Fillable Printable Personal Financial Plan Components Template

Fillable Printable Personal Financial Plan Components Template

Personal Financial Plan Components Template

This instructional aid was prepared by the Tallahassee Community College Learning Commons

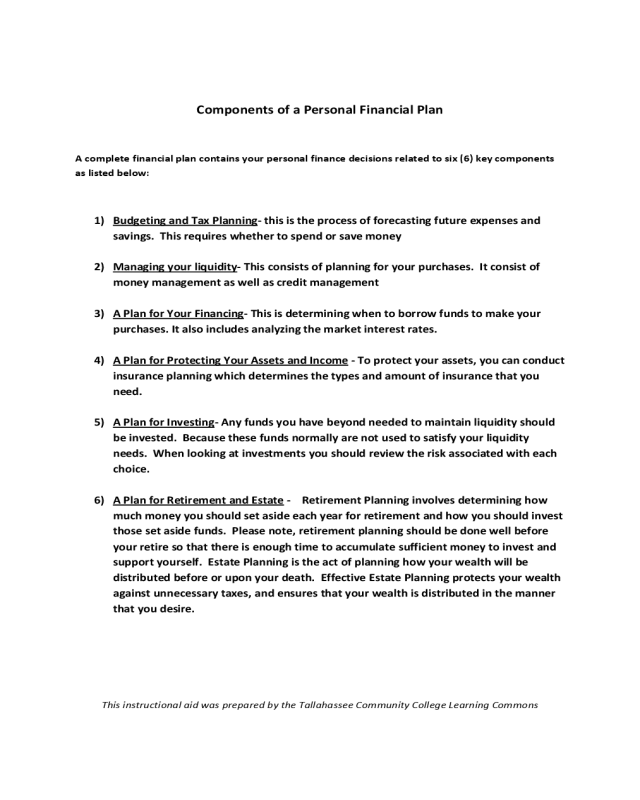

Components of a Personal Financial Plan

A complete financial plan contains your personal finance decisions related to six (6) key components

as listed below:

1) Budgeting and Tax Planning- this is the process of forecasting future expenses and

savings. This requires whether to spend or save money

2) Managing your liquidity- This consists of planning for your purchases. It consist of

money management as well as credit management

3) A Plan for Your Financing- This is determining when to borrow funds to make your

purchases. It also includes analyzing the market interest rates.

4) A Plan for Protecting Your Assets and Income - To protect your assets, you can conduct

insurance planning which determines the types and amount of insurance that you

need.

5) A Plan for Investing- Any funds you have beyond needed to maintain liquidity should

be invested. Because these funds normally are not used to satisfy your liquidity

needs. When looking at investments you should review the risk associated with each

choice.

6) A Plan for Retirement and Estate - Retirement Planning involves determining how

much money you should set aside each year for retirement and how you should invest

those set aside funds. Please note, retirement planning should be done well before

your retire so that there is enough time to accumulate sufficient money to invest and

support yourself. Estate Planning is the act of planning how your wealth will be

distributed before or upon your death. Effective Estate Planning protects your wealth

against unnecessary taxes, and ensures that your wealth is distributed in the manner

that you desire.