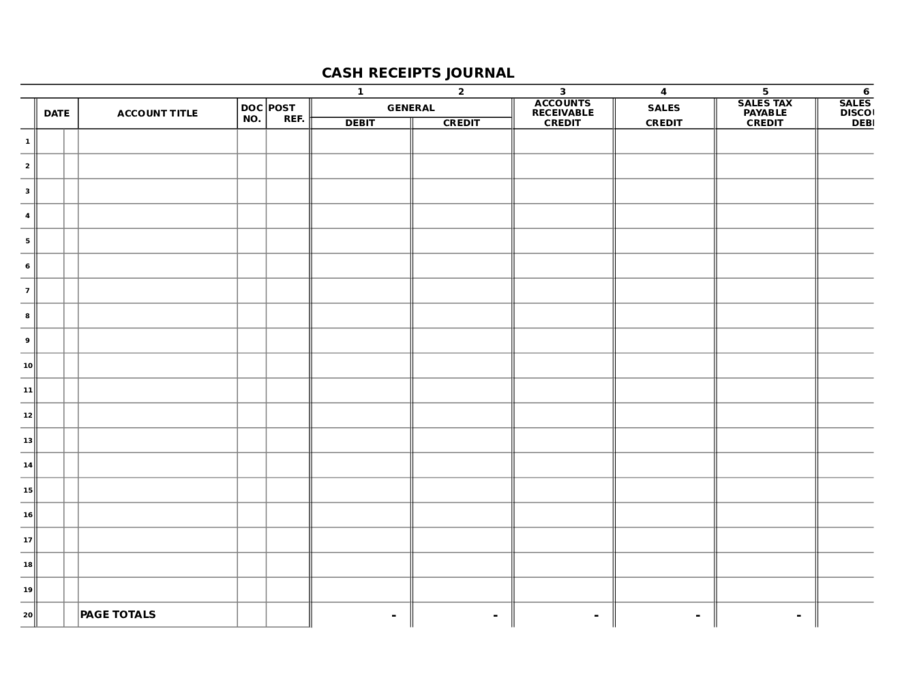

In simple words, Cash Receipts Journal can be defined as a section which is special for a general journal, and they are mainly used to maintain a record of all the receipts of cash. They are also known as a subsidiary ledger which is used to record sales, and they also used to divest transaction volume from the general ledger. This type of journals mainly has credit and debit entries and accounting dealings should always remain in a balanced way. There are many businesses which also uses cash receipt journal as sub-journal to a general ledger in order to keep the non-cash receipts. Cash receipt journals can also be categorized into different sections as well, so it is important that one should not get confused. But it’s better to keep apart all your doubts and get the best through online professional Cash Receipts Journal Template.Certain points should be added to the cash receipts journal, and they are:- Date of transaction.

- Name of customer.

- Identification of the check and it may be invoice paid, client’s name or it may be paid check number.

- Last but not the least it should have debit and credit columns in order to record both sides of each given entry.

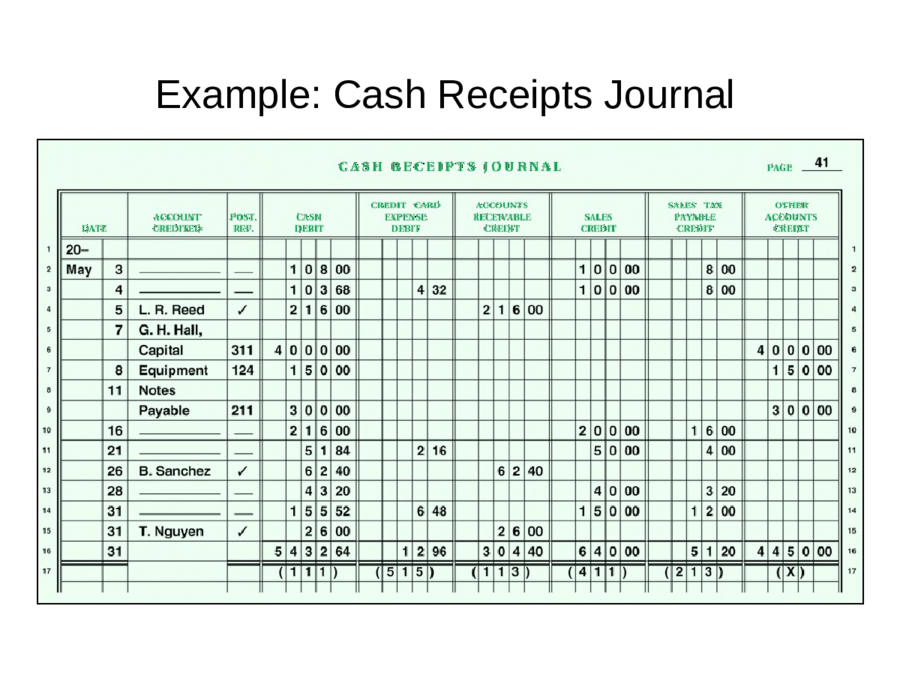

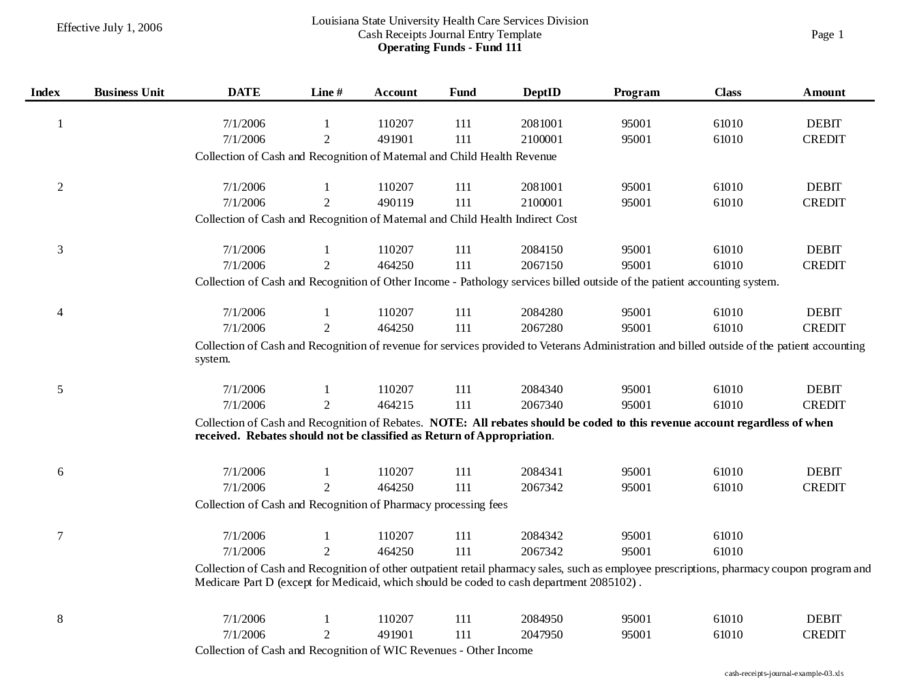

Examples of cash receipt journals

Let us cite some examples where these journals are used:- Cash collected from sales is quite descriptive, so when any retailer sells his products or goods to any given customer and then collects payment, the transaction is recorded in the cash receipts journal.

- There are some other sources of money as well, such as banks, interest from the investments made sales of any non-inventory assets, etc. So whenever any company gets a bank loan, the same transaction is recorded in the Journal of cash receipts.

Cash receipts based on the nature of business

Usually, there are different types of cash receipts based on the nature of business but out of them three are most important one, and they are:- Departmental stores received checks in mail.

- Supermarkets receives check along with coins and currencies.

- Wholesalers generally receive cash in the form of checks.

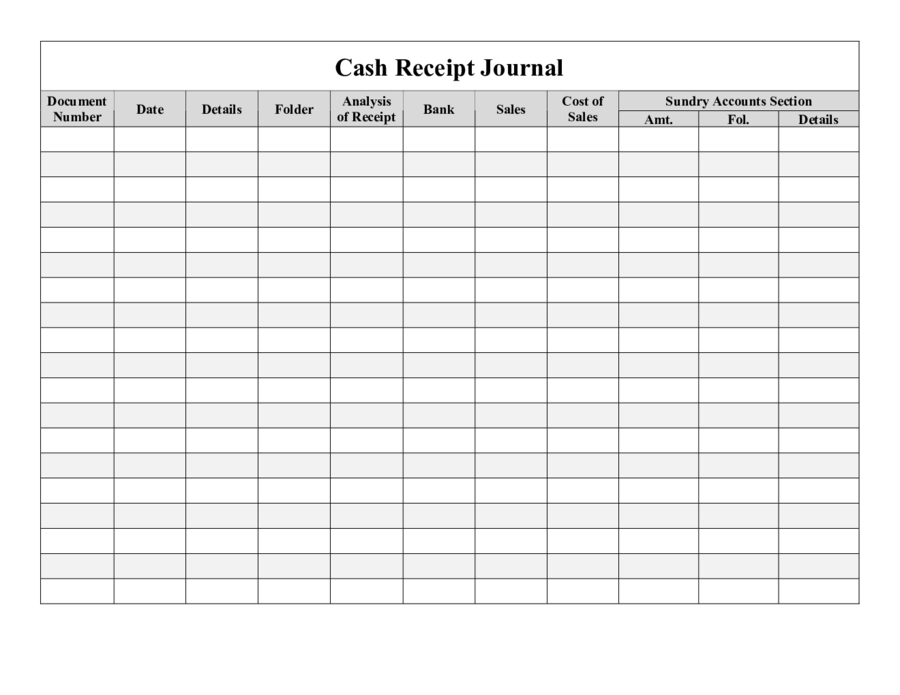

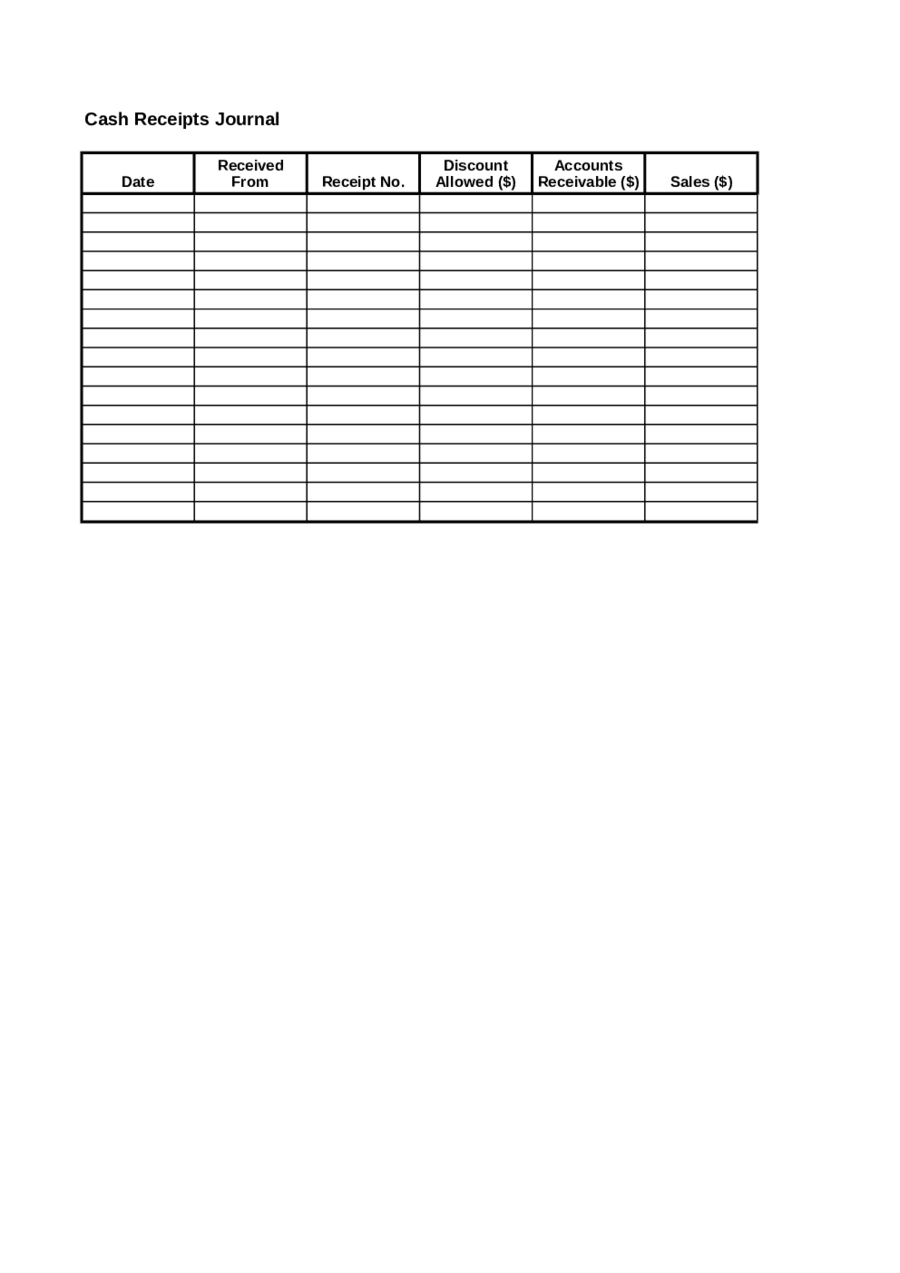

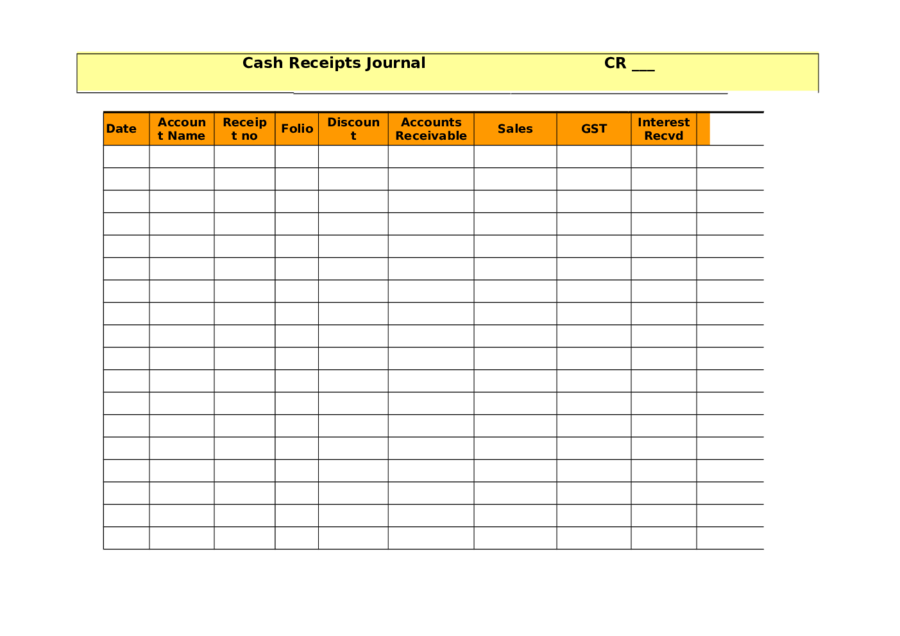

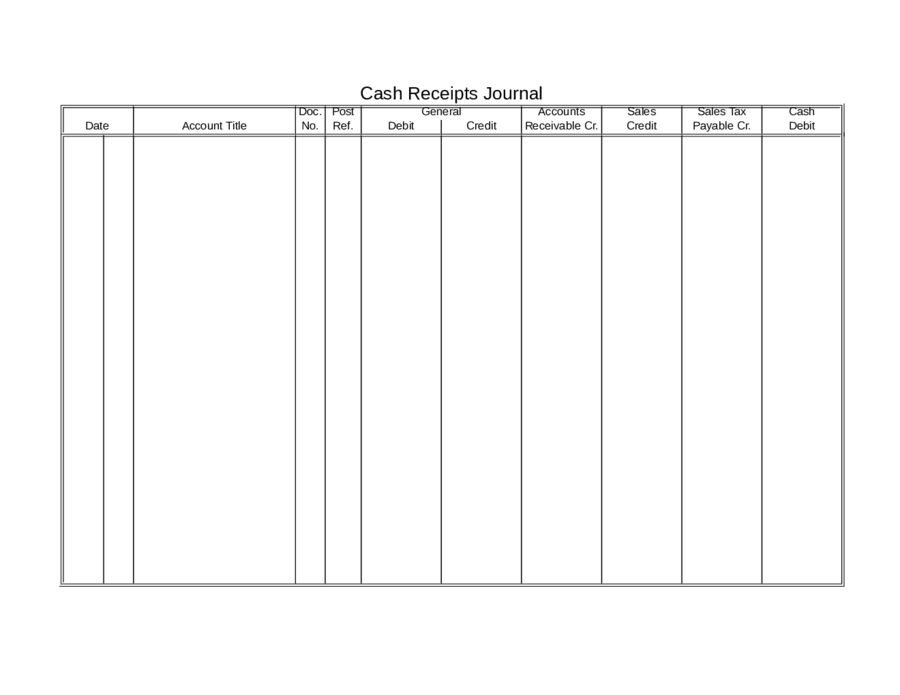

How to design cash receipts journal?

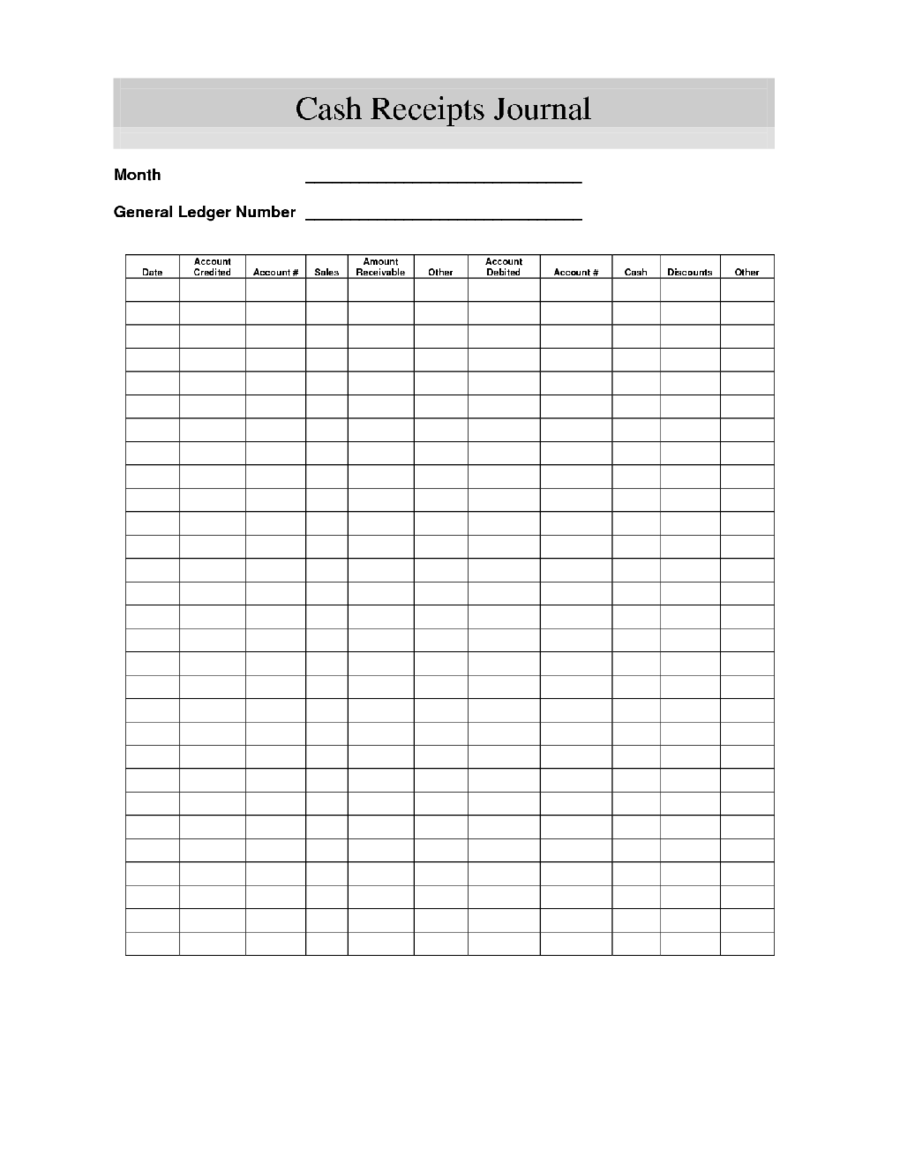

There are certain things to be mentioned in the cash receipts journals, and they are:- Date column

- Posting Reference column

- Other Descriptive Colum or Account Credited

- Credit Columns and Debit Columns

- Summary of all credits and debits

What do you mean by cash disbursement?

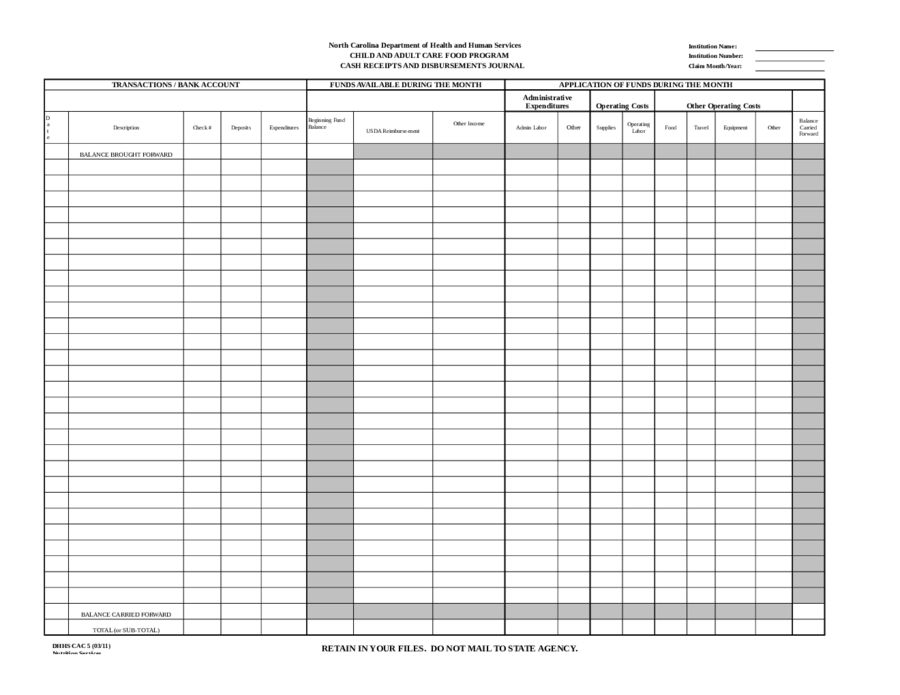

Cash disbursement in accounting terms is also known as cash payments, and it denotes the payments made by nay given organization during a given particular period of time, it may be quarterly or annually. It can also be explained as the discharge of cash funded in the exchange paid for the delivery of goods and services. This can also be used to make a refund to customers and in that case, it is recorded as a reduction of sales.Cash disbursement can be done through electronic fund transfer, bills, checks, coins, etc. The procedure of cash disbursement is also outsourced to a company’s bank. They are mainly used to calculate the amount of money which is usually draining out of any given company which is entirely different from the profit or loss of the organization.What is cash disbursement journal?

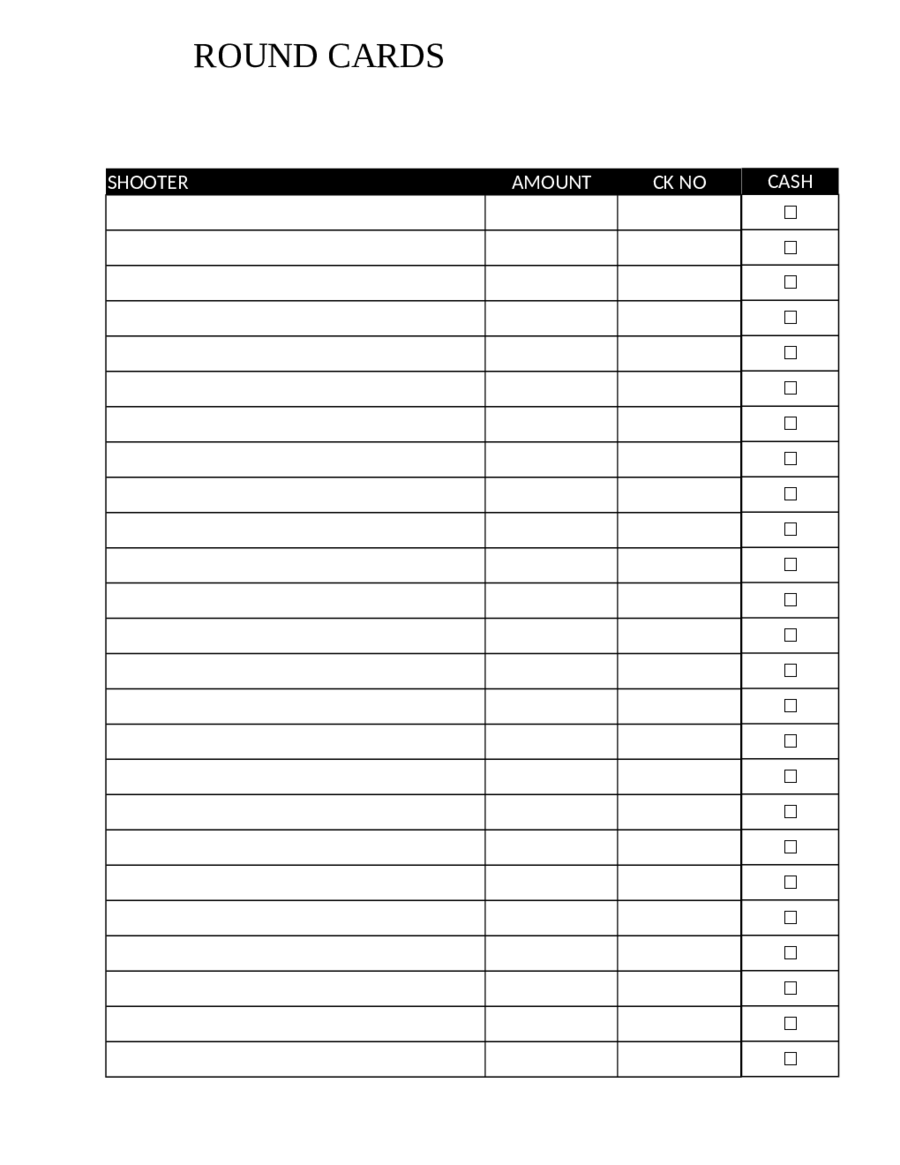

Cash disbursement journals are mainly sued to track and record all the expenditures or cash payments made by the organization. In simple words, it can be said that these journals are primarily used to record the cash outflows of any given company. There are some enterprises in which cash disbursement journals are combined with cash receipts journal and are referred as cash book.There are a number of things to be included in the cash disbursement journal, and usually, they have multiple columns. It also includes certain points, and they are:- Description

- Date of the transaction

- Amount

- Check number

- Type of cash payment (whether cash purchases, accounts payable or taxes)

- Other information (if necessary)

What are cash payments journal?

Cash payments journal are mainly used to record all the cash payments made by given origination. It is primarily utilized for the activities which involve receiving money. It also tracks the outflow of business. For an instance, if an owner of the company withdraws cash from the firm then the entry will be made in the cash payments journal.It is also important to note that cash payments journal involve cash disbursement, and it is already explained above that both, cash payments journal and cash disbursements journal are same.When it is about cash, then you will get a column for crediting cash (Cash CR). In addition to that, you will also get a credit column for purchased discounts as transactions may also involve discounted purchase also.In order to balance the credits, in cash payments journal you will also get two debit columns, and they are account payable and other accounts. You may find it too hectic and difficult to frame the format of cash payments journal, so it is better that not to waste your time in framing the format by your own, rather try for professional templates available online.Different types of receipts

Usually, there are different kinds of receipts available in the market, but out of them there are three different types of receipts which are imperative, even they are widely used also. They are discussed below:Sale receipt

Are you in need of Sale receipt? Well, if it is so then you can get them very easily. All you need to do is to download the pre-structured professional templates from online websites and serve your purpose. Now coming to what it is actually.Sale receipt is mainly used to record all the sales transactions throughout the day, or it may be for any given period of time. On the other hand, most of the customers are using sale receipt in order to track their purchases along with it is also used to monitor the record for the return of goods. These are also the pre-designed documents which are mainly used by the experts.Sale receipt is also used as an official document to record the sales transactions of the company in writing to get some references in future. In a transaction receipt you will get lots of the points such as:- Date and time of the purchase made.

- Total amount of the purchase.

- What are the items purchased?

- Location or name of the entity from where the purchases have been made.

- What is the method used for payment?

- It helps nay given organization to enhance their credibility.

- It also helps the companies to keep the transaction records for business prospect.

- Last but not the least they are very helpful for collecting information when the company is about to pay taxes.

Gross receipt

The gross receipt can be just defined as the total amounts of received by any given organization coming from all different sources without deducting any separate expenses or costs during its fiscal accounting year. Gross receipt also includes revenue from non-sales sources like donation or dividends, interest, etc.For an instance, if a person is operating a non-profit corporation, so the person is required to report gross receipt as his total income instead of gross sales because the revenue of that person is not likely to be sales-driven. Most of the profit making organizations has sales income in which sales of goods and services are included.So, in case any organization which is not having other option for income, then their total gross sales will be equivalent to gross receipt. You can get a better idea regarding gross receipts, all you need to do is to get online and download the professional templates.Cash receipt

Cash receipt suggests that it is directly receiving money from different sources, and it may be anything like:- a person is paying rent for using equipment.

- the amount paid for credit purchases.

- supplementary funds brought by the proprietor in order to expand the business.

- interest received on investments.

How to create a cash receipt journal report?

Cash receipt journal reports is a report which shows the payments received by any given company along with the deposits made by them within a particular time frame. It also comes with a subtotal of each of the customer and grand total at the bottom. There are number of things to be included in the report, and they are:- Date

- Time

- Memo

- Number

- Split and amount

- Deposit

- Receipt

- Sales

- Payment

- Invoice

- Detail level

- Summary

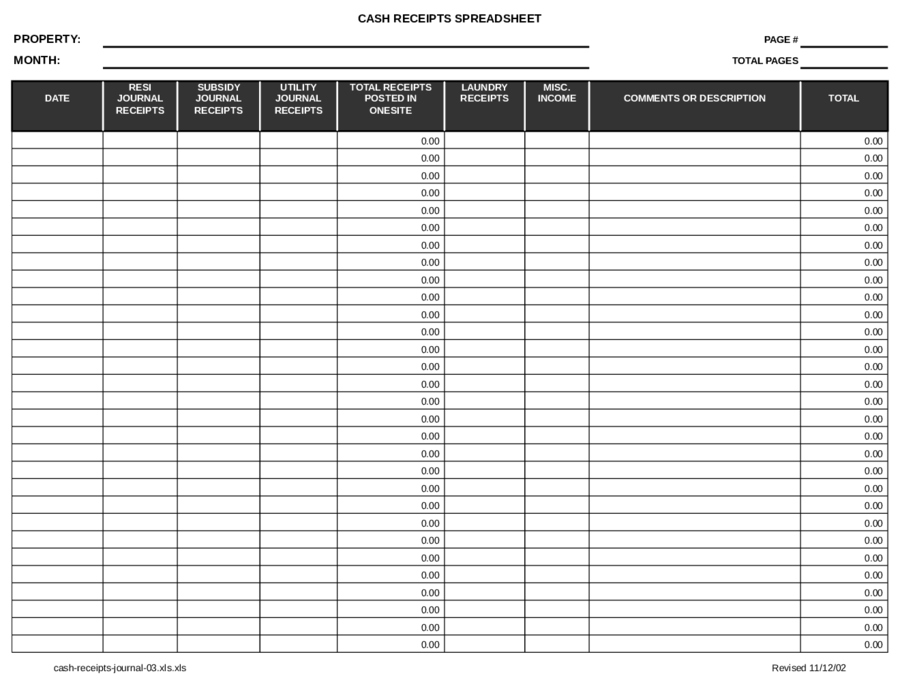

How to keep cash payments and receipts journal?

Well, this is fascinating as cash payments and cash receipts both are quite essential for the smooth run of an accounting system. Most of the companies are maintaining cash receipts and cash payments on different spreadsheets, but it is evident that they can be made together in cash payment and receipts journal. There are some necessary steps in order to keep these journals, and they are:- First of all, it is crucial to choose an accounting tool.

- Then you can identify sub-contacts and also use them as headers to organize information correctly.

- Then it is important to complete the column headers.

- After the completion of basic structure, you have to enter every transaction appropriately and steadily.

- Keeping all the relevant vouchers and receipts is also an important part.

Related Categories

SWOT Analysis TemplateBusiness Letterhead TemplatesMeeting Agenda TemplateMeeting Minutes TemplateWork Breakdown Structure TemplateCost Benefit AnalysisGantt ChartBalance Sheet TemplateProject Charter TemplateProject Proposal TemplateFax Cover Sheet TemplateEmployee Evaluation FormRequest for Proposal TemplateResearch Proposal Template