Fillable Printable Personal Financial Plan Calculator

Fillable Printable Personal Financial Plan Calculator

Personal Financial Plan Calculator

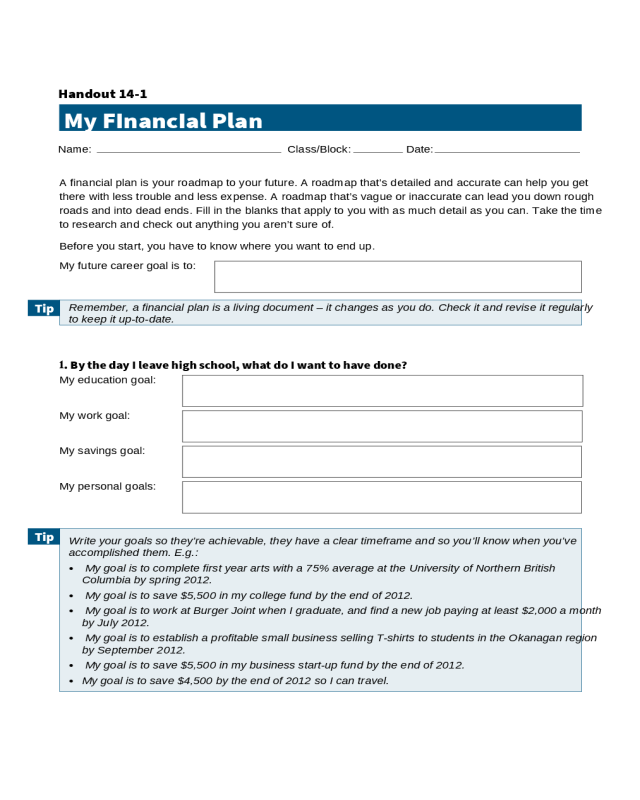

A financial plan is your roadmap to your future. A roadmap that’s detailed and accurate can help you get

there with less trouble and less expense. A roadmap that’s vague or inaccurate can lead you down rough

roads and into dead ends. Fill in the blanks that apply to you with as much detail as you can. Take the time

to research and check out anything you aren’t sure of.

Before you start, you have to know where you want to end up.

My future career goal is to:

Remember, a financial plan is a living document – it changes as you do. Check it and revise it regularly

to keep it up-to-date.

1

. By the day I leave high school, what do I want to have done?

My education goal:

My work goal:

My savings goal:

My personal goals:

Write your goals so they’re achievable, they have a clear timeframe and so you’ll know when you’ve

accomplished them. E.g.:

• My goal is to complete first year arts with a 75% average at the University of Northern British

Columbia by spring 2012.

• My goal is to save $5,500 in my college fund by the end of 2012.

• My goal is to work at Burger Joint when I graduate, and find a new job paying at least $2,000 a month

by July 2012.

• My goal is to establish a profitable small business selling T-shirts to students in the Okanagan region

by September 2012.

• My goal is to save $5,500 in my business start-up fund by the end of 2012.

• My goal is to save $4,500 by the end of 2012 so I can travel.

Handout 14-1

Name: Class/Block: Date:

Tip

Tip

My FInancIal Plan

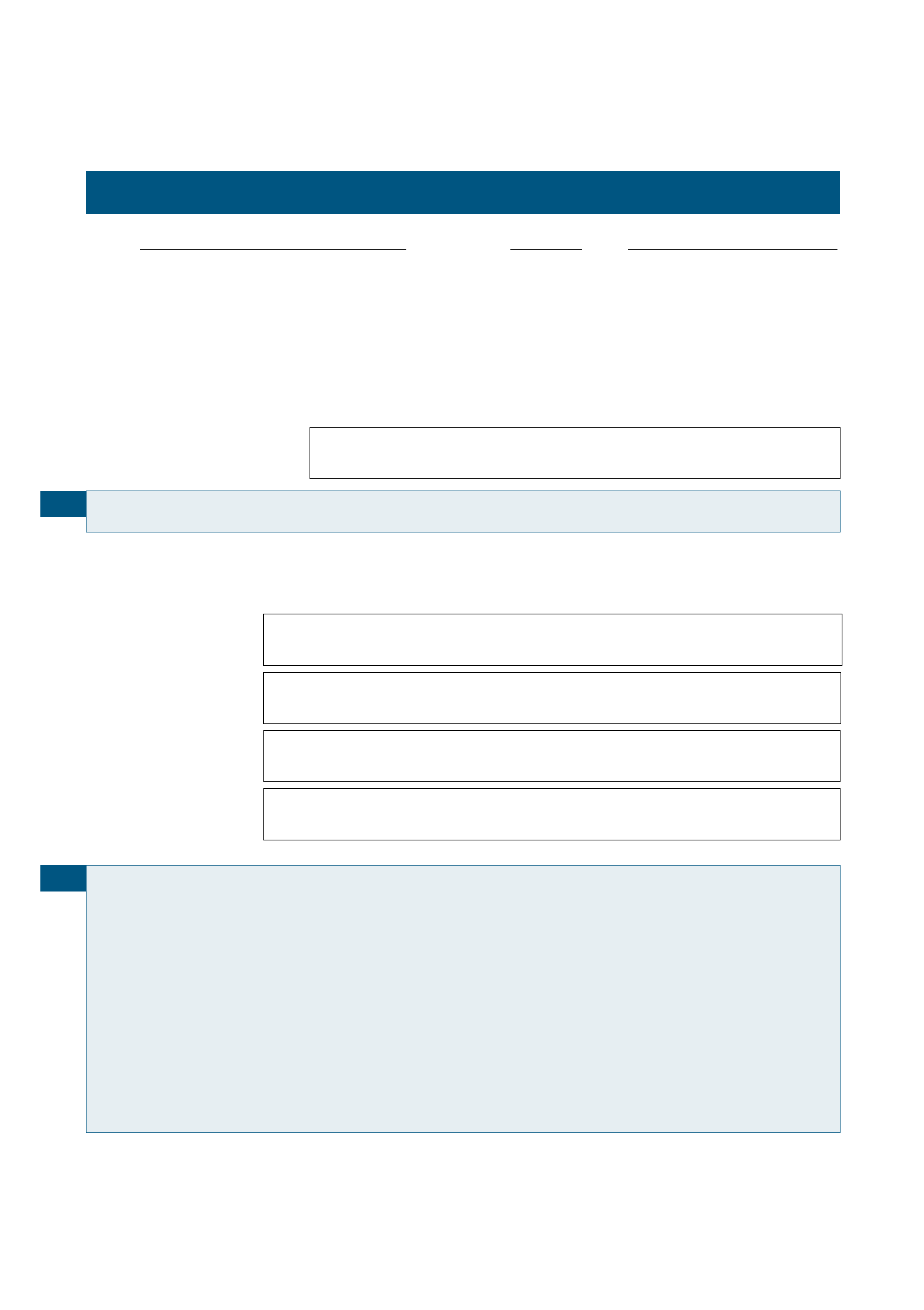

2

. One year after I leave high school, what do I want to have done?

The year after I leave high school runs from:

[date] to [date]

To support my career goal:

I’ll need some education or training. My education/training goal is to:

I have to have a job to get money and experience. My employment goal is to:

I don’t want to work for anyone else. I’ll create my own job. My business goal is to:

The rest of my life is important, too. My personal goals are to:

Handout 14-1 (continued)

My FInancIal Plan

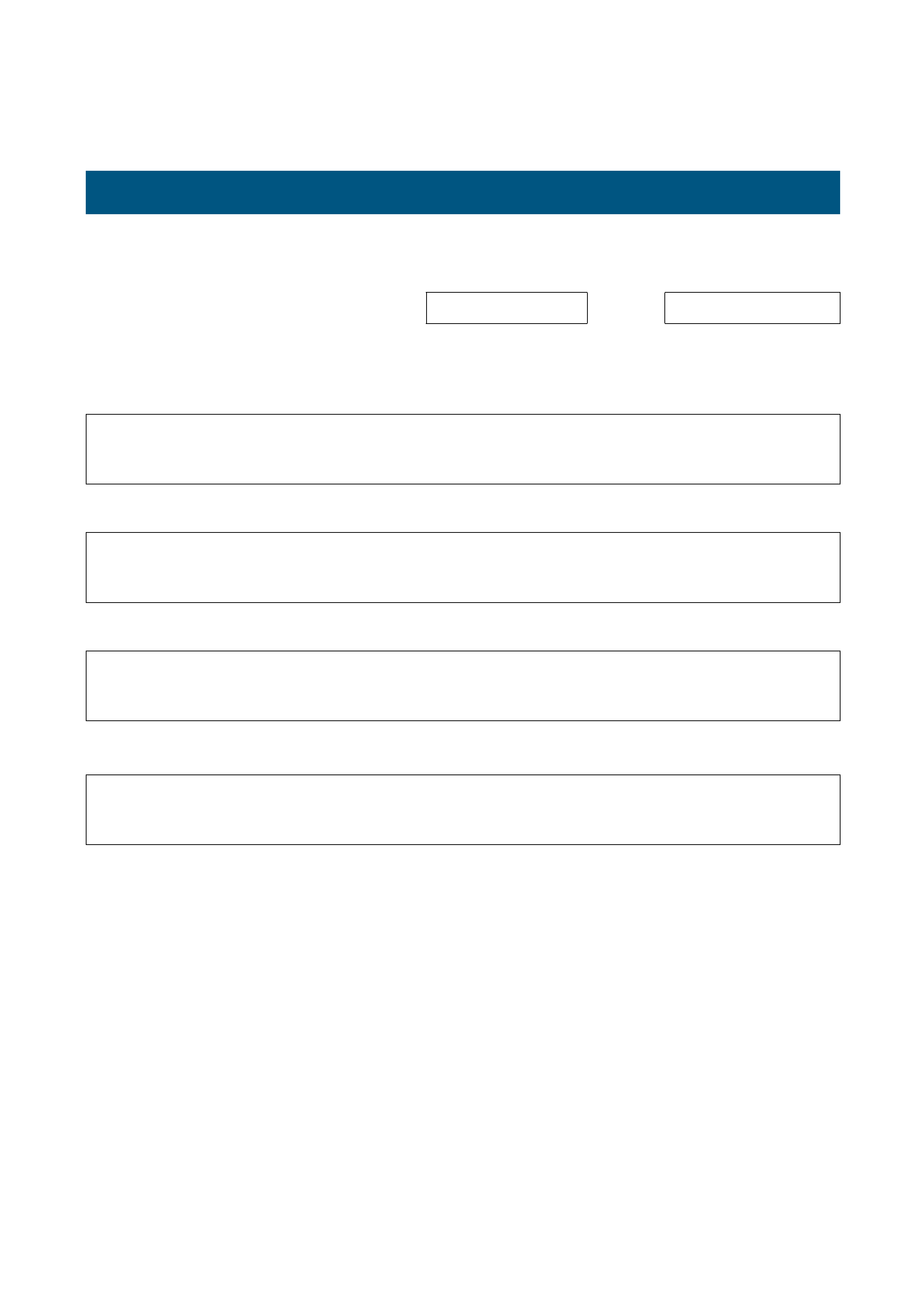

3

. When do I have to have things ready? What are my deadlines?

You’ll have to keep track of dates and deadlines to make sure you can accomplish your goals for the first

year after high school. Enter any dates that apply below.

The program information on the EducationPlanner website can help you find deadlines for education

programs in BC.

If you don’t know of any important deadlines, use the internet, published information or telephone contacts to get key

information and enter it below. Use the form at the end of this plan to keep track of any applications you make. Create

a timeline or put these dates in your daytimer or calendar so you don’t lose track of them.

Keeping my life together

Date

Check

when done

Move to new home (apartment, university residence, etc.)

o

Arrange utilities and telecommunications

o

Buy insurance (home, contents, car, etc.)

o

Apply for Social Insurance Number

o

Apply for BC Medical insurance

o

Transfer banking accounts

o

Change address on ID and other records

o

My education

Apply to educational institutions

o

Use the PAS BC online application to apply to educational institutions in BC. Apply as soon as you

have your records – the earlier the better.

Pay tuition and student fees

o

Apply for government scholarships/bursaries

o

Apply for community/other scholarships/bursaries

o

Apply for student loan

o

Arrange RESP/investment withdrawals

o

Apply for student housing

o

My job

Apply for employment

o

Buy equipment and supplies

o

Enrol in job training program

o

Enrol in job placement program

o

Apply for apprenticeship or other work program

o

Working for myself

Research and write business plan

o

Meet with a business adviser

o

Apply for line of credit or other loans

o

Check the resources on self-employment on the WorkInfoNET Youth website.

Tip

Tip

Tip

Handout 14-1 (continued)

My FInancIal Plan

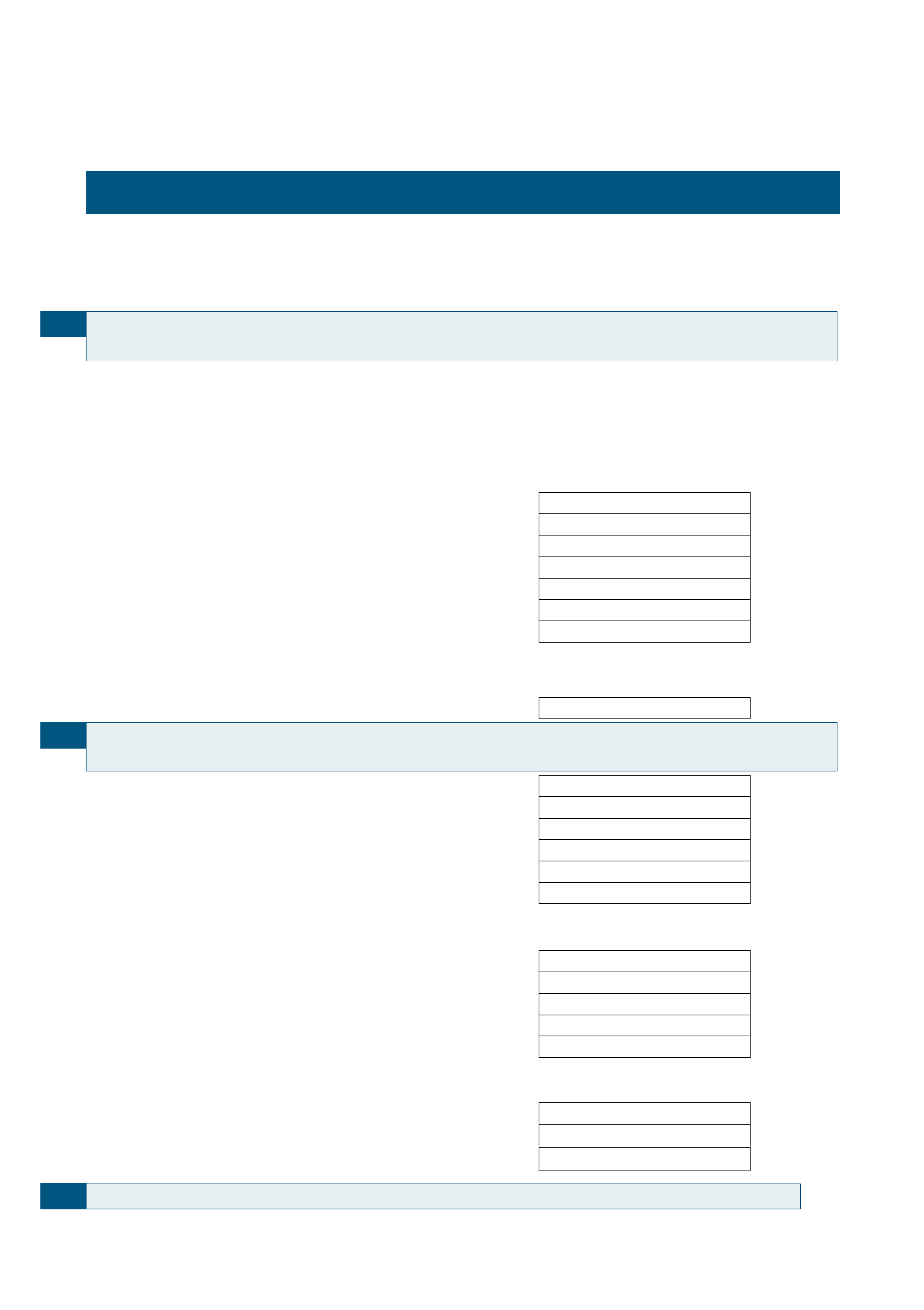

4. What will I be starting out with?

This is your projected net worth statement for the end of high school.

Date I leave high school

assets

List financial assets you expect to have when you leave high school, either your own or those your family

has set aside for you. Enter any amounts that apply.

Consult your family before including assets from them to be sure your financial expectations are the

same as theirs.

My savings

$

My investments $

My other assets $

My scholarships/bursaries (the money I hope to get)

$

My student loans (the money I hope to get)

$

RESP in my name

$

Contributions from family and friends $

Other $

My total assets

$

a

Debts

List any debts you expect to be responsible for.

My credit card balances

$

My student loans (the money I may owe)

$

My car loan $

My bank or other loans $

My other debts (money owed to family and friends) $

My total debts

$

B

My net worth (total assets minus total debts)

$

c = (a – B)

5

. What will my annual income be?

List the income you expect to have in the year (the complete 12-month period) after you leave high school.

Use your Freedom 18 Budget research to help you estimate.

Don’t include here scholarships, bursaries, loans, gifts or similar one-time receipts of money. List them as

assets in Step 4.

Income after deductions

$

Income from investments or other sources $

On-going financial support from family $

Total Income

$

D

Tip

Tip

Tip

Handout 14-1 (continued)

My FInancIal Plan

6

. What will my annual expenses be?

List the expenses you expect to have in the year (the complete 12-month period) after you leave high school.

Use your Freedom 18 Budget research to help you estimate.

Fixed

The year after I leave high school

Housing

$

Car payments

$ 00

Other loan payments

$ 00

Insurance

Car

$ 00

Home or contents

$

Other (e.g.: travel medical)

$

Utilities (electric, gas)

$

Telecommunications (cable, internet, telephone, cellphone)

$

Other

$ 00

Total Fixed Expenses

$

Variable

Food

Groceries

$

Eating out

$

Household (cleaning, maintenance, furniture)

$

Computer (hardware, software, accessories, supplies)

$

Childcare

$ 00

Pets

$

Transportation

Car (gas, maintenance, repairs)

$ 00

Public transit

$

Health care (medical insurance, dental, glasses/lenses, medications)

$

Clothing

$

Personal care (toiletries, hair care, makeup, laundry, etc.)

$

Recreation (movies, games, DVDs, clubs, concerts, sports, etc.)

$

Travel

$

Gifts and charitable donations

$

Education, lessons, etc.

Tuition, fees

$

Books, supplies

$

Other

$

Savings

$ 00

Total Variable Expenses

$

Total Expenses per year

$

Check carefully. Are these expenses realistic for you? Do you have to rethink anything? Have you left anything out?

Tip

Handout 14-1 (continued)

My FInancIal Plan

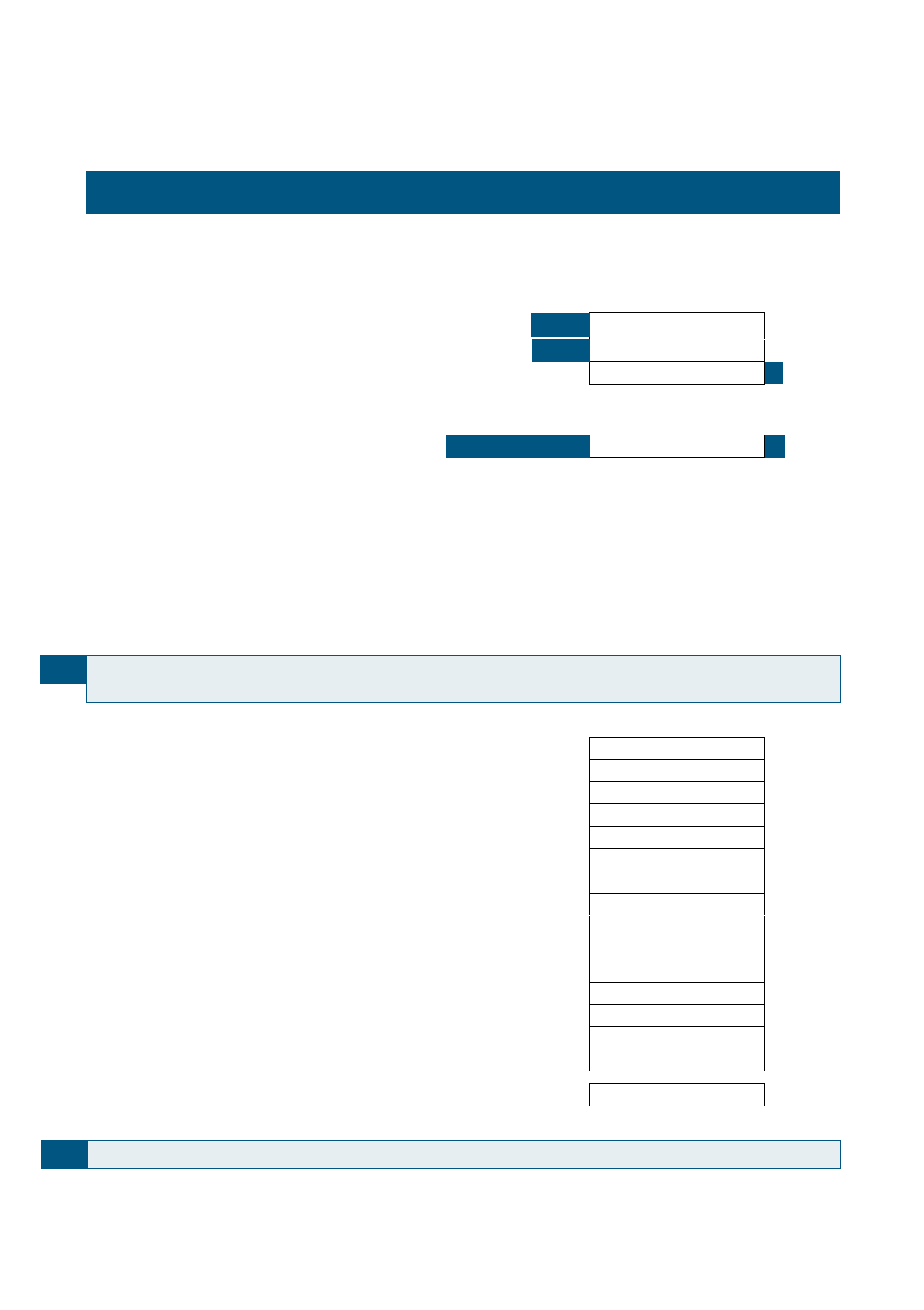

E

7

. Will I have enough money to meet my goals?

Enter the information from your estimates in the blanks below.

In the year after I leave high school:

Income

from D

$ )

Expenses

from E

$ )

Difference

$

F

If the difference is a positive number, you can add it to your savings.

Additional savings I can add to my assets

from F (if positive)

$

G

If the difference is a negative number, you have a few options.

1) Cut back! Reduce your expenses and adjust Step 6.

2) Push on! Work more to earn more money and adjust Step 5.

3) Use your resources! Try the funding strategies in Step 8.

8

. What can I do to get the extra money I need?

You have resources.

You can raise the funds you need with these strategies:

For advice, check out the Achieve BC website and the WorkInfoNET Youth website.

Use the assets I listed in Step 4: amount

Ask family for support $

Use my scholarships and bursaries

$

Use my student loan

$

Use my savings

$

Use my RESP and other investments

$

Apply for additional government scholarships/bursaries

$

Apply for additional community/other scholarships/bursaries

$

Apply for additional student loans

$

Apply for a bank loan or line of credit $

Earn additional income in part-time or full-time employment

$

Earn income from self-employment $

Apply for a co-operative work arrangement $

Apply for an apprenticeship program $

Apply for sponsorship $

Apply to a military program $

Total

$

You can use the assets to cover the difference (Box F) above.

If the resources you can use are greater than your expenses, decide which you’ll use first.

Tip

Tip

Handout 14-1 (continued)

My FInancIal Plan

9. Where can I get the support and advice I need?

Family members

Friends

School counsellors and career centre

Community leaders

Community agencies

Financial advisers

Library and other information resources

Online resources

• EducationPlanner website (www.educationplanner.bc.ca)

• Achieve BC website (www.achievebc.ca)

• WorkInfoNET Youth website (www.workinfonet.ca/youth)

• The Money Belt (www.themoneybelt.gc.ca)

• BCSC website (www.bcsc.bc.ca, click

Planning 10)

Handout 14-1 (continued)

My FInancIal Plan

10. What could go wrong?

Use this checklist to think ahead about possible problems and how you’d solve them.

How will I make sure I don’t miss any important dates and deadlines?

What will I do if the cost of tuition or some of my other expenses go up a lot, or if I don’t meet my savings goal?

Do I have an emergency fund for unplanned expenses?

Do I have enough insurance?

How will I make money if my job falls through?

Who can I call for emergency advice if things don’t work out?

What other problems might come up?

Handout 14-1 (continued)

My FInancIal Plan

11

. How do I keep my plan up-to-date?

No plan can anticipate everything that may come up in the future. That’s why it’s important to review your

plan regularly and adapt it to changes in your life and your goals.

Save your plan on your computer using the downloadable file available from the BCSC click

Planning 10. Then you can update it easily every year.

To keep my plan up-to-date, I’ll review and update it

in [month] of each year.

12

. Family check-in

Discuss your financial plan with your parents or guardians to be sure it’s realistic for you. Write a summary

of your discussion.

Tip

Handout 14-1 (continued)

My FInancIal Plan

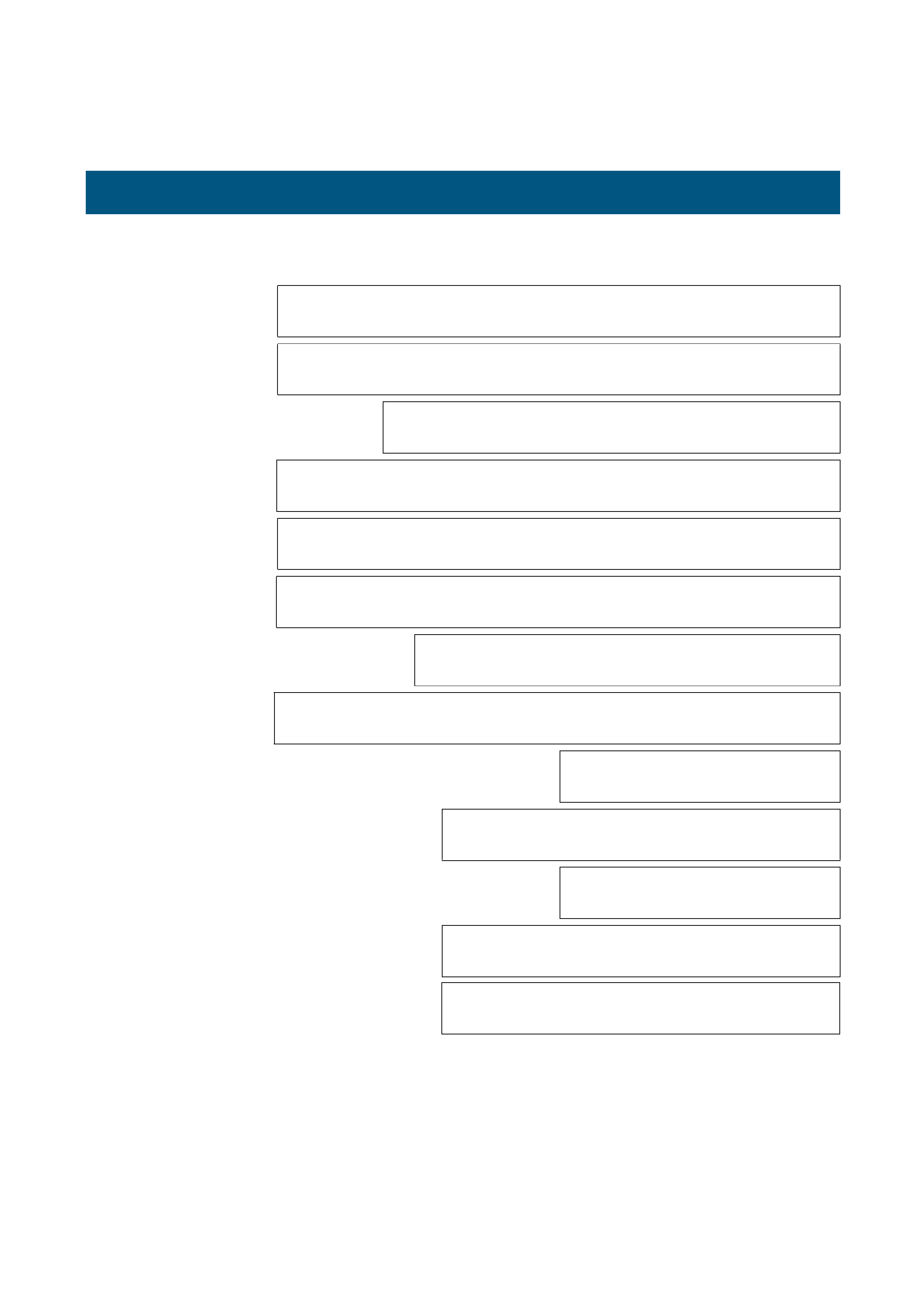

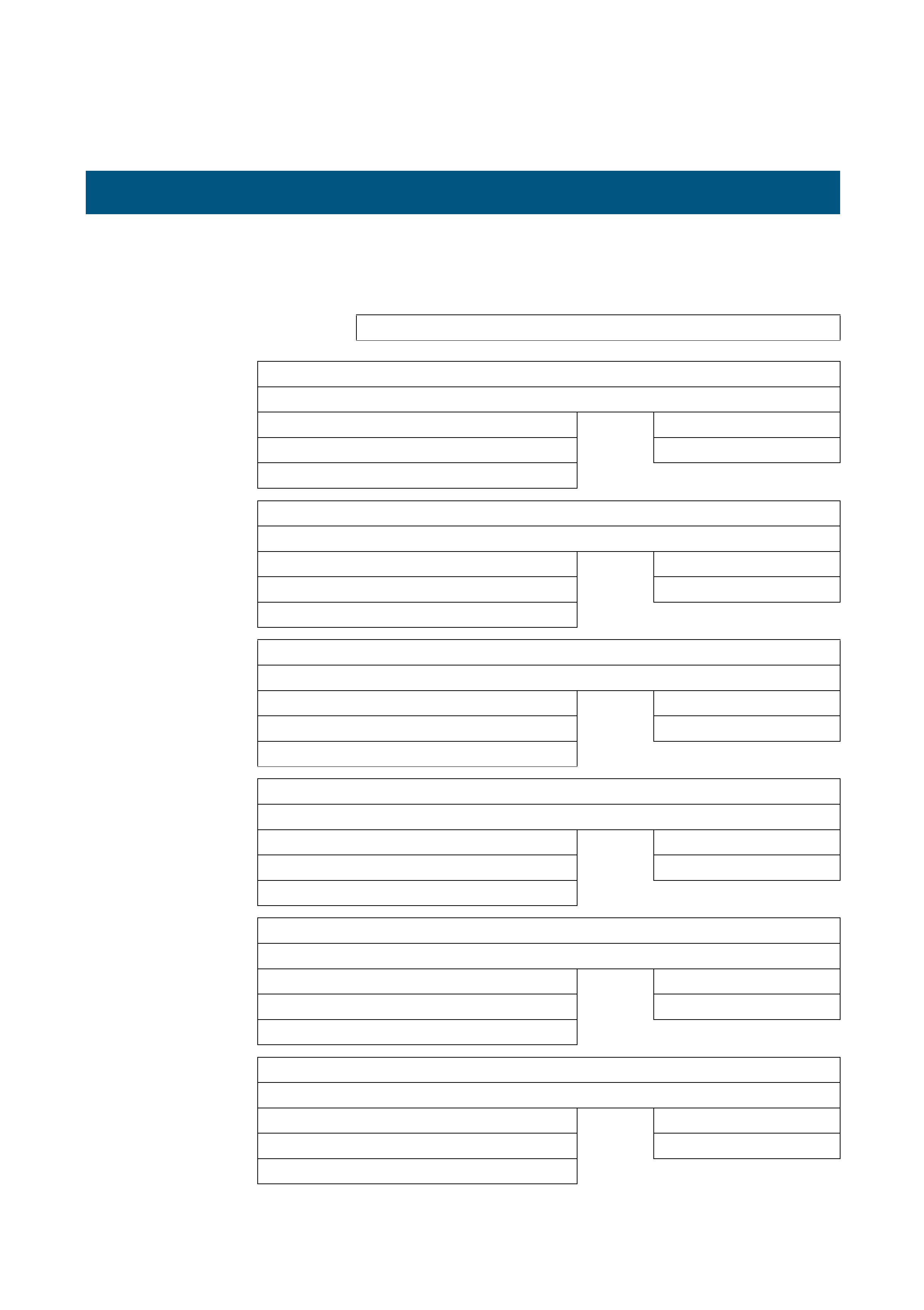

applications Template

Use this form to keep track of important contacts and deadlines. Make copies and keep a separate page for

each type of application – employment, schools, scholarships, bursaries, etc.

My applications for

Apply to:

Address:

Name of contact: Phone:

Apply by: E-mail:

Check back by:

Apply to:

Address:

Name of contact: Phone:

Apply by: E-mail:

Check back by:

Apply to:

Address:

Name of contact: Phone:

Apply by: E-mail:

Check back by:

Apply to:

Address:

Name of contact: Phone:

Apply by: E-mail:

Check back by:

Apply to:

Address:

Name of contact: Phone:

Apply by: E-mail:

Check back by:

Apply to:

Address:

Name of contact: Phone:

Apply by: E-mail:

Check back by:

Handout 14-1 (continued)

My FInancIal Plan