Fillable Printable Sample Financial Plan

Fillable Printable Sample Financial Plan

Sample Financial Plan

Sample Financial Plan

For more information, please call:

John Jones

Wealth Advisor

ScotiaMcLeod

715 Hewitson St.

Thunder Bay. Ontario

P7B 6B5

John and Mary Smith

June 19, 2009

Table of Contents

Disclaimer........................................................................................................................ 3

Introduction...................................................................................................................... 4

Net Worth ........................................................................................................................ 5

Cash Flow ...................................................................................................................... .6

Asset Allocation............................................................................................................... 7

Retirement....................................................................................................................... 9

Life Insurance - John..................................................................................................... 13

Life Insurance - Mary..................................................................................................... 15

Life Insurance - John and Mary..................................................................................... 17

Estate Summary............................................................................................................ 19

Conclusion..................................................................................................................... 20

Appendix - Plan Data Summary.................................................................................... 21

Important: The projections or other information generated by NaviPlan® version 11.0 regarding the likelihood of various

investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future

results. The projections utilize return data that do not include fees or operating expenses, are not available for

investment, and are shown for illustrative purposes only. If included, fees and other operating expenses would materially

reduce these projections. See the Disclaimers section at the beginning of this document for more information.

Page 3 of 26

Disclaimer

This financial plan is hypothetical in nature and is intended to help you in making decisions on your financial

future based on information that you have provided and re viewed.

IMPORTANT: The projections or other information generated by NaviPlan® regarding the likelihood

of various investment outcomes are hypothetical in nature, do not reflect actual investment results,

and are not guarantees of future results.

Criteria, Assumptions, Methodology, and Limitations of Plan

The assumptions used in this financial plan are based on inform ation provided and reviewed by you. Please

review all assumptions in the Appendix - Plan Data Summary section before reviewing the rest of the report

to ensure the accuracy and reasonable ness of the assumptions. Those assumptions must be reconsidered

on a frequent basis to ensure the results are adjusted accordingly. The smallest of changes in assumptions

can have a dramatic impact on the outcome of this financial plan. Any inaccurate represent ation by you of

any facts or assumptions used in this financial plan invalidates the results.

We have made no attempt to review your property and liability insurance policies (auto and homeowners, for

example). We strongly recommend that in conjunction with this financial plan, you consult with your property

and liability agent to review your current coverage to ensure it continues to be appropriate. In doing so, you

may wish to review the dollar amount of your coverage, the deductibles, the liability coverage (including an

umbrella policy), and the premium amounts.

This plan does not constitute advice in the areas of legal, accounting or tax. It is your responsibility to

consult with the appropriate professionals in those areas either independently or in conjunction with this

planning process.

Results May Vary With Each Use and Over Time

The results presented in this financial plan are not predictions of actual results. Actual results may vary to a

material degree due to ext ernal factors beyond the scope and control of this financial plan. Historical data is

used to produce future assumptions used in the financial plan, such as rates of return. Past performance is

not a guarantee or predictor of future performance.

The results are based on your representation of risk and include information current as of March 13, 2009.

You are responsible for confirming that the answers you provided to determine your individual risk tolerance

used in this financial plan are accurately represente d. The proposed asset allocation presented in this plan

is based on your answers to a risk tolerance questionnaire and may represent a more aggressive and

therefore more risky investment strategy than your current allocation mix. Actual return rates and

performance may vary to a significant degr ee from that represented in this plan.

Investments Considered

This plan does not consider the selection of individual securities; the plan provides model portfolios. The

results contained herein do not constitute an actual offer to buy, sell or recommend a particular investment

or product. All investments are inherently risky. The asset classes and return rates used in the plan are

broad in nature. The illustrations are not indicative of the future performance of actual investments, which

will fluctuate over time and may lose value. Refer to the Asset Allocation section of this report for details on

return rate assumptions used throughout this plan.

There are risks associated with investing, including the risk of losing a portion or all of your initial investment.

Important: The projections or other information generated by NaviPlan® version 11.0 regarding the likelihood of various

investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future

results. The projections utilize return data that do not include fees or operating expenses, are not available for

investment, and are shown for illustrative purposes only. If included, fees and other operating expenses would materially

reduce these projections. See the Disclaimers section at the beginning of this document for more information.

Page 4 of 26

Introduction

Why devel op a pla n?

By developing a financial plan, you an d your family:

• Will have a better understanding of your current financial situation.

• Determine attainable retir ement, educati on, insurance, and other financial goals.

• Review goals, funding strategies, and alternatives where goals have to be compromised.

• Have the necessary financial resources set aside to fund your goals as they occur.

• Reduce the effect of unexpected events, such as disability, premature death, etc.

Planning is a life-long journey.

For the planning process to evolve successfully, changing circumstances or lifestage requirements must be

factored in. Your Scotiabank advisor will want to know when personal or financial events occur, anticipated

or not, to clarify whether your goals are affected and if there are new decisions needed.

When do we revie w the pla n?

While simply having a plan in place will give you a better understanding of your financial situation, regularly

reviewed and updated, th e likelihood of achieving the desired results is gr eatly enhanced. Some of the

events for which you may need to review your strategies are: changes in your career status, marital

situation, and the well-being of your lo ved ones.

Important: The projections or other information generated by NaviPlan® version 11.0 regarding the likelihood of various

investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future

results. The projections utilize return data that do not include fees or operating expenses, are not available for

investment, and are shown for illustrative purposes only. If included, fees and other operating expenses would materially

reduce these projections. See the Disclaimers section at the beginning of this document for more information.

Page 5 of 26

Net Worth

This net worth summary provides a snap shot showing a financial situation at a certain point in time. It

includes what you own (a ssets), what you owe to creditors (liabi lities), and the net value or difference

between the two (net worth). In simple terms, the net worth statement shows how much money would be left

if everything you owned w as converted into cash and used to pay off your debts (before taxes).

The following information is a description of items likely to appear in the report below. Your report may

contain some or all of the items listed:

• Lifestyle assets include your home, vacation homes and collectibles.

• Non-Registered assets include stocks, bonds, mutual funds and cash.

• Registered assets include your registered and locked-in retirement plans, such as RRSPs, RRIFs, LIFs

and LRIFs.

• Liabilities include your mo rtgages, loans, personal lines of credits and credit cards.

• Cash Flow Surplus is the amount of surplus funds from your cash flow statement. In other words,

income you did not spend which may be represent ative of your checking account, for instance.

Net Worth Summary

As of March 13, 2009

John Mary Joint Total

Non-Reg istered Investments

Investment Portfolios 125,897 125,897

Register ed Investmen t s

RRSPs / Spousal RRSPs 35,986 126,789 162,775

RPP - money purchase 106,898 106,898

Lifestyle Assets (residences, etc.)

450,000 450,000

Life Insu ran ce Cash Value

Liabilities

(98,786) (98,786)

Total Net Worth 142,884 126,789 477,111 746,784

Important: The projections or other information generated by NaviPlan® version 11.0 regarding the likelihood of various

investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future

results. The projections utilize return data that do not include fees or operating expenses, are not available for

investment, and are shown for illustrative purposes only. If included, fees and other operating expenses would materially

reduce these projections. See the Disclaimers section at the beginning of this document for more information.

Page 6 of 26

Cash Flow

The cash flow report below outlines your current sources of income and expenses. Your income includes

employment income, investment income and any other sources. Your expenses include your daily living

expenses, debt payment s including your mortgage, current investment contributions and insurance

premiums.

Current Surplus/(Deficit) displays any excess cash available or shortfall at the end of the current year once

all expenses have been covered an d investments made. Ending Surplus/(Deficit) displays the final surplus

or deficit at the end of the current year after adjustments to or from other family members. The family’s

ending surplus or deficit is the sum of the individual family member’s ending surpluses or deficits.

John Mary Family

Cash Inflows

Employment Inflows $82,000 $64,000 $146,000

Investment Inflows $3,263 $2,334 $5,597

Total Cash Inflows

$85,263 $66,334 $151,597

Cash Outflows

Lifestyle Expenses $52,152 $44,831 $96,983

Taxes $24,571 $15,472 $40,043

Employment/Business Expenses $732 $732 $1,465

Miscellaneous Expenses $929 $0 $929

Non-Registered Contributions and Reinvestments $1,483 $1,483 $2,966

Registered Contributions $5,396 $3,816 $9,212

Total Cash Outflows

$85,263 $66,334 $151,597

Current Surplus/(Deficit)

0

Ending Surplus/(Deficit)

0

Important: The projections or other information generated by NaviPlan® version 11.0 regarding the likelihood of various

investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future

results. The projections utilize return data that do not include fees or operating expenses, are not available for

investment, and are shown for illustrative purposes only. If included, fees and other operating expenses would materially

reduce these projections. See the Disclaimers section at the beginning of this document for more information.

Page 7 of 26

Asset Allocation

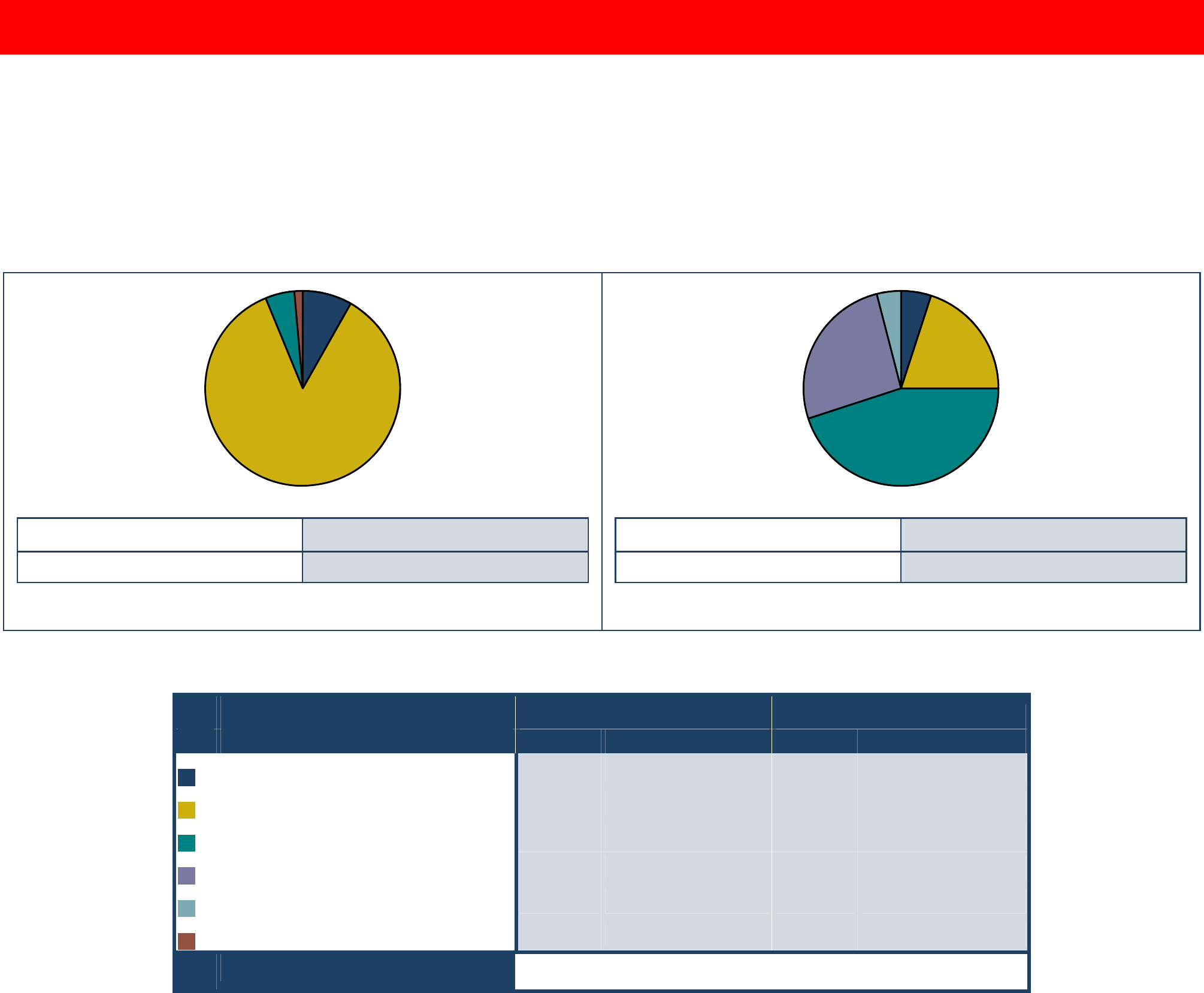

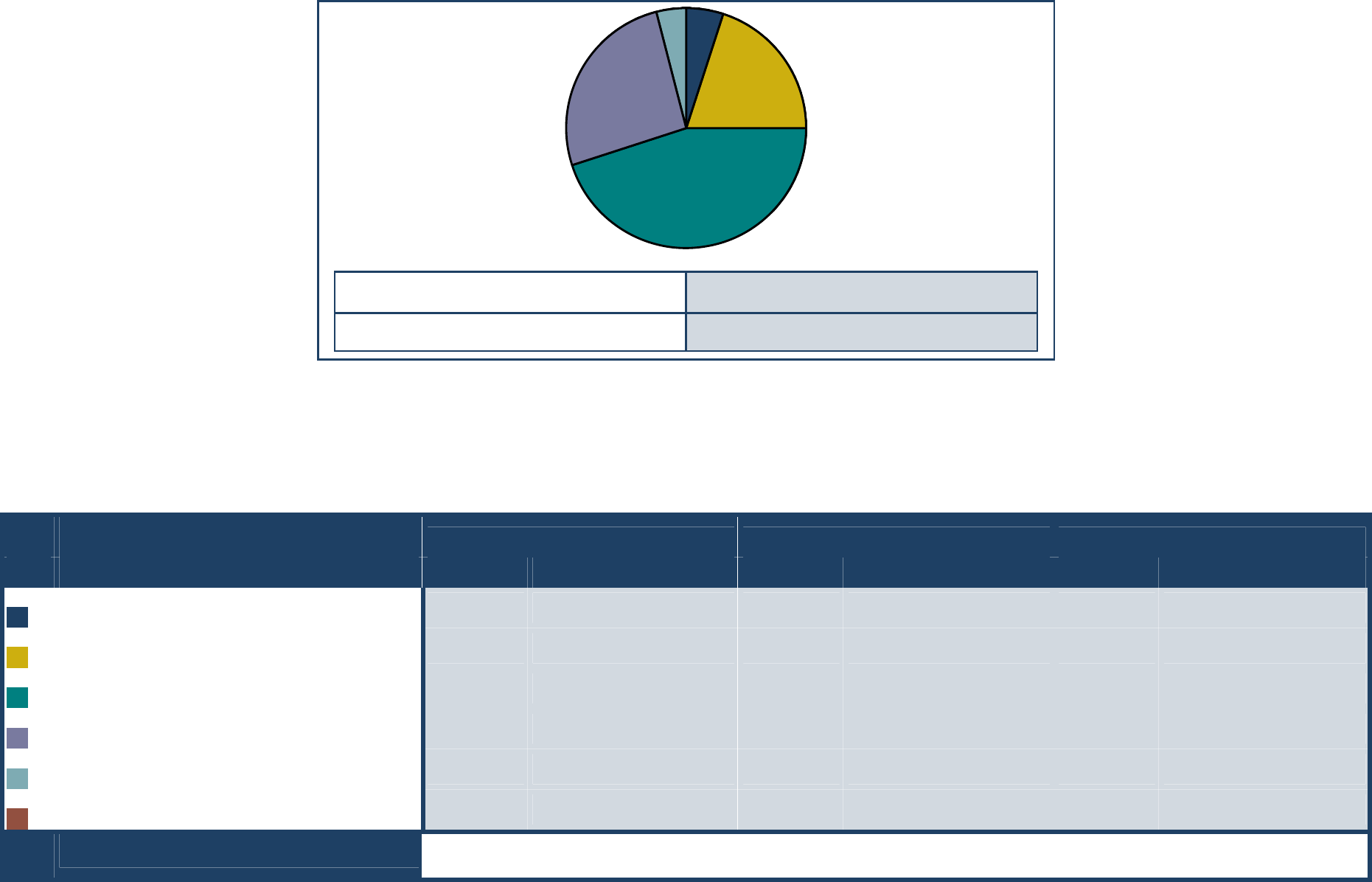

These pie graphs illustrate your current asset mix and suggested asset mix for your entire portfolio.

However, the suggested asset mix will not be used in the proposed plan. Due to modifications the assumed

asset mix on the following page will be used instead.

Current Asset Mix Suggested Asset Mix*

Cons Growth

Rate of Return

4.98%

Standard Devi ation 0.00%

Rate of Return

7.15%

Standard Devi ation 0.00%

*Modifications have been made to the suggested asset mix.

Current Asset Mix Suggested Asset Mix

Asset Class (%) ($) (%) ($)

Cash

8.2 32,377 5.0 19,779

Fixed In come

85.6 338,911 20.0 79,114

Canadian Equity

4.8 18,885 45.0 178,007

US Equity

26.0 102,848

Internationa l Equity

4.0 15,823

Preferreds

1.4 5,398

Total

100.0

395,570

100.0

395,570

Important: The projections or other information generated by NaviPlan® version 11.0 regarding the likelihood of various

investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future

results. The projections utilize return data that do not include fees or operating expenses, are not available for

investment, and are shown for illustrative purposes only. If included, fees and other operating expenses would materially

reduce these projections. See the Disclaimers section at the beginning of this document for more information.

Page 8 of 26

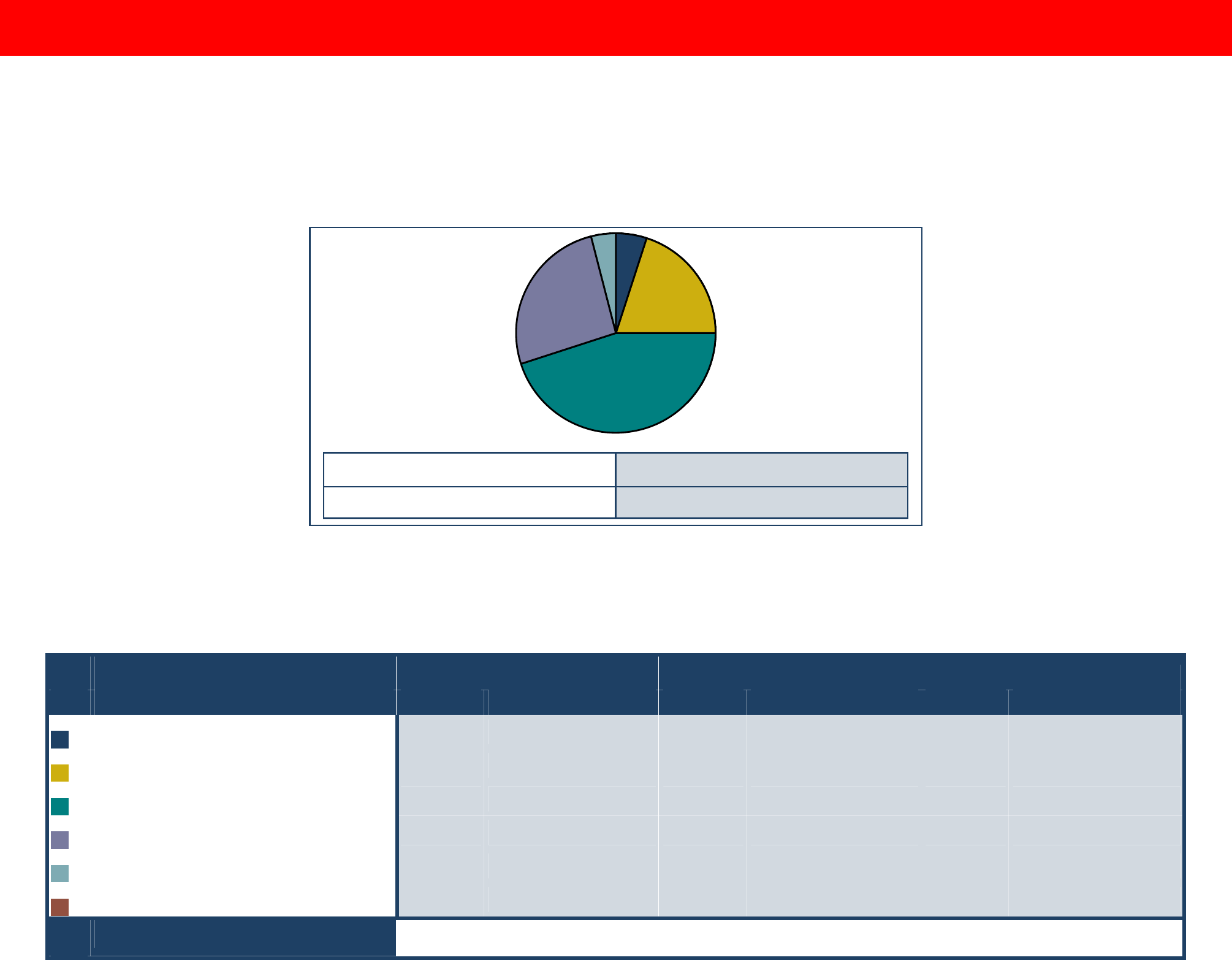

Assumed Asset Mix for Entire Portfolio

This pie graph illustrates the Assumed asset mix for your entire portfolio and will be used for the proposed

plan.

Assumed Asset Mix

Cons Growth

Rate of Return

7.15%

Standard Devi ation 0.00%

The table below pro vides a breakdown of the percentages and dollar values for each asset class in the

current and assumed portfolio. The Change column indicates the rebalancing required t o reach the assumed

asset mix.

Current Asset Mix Change Assumed Asset Mix

Asset Class (%) ($) (%) ($) (%) ($)

Cash

8.2 32,377

-3.2 -12,598

5.0 19,779

Fixed In come

85.6 338,911

-65.6 -259,797

20.0 79,114

Canadian Equity

4.8 18,885

+40.2 +159,122

45.0 178,007

US Equity

+26.0 +102,848

26.0 102,848

Internationa l Equity

+4.0 +15,823

4.0 15,823

Preferreds

1.4 5,398

-1.4 -5,398

Total

100.0

395,570

+0.0

+0

100.0

395,570

Consider the foll ow ing:

• Consider the income tax implications of selling non-registered investments such as stocks that have

grown significantly. You may wish to reallocate this type of asset over time.

• Direct future investment contributions to the appropriate asset allocation.

• Rebalance your portfolio on a regular basis. Some investments grow at a faster rate than others causing

an imbalance in your po rtfolio.

• Consider the timing of each objective. For example, volatile equity (stock) investments are not usually

suitable for goals that are short-term in nature (less than five years).

Important: The projections or other information generated by NaviPlan® version 11.0 regarding the likelihood of various

investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future

results. The projections utilize return data that do not include fees or operating expenses, are not available for

investment, and are shown for illustrative purposes only. If included, fees and other operating expenses would materially

reduce these projections. See the Disclaimers section at the beginning of this document for more information.

Page 9 of 26

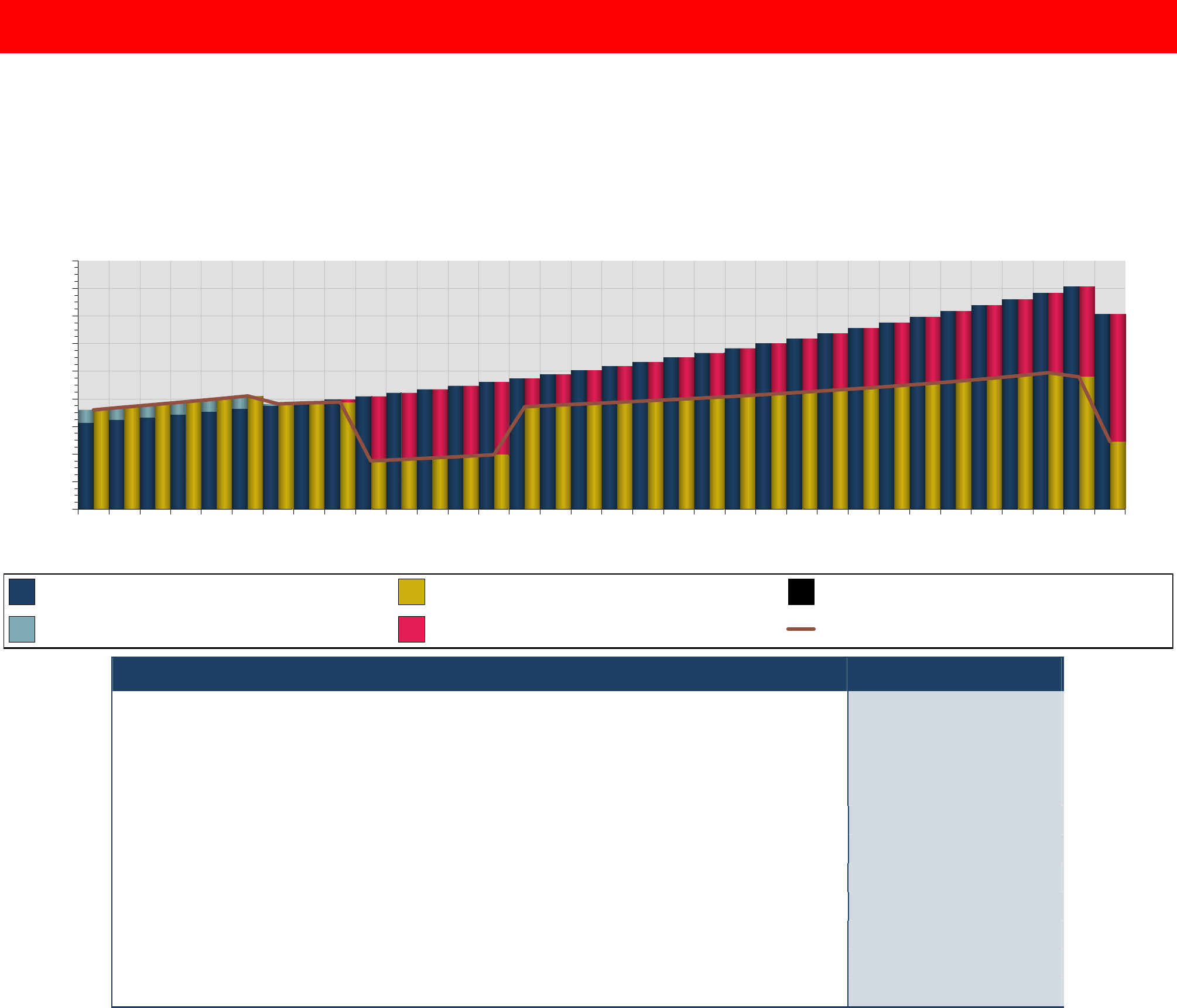

Retirement

The following graph illustrates your projected needs vs. abilities during retirement. The top graph displays

your current financial situation without additional savings, with a rate of return of 4.98%.

Retirement Needs Vs. Abilities

Current Plan

2018 2020 2022 2024 2026 2028 2030 2032 2034 2036 2038 2040 2042 2044 2046 2048 2050

$0K

$20K

$40K

$60K

$80K

$100K

$120K

$140K

$160K

$180K

Retirement Needs

Other Needs

Ability to Cover Needs

Shortfall

Surplus

After-Tax Cash Inflow

Financia l Object iv es Current

John's Retirement Age/Year 58 / 2018

John's Life Ex pectancy 90 / 2050

Mary's Retirement Age/Year 57 / 2018

Mary's Life Expectancy 90 / 2051

Annual Needs at Retirement, in today's dollars $48,000

Inflation Rate 3.00%

Return Rate 4.98%

Available Assets $395,570

Assumed Monthly Savings $547

Note: Numbers in bold indicate a change from the Current Plan.

Important: The projections or other information generated by NaviPlan® version 11.0 regarding the likelihood of various

investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future

results. The projections utilize return data that do not include fees or operating expenses, are not available for

investment, and are shown for illustrative purposes only. If included, fees and other operating expenses would materially

reduce these projections. See the Disclaimers section at the beginning of this document for more information.

Page 10 of 26

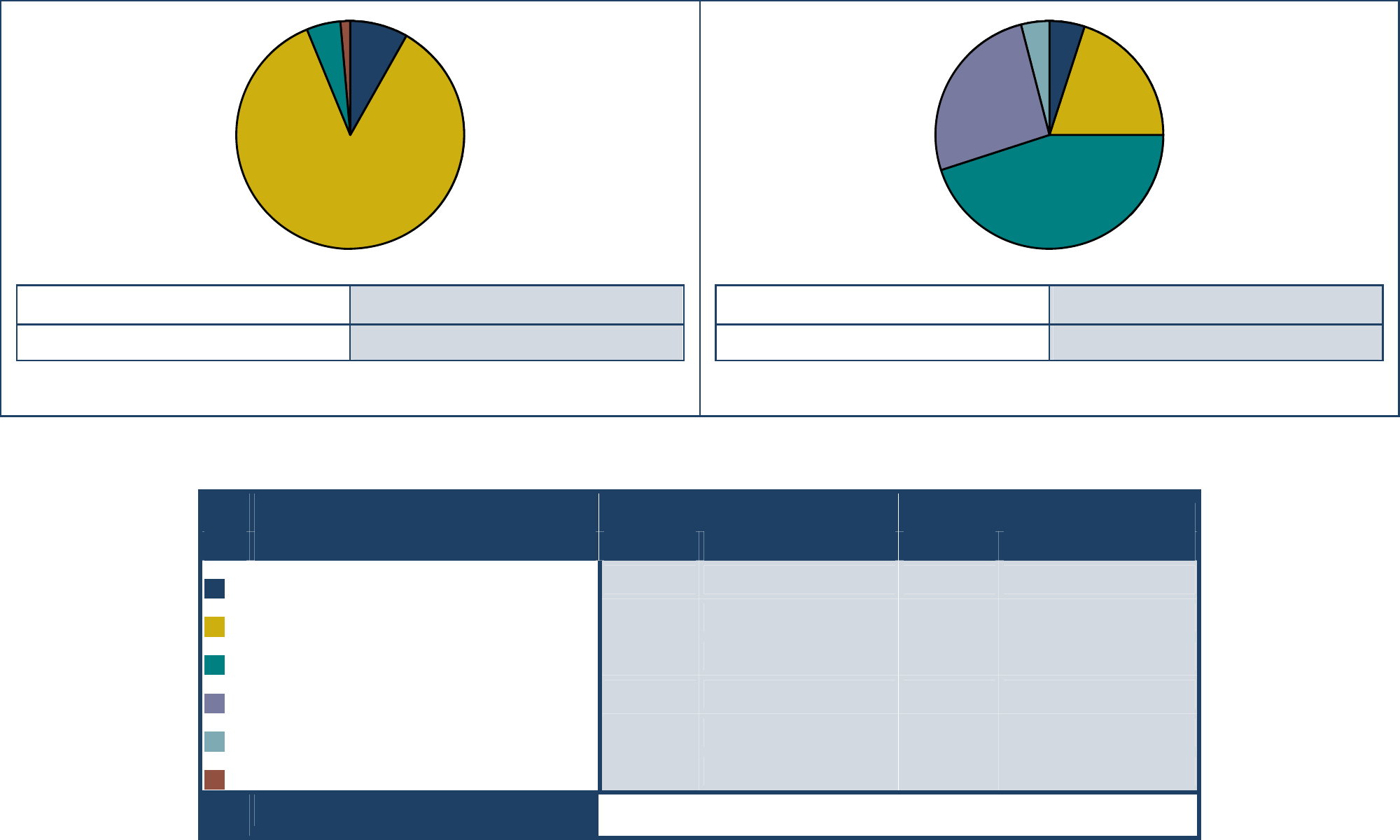

Asset Allocation for Retirement

These pie graphs illustrate your current asset mix and suggested asset mix for your retirement goal.

However, the suggested asset mix will not be used in the proposed plan. Due to modifications the assumed

asset mix on the following page will be used instead.

Current Asset Mix Suggested Asset Mix*

Cons Growth

Rate of Return

4.98%

Standard Devi ation 0.00%

Rate of Return

7.15%

Standard Devi ation 0.00%

*Modifications have been made to the suggested asset mix.

Current Asset Mix Suggested Asset Mix

Asset Class (%) ($) (%) ($)

Cash

8.2 32,377 5.0 19,779

Fixed In come

85.6 338,911 20.0 79,114

Canadian Equity

4.8 18,885 45.0 178,006

US Equity

26.0 102,848

Internationa l Equity

4.0 15,823

Preferreds

1.4 5,398

Total

100.0

395,570

100.0

395,570

Important: The projections or other information generated by NaviPlan® version 11.0 regarding the likelihood of various

investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future

results. The projections utilize return data that do not include fees or operating expenses, are not available for

investment, and are shown for illustrative purposes only. If included, fees and other operating expenses would materially

reduce these projections. See the Disclaimers section at the beginning of this document for more information.

Page 11 of 26

Assumed Asset Allocation for Retirement

This pie graph illustrates the Assumed asset mix for your retirement goal and will be used for the proposed

plan.

Assumed Asset Mix

Retirement

Cons Growth

Rate of Return

7.15%

Standard Devi ation 0.00%

The table below pro vides a breakdown of the percentages and dollar values for each asset class in the

current and assumed portfolio. The Change column indicates the rebalancing required t o reach the assumed

asset mix.

Current Asset Mix Change Assumed Asset Mix

Asset Class (%) ($) (%) ($) (%) ($)

Cash

8.2 32,377

-3.2 -12,598

5.0 19,779

Fixed In come

85.6 338,911

-65.6 -259,797

20.0 79,114

Canadian Equity

4.8 18,885

+40.2 +159,122

45.0 178,007

US Equity

+26.0 +102,848

26.0 102,848

Internationa l Equity

+4.0 +15,823

4.0 15,823

Preferreds

1.4 5,398

-1.4 -5,398

Total

100.0

395,570

+0.0

+0

100.0

395,570

Consider the foll ow ing:

• The required monthly savings amount is based on savings to non registered assets. Registered savings

plans, such as RRSPs and LIRAs may reduce the amount you need to save. We should discuss the

various alternatives that are available to you.

• Maximize contributions to tax-advantaged registered retirement plans.

• If you feel the amount of your required savings is unmanageable, we should review the various goals to

find an appropriate solution: should you consider looking at alternative asset allocation, or perhaps

reduce your income need or delay retirement?

• If your projected savings is greater than your need, you may h ave the opportunity to spend more in

retirement. Additionally, a large surplus may indicate the need for estate planning.

• Retirement is often the first financial objective that comes to mind. We want to ensure that your

pensions, Old Age Security, and savings provide a comfortable retirement.

• If you have not already do ne so, begin investing on a regular basis.