Fillable Printable Financial Planning Template

Fillable Printable Financial Planning Template

Financial Planning Template

1

Financial Planning Templates 2014/15 to 2018/19 - Guidance for

CCGs

Contents

1. Introduction ................................................................................................................................ 2

2. Cover .......................................................................................................................................... 2

3.

Financial Plan Summary

......................................................................................................... 3

4.

Revenue Resource Limit

......................................................................................................... 3

5.

Planning Assumptions

............................................................................................................. 3

6.

Financial Plan Detail

................................................................................................................ 4

7. QIPP ........................................................................................................................................... 6

8. Risk ............................................................................................................................................. 7

9.

Investment

................................................................................................................................. 8

10.

Better Care Fund (BCF)

...................................................................................................... 9

11.

Contract Value Triangulation

............................................................................................ 10

12.

Cash flow and Statement of Financial Position

............................................................. 11

13. Capital .................................................................................................................................. 11

Appendix A: Suggested Approach

............................................................................................... 12

Appendix B: Financial Planning Business Rules

....................................................................... 14

2

1. Introduction

Planning templates have been constructed to provide sufficient granularity for NHS

England to assess CCG plans for the five year period from 2014/15 to 2018/19.

Due to the need to develop comprehensive plans for a full five year period, templates

have been adjusted from the 2013/14 planning round. Each financial year has its

own expenditure plan. Rather than having to enter values for all five years, the later

years are open to a degree of pre-population by adjusting assumptions on key

factors such as levels of activity growth.

The financial information included in the templates should reflect the assumptions

set out in the wider plans for CCGs.

All financial values should be entered in £000.

Cells in light yellow should be completed by CCGs where appropriate; those in blue

are calculated, and those in light green will be pre-populated.

The sections below give more detailed guidance on each sheet within the workbook.

Appendix A also gives a suggested approach to completing the template.

Please submit completed plans to the Financial Performance (NHS England)

mailbox at

NHSCB.financialperformance@nhs.net

in line with the submission date on

the email instruction. Please also direct any queries on template completion to this

mailbox.

2. Cover

Input is required on this tab.

Firstly select your CCG from the drop down list. This will then populate further

information on this sheet as well as your allocation for 2014/15 and 2015/16 on the

Revenue Resource Limit tab.

Thereafter, please complete all of the boxes shaded red in order to demonstrate

sufficient ownership and sign off of the financial plan.

Once you have finished completing the template please ensure that the box for

quality checks is showing as ‘cleared’ before submitting the plan. Further detail on

the checks can be found in the ‘quality checks’ tab further on in the template.

3

3. Financial Plan Summary

The majority of numbers on the Financial Plan Summary tab will be pre-populated

from the other input sheets within the template, it is therefore suggested that this

sheet is completed once data has been entered into all of the other sheets. The only

numbers that do need to be input on this sheet relate to 2013/14.

Column J requires commentary on the CCG’s financial position to be entered. It is

recommended that financial performance is linked to wider strategic and operational

plans over the five year period.

4. Revenue Resource Limit

This tab will be pre-populated with the CCG’s allocation for 2014/15 and 2015/16 in

order to prevent the difficulties that were faced in 2013/14 reconciling resource limits.

Therefore if the CCG thinks the allocation is incorrect they need to raise this with

their Area Team immediately.

CCGs should enter their assumptions for the years 2016/17 – 2018/19.

Values are shown for the non elective, headroom and 70% non elective collection.

These funds should be taken from the notified allocation and employed non

recurrently with the plans for their investment detailed on the Investment and

Financial Plan Summary tabs.

5. Planning Assumptions

In order to populate future years, an Assumptions tab has been added in in order to

better link assumptions and costs. Percentage growth assumptions should be added

where relevant for each financial year for recurrent costs. The growth percentages

ought to be year on year growth, for example the percentage increase in cost against

a service compared to the previous year. Costs in the financial plan will be pre-

populated with recurrent costs based on the % assumptions added in this tab.

Assumptions should be added for demographic and non-demographic activity

growth, gross provider efficiency and inflation. Demographic growth must be derived

from a published source (e.g. ONS). Non-demographic growth includes pressures

arising from technological developments, increased prevalence etc.

4

This assumptions sheet allows a CCG to link financial planning with other

operational and activity plans, and use this information to drive future year financial

plans.

6. Financial Plan Detail

This is designed to capture all of the CCG’s resource and spend. The table

separates recurrent and non-recurrent items in order to calculate the CCG’s

underlying position.

Rows 2 and 3 detail the resource limit. The figures feed from the revenue resource

limit sheet and therefore do not need to be populated. This is for information while

completing the template and supporting the calculation of surplus or deficit while the

plan is being completed.

The remaining rows detail the expenditure as follows;

Column B - 13/14 Forecast Outturn this column should be populated with the

latest FOT position.

Columns C - E - Adjustments to expenditure baseline - These columns are

designed to account for any adjustments in order for the CCG to get back to a

recurrent opening budget position. The adjustments that reflect the underlying

position should reflect what the organisation has submitted on the non-ISFE

underlying position return.

o

Any non recurrent expenditure incurred in 2013/14 should be entered

in Column C.

o

Column D would include the full year effect of any QIPPs achieved in

2013/14, or of any investments

o

Column E is for any other full year effects not covered in Column D

adjustments.

Column F – This column is calculated and outlines the recurrent underlying

expenditure position for the CCG, and is used to calculate the underlying

surplus.

Columns G - I - Demonstrates the provider efficiency requirement delivered

(min 4%) and the inflation funded to show net price deflation / inflation. These

numbers will be calculated from the assumptions sheet. The % change is not

expected to be applicable to exclusions/cost per case, but CCGs can enter

values if appropriate.

Column J - Demographic Growth uplift reflecting population change (Must be

derived from a published source e.g. ONS). These numbers will be calculated

form the assumptions sheet.

5

Column K - Non-demographic growth pressures arising from other population

changes, technological developments, increased prevalence etc. These

numbers will be calculated from the assumptions sheet.

Column L - Cost pressures. These are free cells to enter costs as financial

values directly onto the expenditure template (i.e. they are not driven by the

assumptions sheet). This would include any recurrent cost pressures not

adequately captured by the headings in columns G to K.

Columns M & N – These cells capture the information entered onto the QIPP

sheet. All QIPP schemes will need to have an expenditure type selected from

the drop down box on the QIPP sheet for the information to flow through to

the Financial Plan and reconcile.

Column O - Investment which is not QIPP related, but relating to other service

quality/developments. As above, this is pre-populated once the CCG has

completed the investments worksheet within the template. All costs entered

on the investments worksheet need to be allocated to a cost category on the

drop down menu for the workbook to reconcile.

Column Q - CCGs need to enter any non-recurrent pass through costs here

that the CCG has received and has been assumed in the allocation.

Column R - Non-recurrent pressures, investments (incl. CQUIN where

relevant). Non-recurrent items all at 2014/15 prices.

Column S – Non Recurrent Investments. As with the recurrent investments

this will be captured from the Investments tab

Columns T & U – Non Recurrent QIPPs. As with the recurrent QIPPs, these

will be captured from the QIPPs sheet.

Include Learning Disability costs under Mental Health (hospital-based) or Community

Services.

The CCG’s total Programme Resources should be matched across the expenditure

categories, the difference being its surplus or deficit (shown in the Financial Plan

Summary). Where reserve budgets are expected to be used to fund other

programme expenditure, e.g. the use of reablement funding for community services

investment, this should be shown netting off in the investments column (i.e. reducing

reserves line and increasing service expenditure).

Running costs have been split between CCG pay costs, CSU re-charge, NHS

Property Services Recharge and other non-pay. The Financial Plan Summary will

match the total expenditure to the running costs allocation to check to see whether

the CCG is within target allocation.

Columns Y - AJ - Monthly expenditure profile. Please enter the correct

monthly profile into these columns. The March figure will calculate

automatically to ensure that the monthly totals match the annual plan in

column V.

6

The template for 2015/16 replicates the 2014/15 sheet requiring the same level of

detail. For the following three years the information requirement is reduced.

7. QIPP

There is a separate QIPP sheet for each year with the first two years requiring

further detail.

The QIPP table splits QIPP into two headings:

Transactional & Contract efficiencies relate to savings made from providers

from purchasing activity more efficiently, i.e. re-procurement of diagnostics,

contract conditions such as new to follow up ratios.

Transformational & Pathway changes relate to savings from de-

commissioning, more effective service provision, new models of care.

Under each heading the QIPP is broken down into separate work streams.

The QIPP plan will need to be split between recurrent and non-recurrent schemes.

Column A requires the local name of each scheme over £0.5m. All schemes that are

under £0.5m should be grouped together under the balance of schemes under

£0.5m section. In order that the QIPP tab feeds the financial plan detail tab column B

requires the area of spend to be selected. Therefore, more than one line would be

needed for each local scheme. For example, a transformational QIPP scheme for a

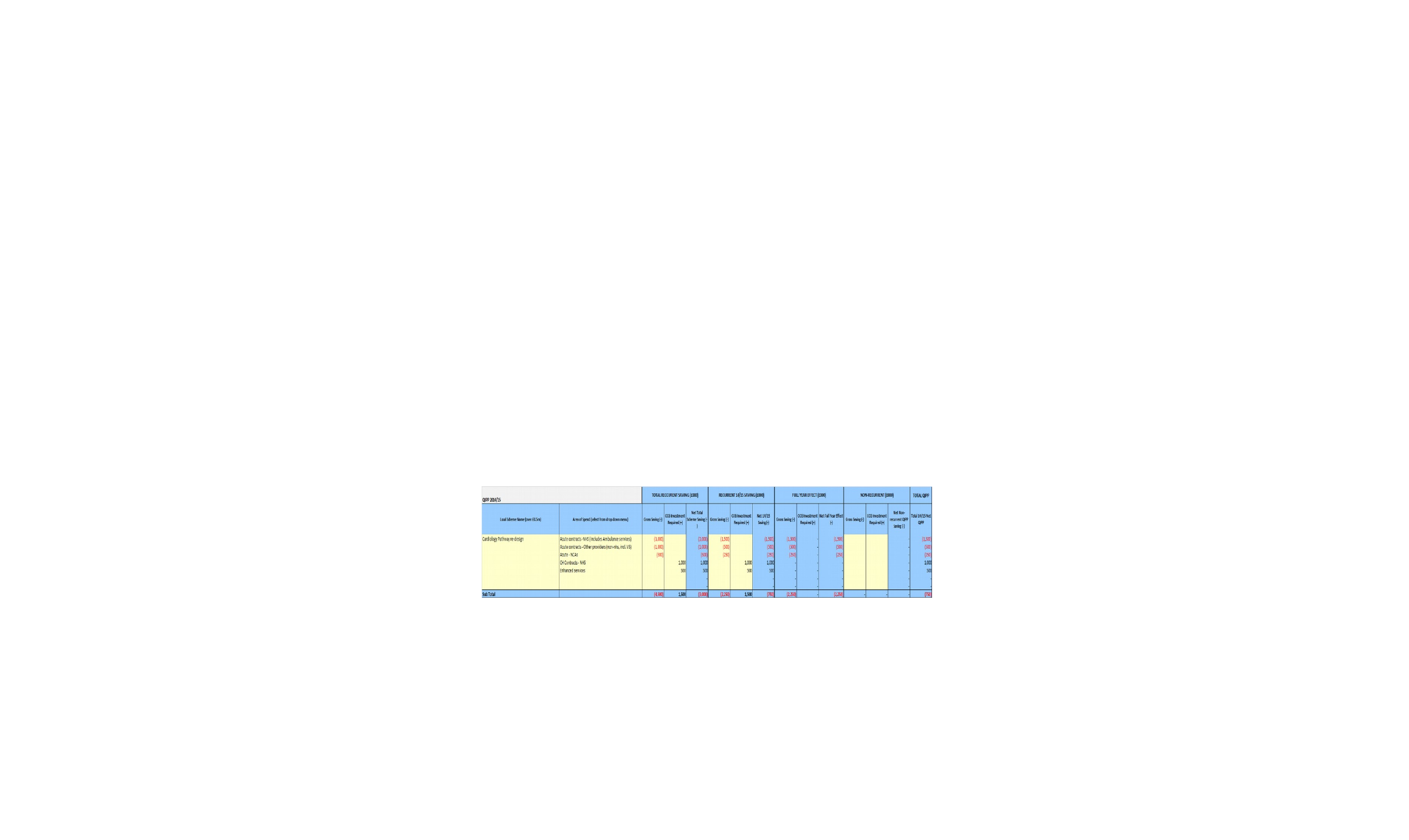

cardiology pathway redesign might require the following:

In Columns C and D please enter the expected full recurrent annual value of savings

and investment. In the above example the scheme is expected to generate recurrent

savings of £4.5m (Col C) with recurrent annual investment of £1.5m (Col D). Column

E calculates the net annual recurrent saving, in this case £3m.

In Columns F & G please enter how much of that saving/investment will occur in

2014/15. In the above example the investment of £1.5m was needed up front, but

the savings came in half way through the year generating a £2.25m saving and an

overall net saving of £0.75m.

7

Columns I and J calculate the full year effect of the scheme; that is, the difference

between the total recurrent annual saving and the 2014/15 saving. This will be used

to calculate the recurrent underlying surplus.

In Columns L and M please enter the value of any non recurrent savings in that year.

The QIPP sheets for all five years are identical with the exception that for years

2014/15 and 2015/16 the QIPP savings profile is required (columns Q to AB). For

later years the schemes are not expected to be as detailed, but strategic intentions

are expected to be outlined and there are consequently fewer areas of spend to

choose from.

Please note – On each worksheet only enter new schemes anticipated to be effected

that year. Do not include the full year effect of schemes begun in prior periods as this

will be calculated automatically.

Unidentified QIPPs needs to be entered on rows 169 - 173 with the spend category

chosen from the drop down box to ensure the figures feed through to the overall

financial plan. Levels of unidentified QIPP will be reviewed during the assurance

process.

If there are risks to the achievement of the QIPP programme please enter these onto

the Risk sheet.

QIPP schemes may require investment by other parties, for example by an Area

Team within Primary Care. If your CCG’s QIPP requires external investment please

complete the section at the end of the QIPP form – external investment supporting

QIPP.

8. Risk

The format for risk assessment follows a similar format to that used for non-ISFE

reporting throughout 2013-14.

For the first two years, CCGs are required to enter their full risk value and

percentage probability of risk being realised which automatically populates a

potential risk value amount. Please note that risks entered here ought to be anything

in addition to what has been incorporated in the planned position. As a general rule

of thumb, if there is a very high chance that a risk will materialise (over 90%) it would

be expected to be shown in the expenditure tabs as part of the planned surplus or

deficit position. Only include additional risks in this tab which put the achievement of

your planned position at risk.

CCGs are also asked to provide meaningful commentaries against each risk figure

entered, providing specific detail as to what is driving the risk and avoiding general

terminology as much as possible.

8

CCGs are then asked to enter any mitigations that can be used to offset this risk.

This is split between “Uncommitted Funds” and “Actions to Implement”. Uncommitted

funds ought to include any funds available that have not been committed in the

plans. Again CCGs should enter the full mitigation value and the probability of

success of the mitigation working as a percentage and the expected mitigation value

will automatically populate. A commentary box is provided to show detail of what

these mitigating actions are.

For the final three years of the five year plan, CCGs are only required to enter the

potential risk value and expected mitigation value as net figures already, and provide

a commentary to add detail where possible.

The key figure produced by these assessments is the net risk/headroom position

which is used to drive a risk adjusted planned surplus/ (deficit) position in the

Commetary sheet.

9. Investment

The table requires a high-level analysis of where CCGs propose to apply their

investments.

Each development should be named in Column A with the category of spend

selected from Column B in order that the detail feeds through to the financial detail

tab

Recurrent

Column C –Investment the CCG will incur in the financial year. Please enter

the part year effect for the year that is being completed.

Column M – Enter the total value of the investment needed.

Column O – This will calculate the full year effect of the investment (the

difference between Columns M and C) and feed through to the underlying

surplus calculations.

Non Recurrent

Column E - Bought forward Surplus - how and where the brought forward

surplus is being spent

Column F - Non-Recurrent Headroom - application of the funds will be subject

to Business Case approval by ATs and no funds should be committed at plan

stage unless the AT has specifically approved the scheme.

Column G - 70% Threshold

Column H - Readmissions Credit

9

There may be circumstances where expenditure that should have been committed

non-recurrently has been committed recurrently. Where this has happened this

should be recorded as an over-commitment under the recurrent section of the

investment tab.

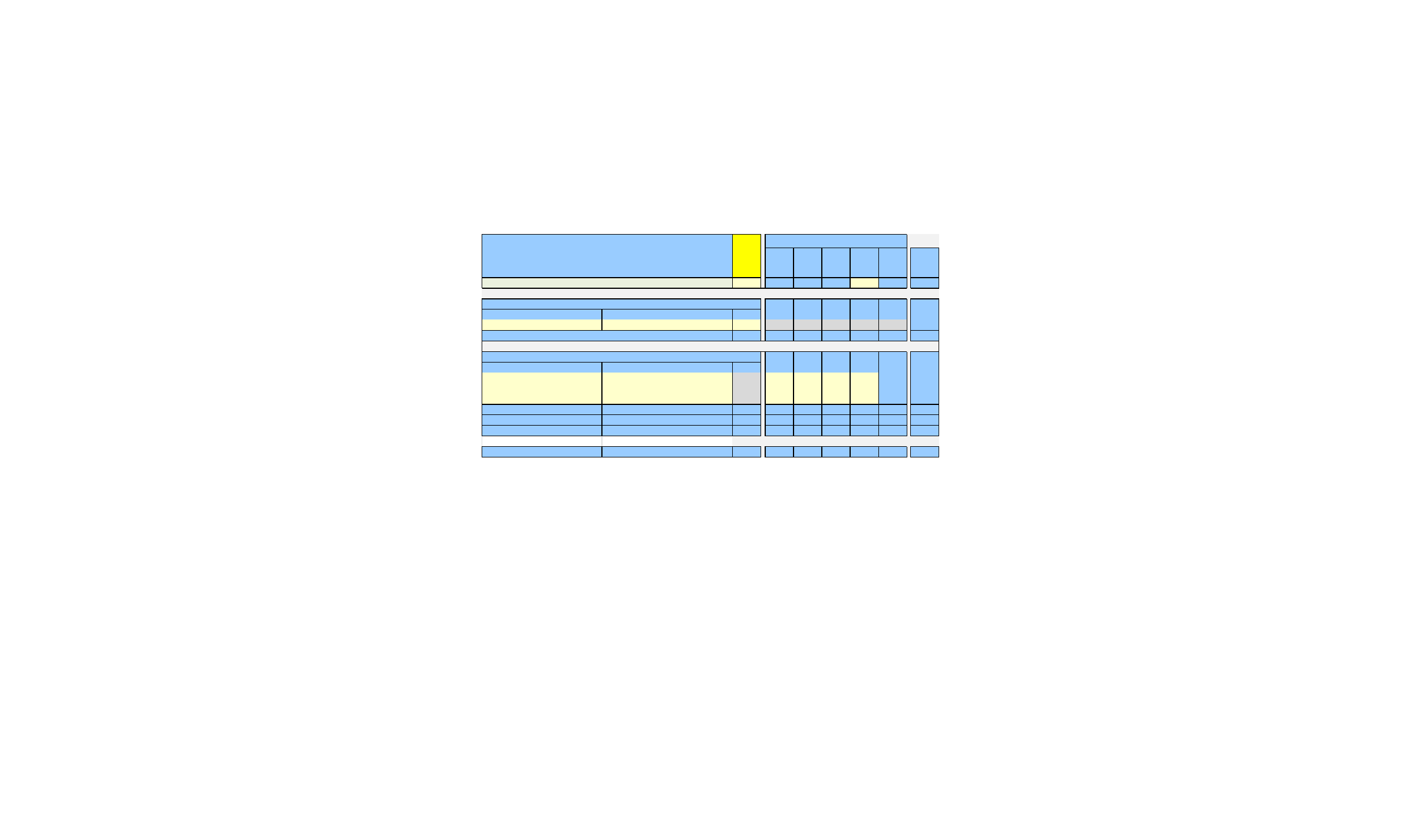

In the example below; the CCG has planned to invest both the non-recurrent

headroom (£4m) and the 70% threshold (£1m) in non recurrent schemes. However,

only £1m of the £2.5m bought forward surplus is planned to be spent non-

recurrently. Effectively, £1.5m has been invested recurrently and therefore appears

in column C.

10. Better Care Fund (BCF)

CCGs are required to detail investment in the Better Care Fund for 2014/15 and

2015/16.

The top two rows in the worksheet outline the funding available and will be

calculated from elsewhere in the template; the Notified BCF Allocation will be pre-

populated in the Revenue Resource Allocation worksheet; and Transfers from other

Pooled Budgets will be calculated from within this worksheet where additional funds

have been identified for investment into the BCF.

In the Expenditure section CCGs are required to firstly state where the Notified

Allocation will be spent and secondly identify any additional funding that is being

invested into the BCF.

Within both expenditure sections CCGs are asked to detail how the funding will be

spent: which organisation will hold the pooled fund and which Health and Wellbeing

Board will oversee the allocation of funds.

2014/15

B/F surplus

NR

Headroom

70%

Threshold

Re-

admission

Credit

NR Total Total

Available to Invest 0 2500 4000 1000 7500 7,500

Recurrent

Description Area of Spend (select from drop down)

Admission Prevention Schemes (b/fwd Surplus) Other Programme Services 1500

1,500

Sub-total recurrent 1,500 - - - - 1,500

Non-Recurrent

Description Area of Spend (select from drop down)

Admission Prevention Schemes Other Programme Services 4000 4000

4,000

Acute Re-investment Acute contracts -NHS (includes Ambulance services) 1000 1000

1,000

Conti ngency Conti ngency 1000 1000

1,000

Sub-total Non-Recurrent - 1,000 4,000 1,000 - 6,000 6,000

Total planned Investment 1,500 1,000 4,000 1,000 - 6,000 7,500

Remaining Funds (1,500) 1,500 - - - 1,500 -

Recurrent

resource

(underying

and in-yr

surplus)

Non-Recurrent

10

Any benefits expected from this fund should be shown on the QIPP sheets.

11. Contract Value Triangulation

This information is being collated to provide more detailed analysis for planning

purposes and to provide an overall position of contract values reported between

Commissioners, NHS Trusts and Foundation Trusts.

It is expected that organisations will align their plans with those of the wider local

health economy. In order to test the alignment of key assumptions Monitor, NHS

England, and NTDA will reconcile provider and commissioner plans both for the two

and five year submission review phases.

The outputs of the reconciliation will be shared between the regional teams of

Monitor, NHS England and NTDA. Every step will be taken not to prejudice the

position of any trust or commissioner and no information will be shared at individual

organisation level without first contacting the appropriate party.’

There are separate sheets for each year detailing the significant contracts (over

£5m) for acute, mental health and community. The sheet breaks the contracts down

in to value and activity over the relevant headings.

For all contracts under £5m, the total value should be included within the other

contract line.

All contract spend across the headings should reconcile back to the value on the

financial plans elsewhere on the templates. Therefore, for 2013/14 please enter the

forecast performance for each provider rather than values contained within service

level agreements. And for subsequent years please enter the anticipated value of

activity with providers inclusive of any QIPP schemes. Please also outline the QIPP

per provider as a memorandum, as well as the value of CQUIN per provider.

The contracts data tab requires information to be split by point of delivery. If you are

in doubt as to what category activity falls into please refer to the NHS Data Model

and Dictionary (http://www.datadictionary.nhs.uk ).

Entries on this sheet will be compared with provider submissions via Monitor or the

TDA.

11

12. Cash flow and Statement of Financial Position

The cash draw-down profile for the CCG and a projected Statement of Financial

Position will be required for the first two years of the model.

13. Capital

The table captures direct CCG capital plans and those that it is expecting to be made

within its area by other organisations such as NHS Property Services and the NCB

(predominantly Primary Care related).

For 2014/15 the information provided should be in line with the Capital Planning

Returns submitted to your Area Teams and approved by your Region.