Fillable Printable Financial Planning for Retirement Workbook

Fillable Printable Financial Planning for Retirement Workbook

Financial Planning for Retirement Workbook

Purdue extension

Consumer and

Family Sciences

CFS-685-W

Department of

Consumer Sciences

and Retailing

Financial Planning for

Retirement Workbook

Financial Planning for Retirement Workbook • CFS-685-W

Purdue extension

• Introduction

3

• Your Retirement Lifestyle

3

• Your Current Financial Situation

4

• The Inflation Factor

7

• Changes in Spending Patterns

After Retirement

8

• Planning for Future Inflation

8

• Planning for Large Future

Irregular Expenses

8

• How Much Are You Worth?

11

• Estimating Retirement Income

11

• Where to Go for Information

18

• Balancing Income with Expenses

18

• Increasing Income

18

• Reducing Expenses

22

• Medicare and Other Health Insurance

22

• Housing Expenses

23

• Looking Ahead

23

• References

25

• Credits

25

Financial Planning for Retirement

Workbook

Revised and updated by Janet C. Bechman, Purdue Extension specialist, and

Barbara R. Rowe, Utah State University Cooperative Extension specialist,

based on North Central Regional Extension publication 264 by Irene Hathaway,

Michigan State University

Worksheets

Worksheet 1 – Your Retirement Lifestyle

5

Worksheet 2 – Estimated Annual Cost

of Living 6

Worksheet 3 – Estimated Changes in Spending

After Retirement 9

Worksheet 4 – Estimated

Annual Cost of

Living 10 Years After Retirement 12

Worksheet 5 – Large Future Irregular

Expenses 13

Worksheet 6 – How Much Are You Worth?

14

Worksheet 7 – Estimated Annual Income

After Retirement 19

Worksheet 8 – Estimated Annual Income

10 Years After Retirement 20

Worksheet 9 – Monthly Cost of Living

Worksheet 24

Tables

Table 1. The Inflation Factor

7

Table 2. Expectation of Life by Age

and Sex

10

Table 3. Age to Receive Full Social

Security Benefits 15

Table 4. Benefit Increases for

Delayed Retirement 16

Table of Contents

Purdue extension

Financial Planning for Retirement Workbook • CFS-685-W

Introduction

Are you looking forward to the day you retire?

To having more time to travel, spend with family

and friends, enjoy new hobbies, or increase your

volunteer work? Or does the thought of retirement

make you slightly uneasy; unsure if you will have

enough money to stop working, but not knowing how

much you need to save? Being able to retire when

you want and living comfortably is a dream for many

Americans, and the goal of this workbook is to help

you reach it.

The biggest question is, when the time comes

to stop working, will you have enough income to

continue the lifestyle you had before retirement? That

depends on the lifestyle you want to maintain and

the types of income you will have. Social Security

payments alone will not be enough for most of us. In

2009 the maximum Social Security monthly benefit

payable to a worker retiring at age 66 was $2,323,

while the average monthly benefit was $1,153

(www.ssa.gov/pressoffice/factsheets/colafacts2009.htm).

As you plan, keep in mind that the average

American life expectancy is 74.7 years for men and

80.0 years for women.

1

The “average” person who

retires at age 65 looks forward to another 16 to 20

years of life. Many of us will have even more years. It

is never too early to begin planning how you want to

spend those years.

When you think ahead to retirement, here are some

questions to answer:

1. What lifestyle will you want during retirement?

2. What is your current financial situation?

3. How will your financial situation change at

retirement?

4. How can you control your financial future to be

able to retire with the resources needed to achieve

your desired lifestyle?

See how your retirement picture might look by

following the steps in this workbook, filling in the

worksheets, and doing the calculations. No one can

predict the future exactly. However, projecting from

what you know now will give you an estimate of what

to expect in the future.

1

Source: National Vital Statistics Reports, Vol. 54, No. 14,

April 19, 2006 Retrieved from www.cdc.gov/nchs/data/

nvsr/nvsr54/nvsr54_14.pdf

Your Retirement Lifestyle

As you think about your retirement days, how will

you want to live? What type of lifestyle do you hope

for? Will you have enough money to support that

lifestyle? What will be important to you and what

won’t be? How will your life and expenses change

after retirement? Here are some items to consider:

• Your home —Where will you live? Changing your

housing or moving to a different part of the state

or country, or to another country, can increase or

decrease your expenses. Even if you plan to “stay

put” in the same house, some of your costs will still

change. For example, your heating and light bills

may increase if you spend more hours at home. Or

they may decrease if you spend more time traveling

away from home. As your home ages, it will need

more repairs and maintenance.

• Transportation — What does it cost you now?

How much of your transportation costs (gas, car

maintenance, bus or train fares) are for travel to

and from work? Will you keep your own car, rely

on public transportation exclusively, or use some

combination of the two?

• Food — Will you eat out more often in retirement,

or entertain friends and family more often? How

much do you pay a year for lunches or other meals

eaten at work?

• Clothing and personal care — How much of your

present clothing costs are for special clothing for

your job? How much is for more expensive clothing

than you will need after retirement?

• Health and medical expenses — Will you buy

insurance to supplement Medicare gaps, or will you

be paying for all your health care insurance until

you are age 65? Will you buy exercise equiment,

or join a health club, or cancel a health club

membership?

• Entertainment — Will you spend more or less on

movies, books, theater, clubs, shopping?

• Hobbies — Will you spend more money on

hobbies, such as woodworking and gardening?

• Recreation — Will you spend more money on

leisure activities, such as golfing and fishing?

• Travel — Will you increase your travel during

retirement?

After you retire, you may spend more in certain

categories such as health care and health insurance.

Financial Planning for Retirement Workbook • CFS-685-W

Purdue extension

You also may spend more on travel, entertainment,

and leisure activities, because you have more time to

enjoy them.

Use Worksheet 1, “Your Retirement Lifestyle”

(page 5), to describe the lifestyle you desire during

retirement. As you dream about your retirement

days, will you be able to afford the lifestyle you find

desirable?

Your Current Financial Situation

As you plan for your retirement years, it is helpful

to look at what you are spending now to live. Use

Worksheet 2, “Estimated Annual Cost of Living”

(page 6), to record what you spend annually in each

category. If you only have monthly expense figures,

turn to the “Monthly Costs of Living,” Worksheet

9 (page 24). Record your monthly expenses and

multiply by 12 to get the annual figures to put on

Worksheet 2.

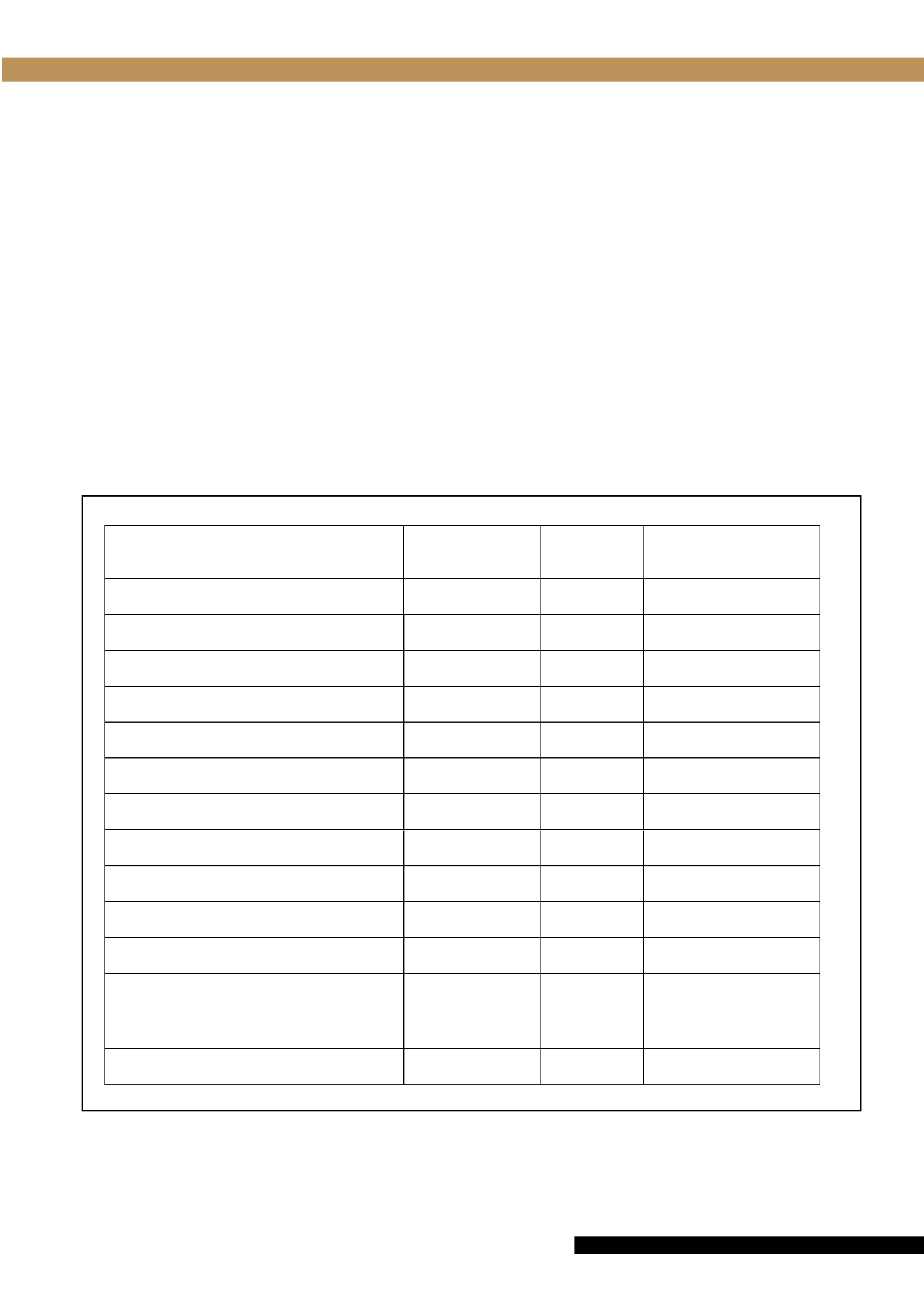

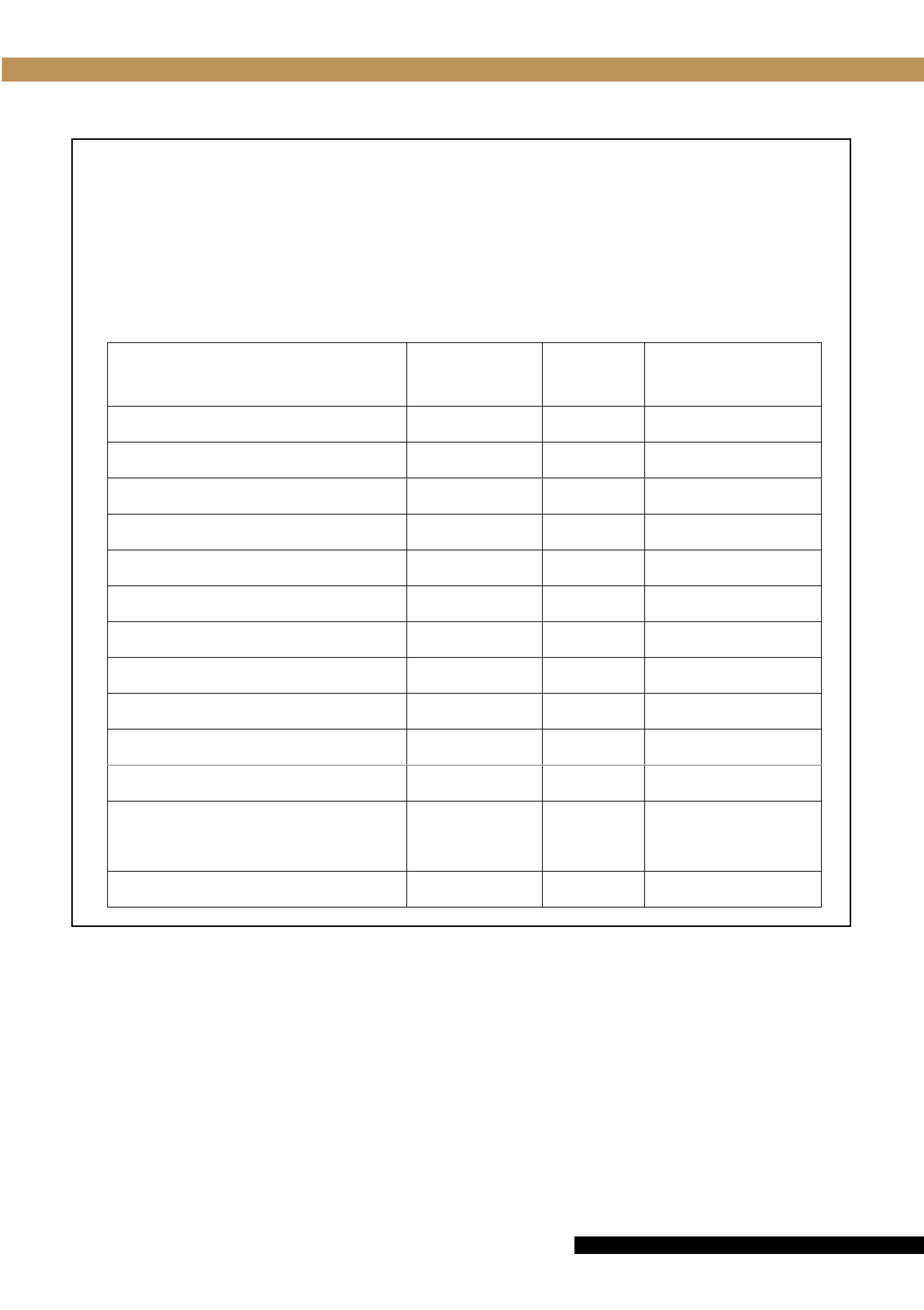

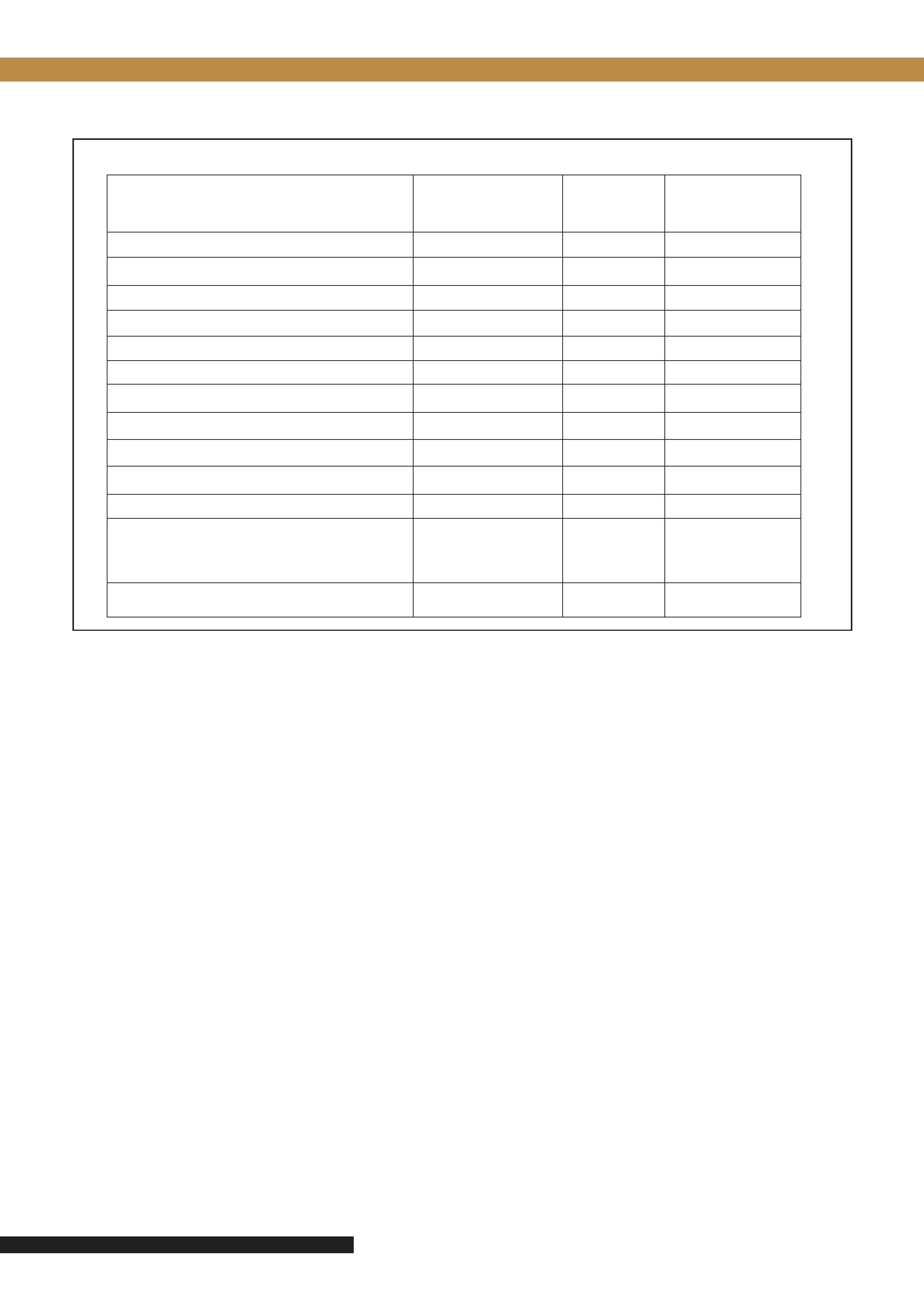

Note: The sample “Estimated Annual Cost of

Living” worksheet on this page is meant to serve as

a guide as you fill in your Worksheet 2. It is based on

this scenario:

a) Mr. and Mrs. Jones would like to retire at age 62,

11 years from now.

b) They guess that the inflation rate will rise slowly

and will average about 5 percent a year.

c) 11 years at 5 percent = 1.71 inflation factor (from

table on page 7).

d) Their estimated current annual expenses of

$32,277, multplied by the inflation factor of 1.71,

shows they will need $55,194 in their first year of

retirement to maintain their current lifestyle.

Example: Estimated Annual Cost of Living

Totals You

Spend Now

Inflation

Factor

Future Budget at

Time of Retirement in

11 years

Housing

$9,956 1.71 $17,025

Household operation and maintenance

$2,230 1.71 $3,813

Automobile and transportation $6,016 1.71 $10,287

Food $4,518 1.71 $7,726

Clothing $1,782 1.71 $3,047

Personal $1,521 1.71 $2,601

Medical and health $1,665 1.71 $2,847

Recreation, education $1,659 1.71 $2,837

Contributions $738 1.71 $1,262

Taxes and insurance $1,112 1.71 $1,902

Savings, investments $780 1.71 $1,333

Irregular expenses

(ex. gifts, license plates, holiday spending,

etc.)

$300

1.71

$513

ANNUAL TOTAL $32,277 1.71 $55,194

Adapted from Planning a Retirement Budget, a CEH Topic, Hogarth, Cornell University, 1984.

Purdue extension

Financial Planning for Retirement Workbook • CFS-685-W

Worksheet 1 – Your Retirement Lifestyle

What will your lifestyle be like during retirement? Beside each item listed below, describe what you

really want in retirement.

1. Your home:

2. Transportation:

3. Food:

4. Clothing and personal care:

5. Health and health care:

6. Entertainment:

7. Hobbies:

8. Recreation:

9. Travel:

From Retirement Planning, DP-CFR-051, Maddux, University of Georgia CES, 5/96.

Financial Planning for Retirement Workbook • CFS-685-W

Purdue extension

Worksheet 2 – Estimated Annual Cost of Living

Fill in the first column with what you are now spending annually to live. Then figure the

Inflation Factor by following the steps listed above the Inflation Factor table on page 7. Fill

in the inflation factor in the second column. (You may do this only for the total, or for each

category of costs.) Multiply column 1 by column 2 to get an idea of the income you will need

during your first year of retirement.

Totals You

Spend Now

Inflation

Factor

Future Budget at

Time of Retirement

in ____ years

Housing $ $

Household operation and maintenance

$ $

Automobile and transportation

$ $

Food

$ $

Clothing

$ $

Personal

$ $

Medical and health $ $

Recreation, education

$ $

Contributions

$ $

Taxes and Insurance

$ $

Savings, investments

$ $

Irregular expenses

(ex. gifts, license plates, holiday spending,

etc.)

$

$

ANNUAL TOTAL $ $

Adapted from Planning a Retirement Budget, a CEH Topic, Hogarth, Cornell University, 1984.

Purdue extension

Financial Planning for Retirement Workbook • CFS-685-W

The Inflation Factor

Inflation is a widespread and sustained increase

in the general price level of goods and services.

Economists say that when prices go up 3 percent

or more a year, the country is in a state of inflation.

While just about everyone gets hurt by inflation,

people who live on fixed incomes may feel the

crunch more than others because prices rise but their

income doesn’t. Increases in inflation rates have been

extremely modest in recent years – between 2 percent

and 4 percent. But even a 2 percent increase every

year will have a cumulative effect, and prices will be

higher in the future than they are now. That’s why it

makes sense to build inflation into your retirement

plans.

On Worksheet 2, “Estimated Annual Cost of

Living,” you filled in the first column with the cost

you calculated for each of the expense categories

listed. To fill in the second column, use Table 1, “The

Inflation Factor” (on this page).

(1) Choose the number of years until your

retirement starts from the “Years to Retirement”

column on the left of Table 1.

(2) Then select an estimated annual inflation rate

from the row across the top. Inflation cannot be

predicted from year to year. In 1980, it was 12.4

percent. In 2001, it was 1.6 percent. In 2007, it was

4.1 percent. You have to make an educated guess.

(3) Read across and down to find the appropriate

inflation factor corresponding to your predicted rate of

inflation. For example, 10 years at 6 percent inflation

gives a factor of 1.79.

(4) Multiply your estimated annual cost of living

expenses from the first column of Worksheet 2 by the

inflation factor to get an idea of the amount of income

you will need for your first year of retirement, if you

want to maintain your current lifestyle. (Example:

$14,000 x 1.79 = $25,060.)

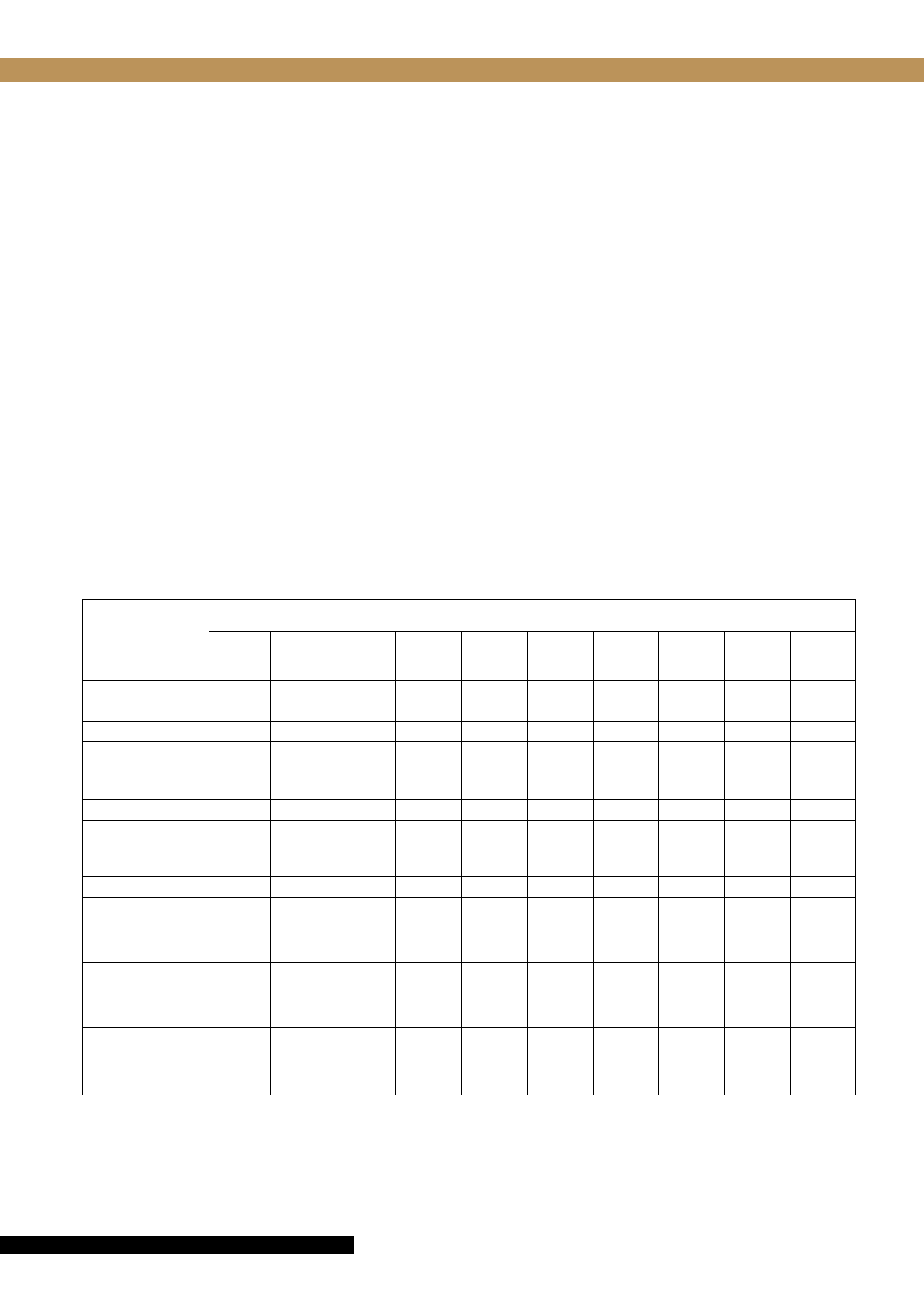

Table 1. The Inflation Factor

Years to

Retirement

Annual Inflation Rate

2% 3% 4% 5% 6% 7% 8% 9% 10% 11%

1 1.02 1.03 1.04 1.05 1.06 1.07 1.08 1.09 1.10 1.11

2 1.04 1.06 1.08 1.10 1.12 1.15 1.17 1.19 1.21 1.23

3 1.06 1.09 1.13 1.16 1.19 1.23 1.26 1.30 1.33 1.37

4 1.08 1.13 1.17 1.22 1.26 1.31 1.36 1.41 1.46 1.52

5 1.10 1.16 1.22 1.28 1.34 1.40 1.47 1.54 1.61 1.69

6 1.13 1.19 1.27 1.34 1.42 1.50 1.59 1.68 1.77 1.87

7 1.15 1.23 1.32 1.41 1.50 1.61 1.71 1.83 1.95 2.08

8 1.17 1.27 1.37 1.48 1.59 1.72 1.85 1.99 2.14 2.30

9 1.20 1.31 1.42 1.55 1.69 1.84 2.00 2.17 2.36 2.56

10 1.22 1.34 1.48 1.63 1.79 1.97 2.16 2.37 2.59 2.84

11 1.24 1.38 1.54 1.71 1.90 2.11 2.33 2.58 2.85 3.15

12 1.27 1.43 1.60 1.80 2.01 2.25 2.52 2.81 3.14 3.50

13 1.29 1.47 1.67 1.89 2.13 2.41 2.72 3.07 3.45 3.88

14 1.32 1.51 1.73 1.98 2.26 2.58 2.94 3.34 3.80 4.31

15 1.35 1.56 1.80 2.08 2.40 2.76 3.17 3.64 4.18 4.78

16 1.37 1.61 1.87 2.18 2.54 2.95 3.43 3.97 4.60 5.31

17 1.40 1.65 1.95 2.29 2.69 3.16 3.70 4.33 5.05 5.90

18 1.43 1.70 2.03 2.41 2.85 3.38 4.00 4.72 5.56 6.54

19 1.46 1.75 2.11 2.53 3.03 3.62 4.32 5.14 6.12 7.26

20 1.49 1.81 2.19 2.65 3.21 3.87 4.66 5.60 6.73 8.06

From Financial Planning for Retirement, NCR-264, Field and Hathaway, Michigan State University CES, 5/87.

Financial Planning for Retirement Workbook • CFS-685-W

Purdue extension

Changes in Spending Patterns

After Retirement

After you retire, you may spend less on certain

categories, such as taxes (income taxes are usually

lower, and you may not pay Social Security

taxes, although some retirees do) and savings and

investments (you probably won’t contribute to a

pension fund, although you still will need a savings

plan).

Income tax

How much did you pay last year? Compare that

amount with the taxes for your estimated retirement

income. Use the table in last year’s 1040 form. About

one third of people who get Social Security have to

pay taxes on their benefits. This provision affects only

people with substantial income in addition to their

Social Security benefits. Pension or annuity payments

from an employer’s retirement plan may be subject to

income taxes.

Social Security taxes

If you continue to work after you begin drawing

your Social Security benefits, you will have to pay

Social Security and Medicare taxes on your earnings.

In 2009, the combined tax rate was 7.65 percent for

an employee and 15.3 percent for a self-employed

person. You do not have to pay Social Security or

Medicare taxes on your Social Security income.

Check your paycheck stub for the amount you paid

into Social Security last year. Compare it with the

expected amount of your post-retirement income.

That will tell you whether you will need to pay Social

Security taxes after retirement and how much they

will be.

Saving and investing in retirement

Check your paycheck stub for contributions to

a pension plan. How much are you investing for

retirement in other ways, including mutual funds,

stock market accounts, and IRAs?

For each expense category, figure the difference

between what you’re spending now and what you

expect to spend after retirement. Enter those amounts

onto Worksheet 3, “Estimated Changes in Spending

After Retirement” (page 9). If your retirement expense

will be lower, put the difference in the “less” column.

If the expense will be higher, put the difference in the

“more” column. Then compare the totals.

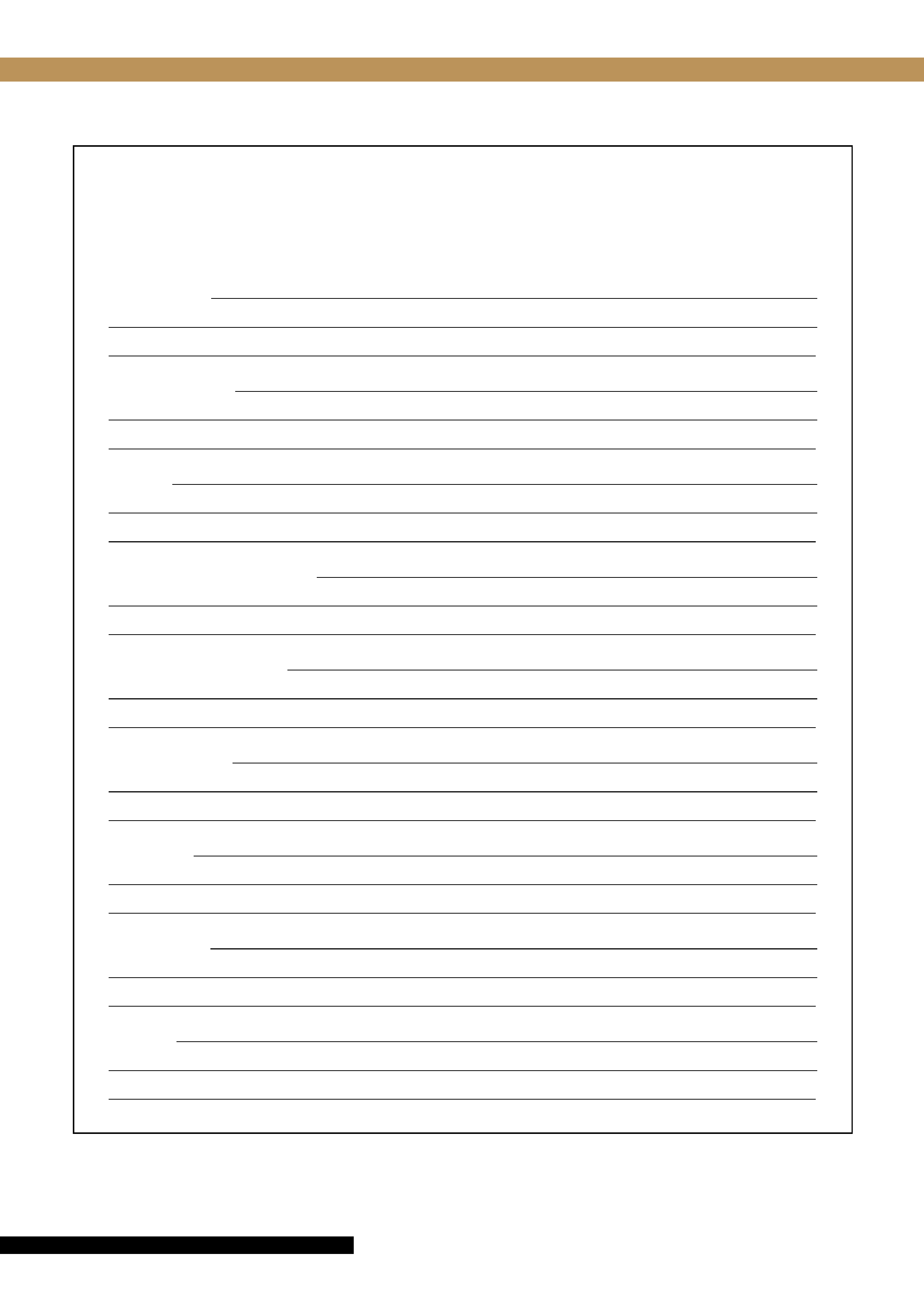

Planning for Future Inflation

On Worksheet 2, “Estimated Annual Cost of

Living,” you calculated the effects of inflation on your

living expenses until you retire. But inflation will

continue, at some rate, after you retire. A man retiring

today at age 65 can expect to live 16.8 more years; a

woman, 19.7 more years (See Table 2, “Expectations

of Life by Age and Sex” (page 10). How will your

expenses be affected by inflation then?

To see how inflation will affect your budget into the

future, turn to Worksheet 2 (page 6). Copy the totals

from the right-hand column, “Your Future Budget at

Time of Retirement in ____ Years” into Column 1

on Worksheet 4, “Estimated Annual Cost of Living

10 Years After Retirement” (page 12). Then go back

to Table 1, “The Inflation Factor” (page 7). Choose

an inflation rate and find the factor for 10 years.

Multiply that factor by the figures in column one on

Worksheet 4. Record your answers on column three

of Worksheet 4.

How much will inflation increase your living costs?

Even a moderate rate of inflation will push up those

costs over time. This shows that it will be necessary

to plan for retirement income that will keep pace with

inflation as much as possible. The example on page 11

assumes an annual average inflation rate of 5 percent.

Planning for Large Future

Irregular Expenses

Some expenses do not occur every month, or

even every year. These are the ones you are most

likely to not plan for (a new roof, an appliance that

dies, another car). These expenses are most likely to

interfere with your retirement budget.

Use Worksheet 5, “Large Future Irregular

Expenses” (page 13), to help you plan ahead for some

of these large expenses. This worksheet will help you

answer some basic questions as you plan ahead for

your large expenses. Think about when you expect

the expense to occur and the estimated cost. Do some

years have more expenses than others? Can you shift

some of those costs to other years? Or, can you set

aside savings in less expensive years to pay for them?

Can good maintenance and/or repairs lengthen the life

of some items so they won’t have to be replaced so

soon? Can you live with certain items after they are

no longer in tip-top shape? Are there some items you

won’t replace as they wear out? What can you replace

before you retire when you may have more money

to pay for them? (Note: The average life expectancy

9

Purdue extension

Financial Planning for Retirement Workbook • CFS-685-W

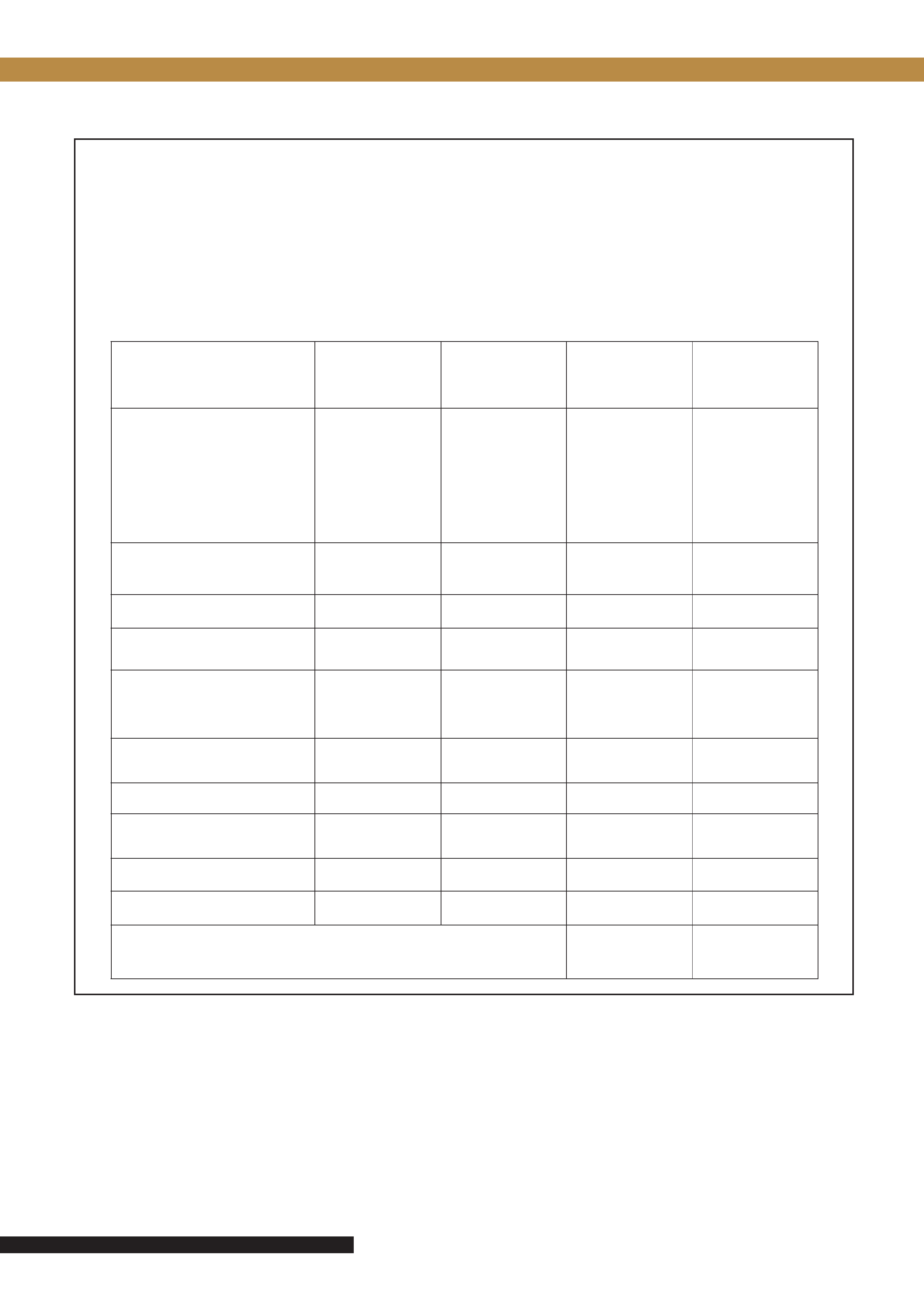

Expense

Now Spend

About How

Much?

Expect to

Spend After

Retirement

Less After

Retirement

More After

Retirement

Work related:

Transportation

Clothing

Dues

Meals

Other

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Social Security taxes

(taken out of check)

$

$

$

$

Income taxes $ $ $ $

Pension plan contributions

$

$

$

$

Contributions to other

retirement accounts

(IRA, etc.)

$

$

$

$

Savings, investments

for retirement

$

$

$

$

Travel $ $ $ $

Entertainment, leisure

activities

$

$

$

$

Health insurance $ $ $ $

Other health care costs $ $ $ $

TOTALS

$

Less

$

More

Adapted from Financial Planning for Retirement, NCR-265, Field and Hathaway, Michigan State University CES, 5/87.

Worksheet 3 – Estimated Changes in Spending After Retirement

Use this worksheet to calculate possible changes in your expenses. For each expense category, figure

the difference between what you are spending now and what you expect to spend after retirement. If

the retirement expense will be lower, put the difference in the “less” column; if it will be higher, put the

difference in the “more” column. Add the figures in both columns and compare the totals. Which total is

larger? What does that suggest about your future spending? Will you need to make some changes in what

you expect to spend?

10

Financial Planning for Retirement Workbook • CFS-685-W

Purdue extension

Table 2: Expectation of life by age and sex

All Races

Age Total Male Female

0 77.4 74.7 80.0

1 77.0 74.3 79.5

5 73.1 70.4 75.6

10 68.1 65.5 70.6

15 63.2 60.5 65.7

20 58.4 55.8 60.8

25 53.6 51.2 56.0

30 48.9 46.5 51.1

35 44.1 41.8 46.3

40 39.5 37.2 41.5

45 34.9 32.8 36.9

50 30.5 28.5 32.3

55 26.2 24.3 27.9

60 22.2 20.4 23.7

65 18.4 16.8 19.7

70 14.8 13.4 15.9

75 11.7 10.5 12.5

80 8.9 7.9 9.5

85 6.6 5.9 7.0

90 4.8 4.3 5.0

95 3.5 3.1 3.5

100 2.5 2.2 2.5

Source: National Vital Statistics Report, Vol. 54, No. 14, April 19, 2006, Report revised March

28, 2007.

Retrieved Aug. 5, 2009

www.cdc.gov/nchs/data/nvsr/nvsr54/nvsr54_14.pdf

11

Purdue extension

Financial Planning for Retirement Workbook • CFS-685-W

estimates listed on Worksheet 5 are just a guide. Your

items may last longer or may need to be replaced

sooner.)

How Much Are You Worth?

As you develop your financial plans for retirement,

you need to know the resources you already have.

A net worth statement gives you that information.

On Worksheet 6, “How Much Are You Worth?”

(page 14), list your current assets and liabilities. Your

assets include everything you own that is of any value

(like cash on hand, your checking and savings account

balances, the current market value of bonds, stocks,

and other investments). Your liabilities include the

outstanding balance due on the debts you owe (such

as your home mortgage or car loan, and other unpaid

bills). Subtracting your liabilities from your assets will

show your net worth.

You may be able to get a fairly accurate estimate

of your home’s value from a real estate firm, or you

can pay a professional appraiser to do this. Other

appraisers can estimate the value of antiques, jewelry,

or other unique valuables (such appraisals should also

be recorded for insurance purposes).

Every year, perhaps at the first of each year, review

your net worth statement and update your figures for

any changes in your financial situation over the year.

Estimating Retirement Income

Where will your retirement income come from?

The primary sources of income for most retirees are

Social Security, public and private pensions, personal

savings and investments, and earnings. In 2006, Social

Security provided 37 percent, earnings 28 percent,

public and private pensions 18 percent, and income

from assets, 15 percent of the income of people 65 or

older.

1

1

Source: Income of the population 55 or older in 2006,

SSA. Retrieved from www.ssa.gov/policy/docs/statcomps/

income_pop55/2006/index.html August 2009.

Sources of Retirement Income

1. Social Security

Social Security provides a base level of income for

most retired people, although it was never designed

to replace all lost earnings. Knowing the amount you

will receive from Social Security will help you plan

your total retirement package. Your eligibility for

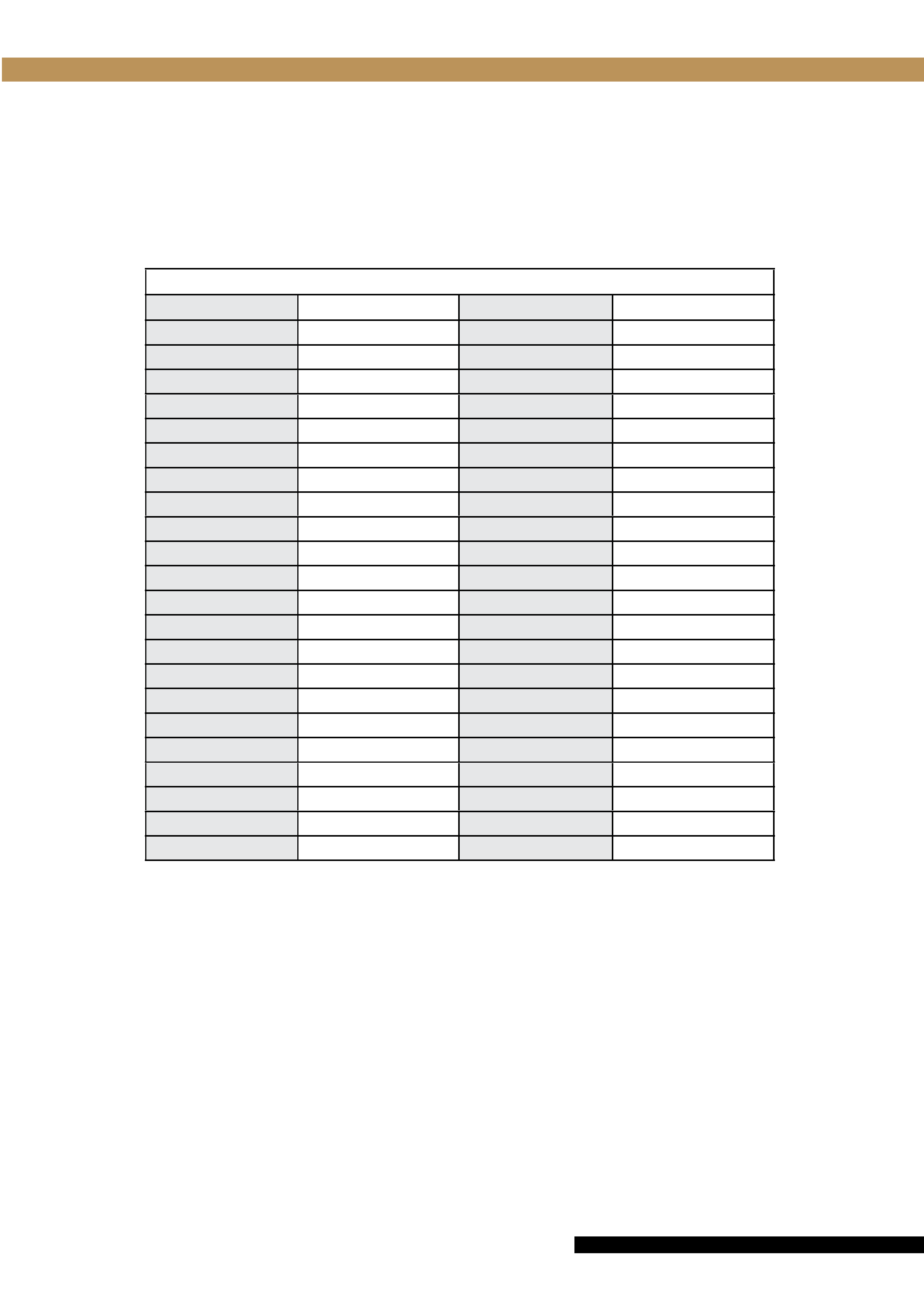

Example: Estimated Annual Cost of Living 10 Years After Retirement

Your Budget at

Retirement

Inflation

Factor

Your Budget

10 Years After

Retirement

Housing

$17,025 1.63 $27,751

Household operation and maintenance

$3,813 1.63 $6,215

Automobile and transportation

$10,287 1.63 $16,768

Food

$7,726 1.63 $12,593

Clothing

$3,047 1.63 $4,967

Personal

$2,601 1.63 $4,240

Medical and health

$2,847 1.63 $4,641

Recreation, education

$2,837 1.63 $4,624

Contributions

$1,262 1.63 $2,057

Taxes and insurance $1,902 1.63 $3,100

Savings, investments

$1,333 1.63 $2,173

Irregular expenses

(ex. gifts, license plates, holiday

spending, etc.)

$513

1.63

$836

ANNUAL TOTAL $55,194 1.63 $89,966

From Financial Planning for Retirement, NCR-264, Field and Hathaway, Michigan State University CES 5/87.