Fillable Printable Form 4574, 2011 Michigan Business Tax Refundable Credits

Fillable Printable Form 4574, 2011 Michigan Business Tax Refundable Credits

Form 4574, 2011 Michigan Business Tax Refundable Credits

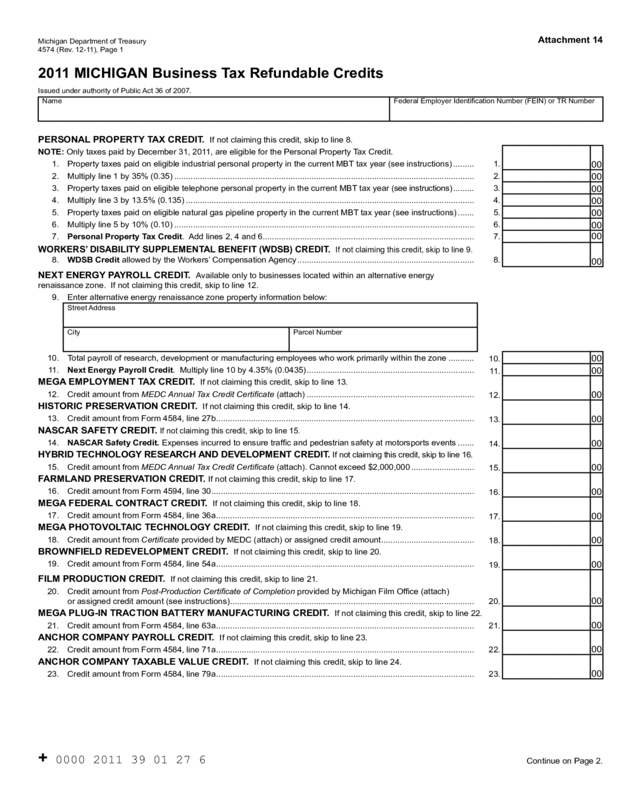

Michigan Department of Treasury

4574 (Rev. 12-11), Page 1

Attachment 14

2011 MICHIGAN Business Tax Refundable Credits

Issued under authority of Public Act 36 of 2007.

Name Federal Employer Identication Number (FEIN) or TR Number

PERSONAL PROPERTY TAX CREDIT. If not claiming this credit, skip to line 8.

NOTE: Only taxes paid by December 31, 2011, are eligible for the Personal Property Tax Credit.

1. Property taxes paid on eligible industrial personal property in the current MBT tax year (see instructions) ......... 1.

00

2. Multiply line 1 by 35% (0.35) ................................................................................................................................. 2.

00

3. Property taxes paid on eligible telephone personal property in the current MBT tax year (see instructions) ......... 3.

00

4. Multiply line 3 by 13.5% (0.135) ............................................................................................................................ 4.

00

5. Property taxes paid on eligible natural gas pipeline property in the current MBT tax year (see instructions) ....... 5.

00

6. Multiply line 5 by 10% (0.10) ................................................................................................................................. 6.

00

7. Personal Property Tax Credit. Add lines 2, 4 and 6 ........................................................................................... 7. 00

WORKERS’ DISABILITY SUPPLEMENTAL BENEFIT (WDSB) CREDIT. If not claiming this credit, skip to line 9.

00

8. WDSB Credit allowed by the Workers’ Compensation Agency ............................................................................ 8.

NEXT ENERGY PAYROLL CREDIT. Available only to businesses located within an alternative energy

renaissance zone. If not claiming this credit, skip to line 12.

9. Enter alternative energy renaissance zone property information below:

Street Address

City Parcel Number

10. Total payroll of research, development or manufacturing employees who work primarily within the zone ...........

10. 00

11. Next Energy Payroll Credit. Multiply line 10 by 4.35% (0.0435) ........................................................................

11. 00

MEGA EMPLOYMENT TAX CREDIT.

If not claiming this credit, skip to line 13.

00

12. Credit amount from MEDC Annual Tax Credit Certicate (attach) ........................................................................

12.

HISTORIC PRESERVATION CREDIT. If not claiming this credit, skip to line 14.

13. Credit amount from Form 4584, line 27b ...............................................................................................................

13. 00

NASCAR SAFETY CREDIT.

If not claiming this credit, skip to line 15.

00

14. NASCAR Safety Credit. Expenses incurred to ensure trafc and pedestrian safety at motorsports events .......

14.

HYBRID TECHNOLOGY RESEARCH AND DEVELOPMENT CREDIT. If not claiming this credit, skip to line 16.

00

15. Credit amount from MEDC Annual Tax Credit Certicate (attach). Cannot exceed $2,000,000 ...........................

15.

FARMLAND PRESERVATION CREDIT. If not claiming this credit, skip to line 17.

00

16. Credit amount from Form 4594, line 30 .................................................................................................................

16.

MEGA FEDERAL CONTRACT CREDIT. If not claiming this credit, skip to line 18.

00

17. Credit amount from Form 4584, line 36a ...............................................................................................................

17.

MEGA PHOTOVOLTAIC TECHNOLOGY CREDIT. If not claiming this credit, skip to line 19.

00

18. Credit amount from Certicate provided by MEDC (attach) or assigned credit amount ........................................

18.

BROWNFIELD REDEVELOPMENT CREDIT. If not claiming this credit, skip to line 20.

00

19. Credit amount from Form 4584, line 54a ...............................................................................................................

19.

FILM PRODUCTION CREDIT. If not claiming this credit, skip to line 21.

00

20. Credit amount from Post-Production Certicate of Completion provided by Michigan Film Ofce (attach)

or assigned credit amount (see instructions) ......................................................................................................... 20.

MEGA PLUG-IN TRACTION BATTERY MANUFACTURING CREDIT. If not claiming this credit, skip to line 22.

0021. Credit amount from Form 4584, line 63a ............................................................................................................... 21.

ANCHOR COMPANY PAYROLL CREDIT. If not claiming this credit, skip to line 23.

0022. Credit amount from Form 4584, line 71a ............................................................................................................... 22.

ANCHOR COMPANY TAXABLE VALUE CREDIT. If not claiming this credit, skip to line 24.

0023. Credit amount from Form 4584, line 79a ............................................................................................................... 23.

+ 0000 2011 39 01 27 6

Continue on Page 2.

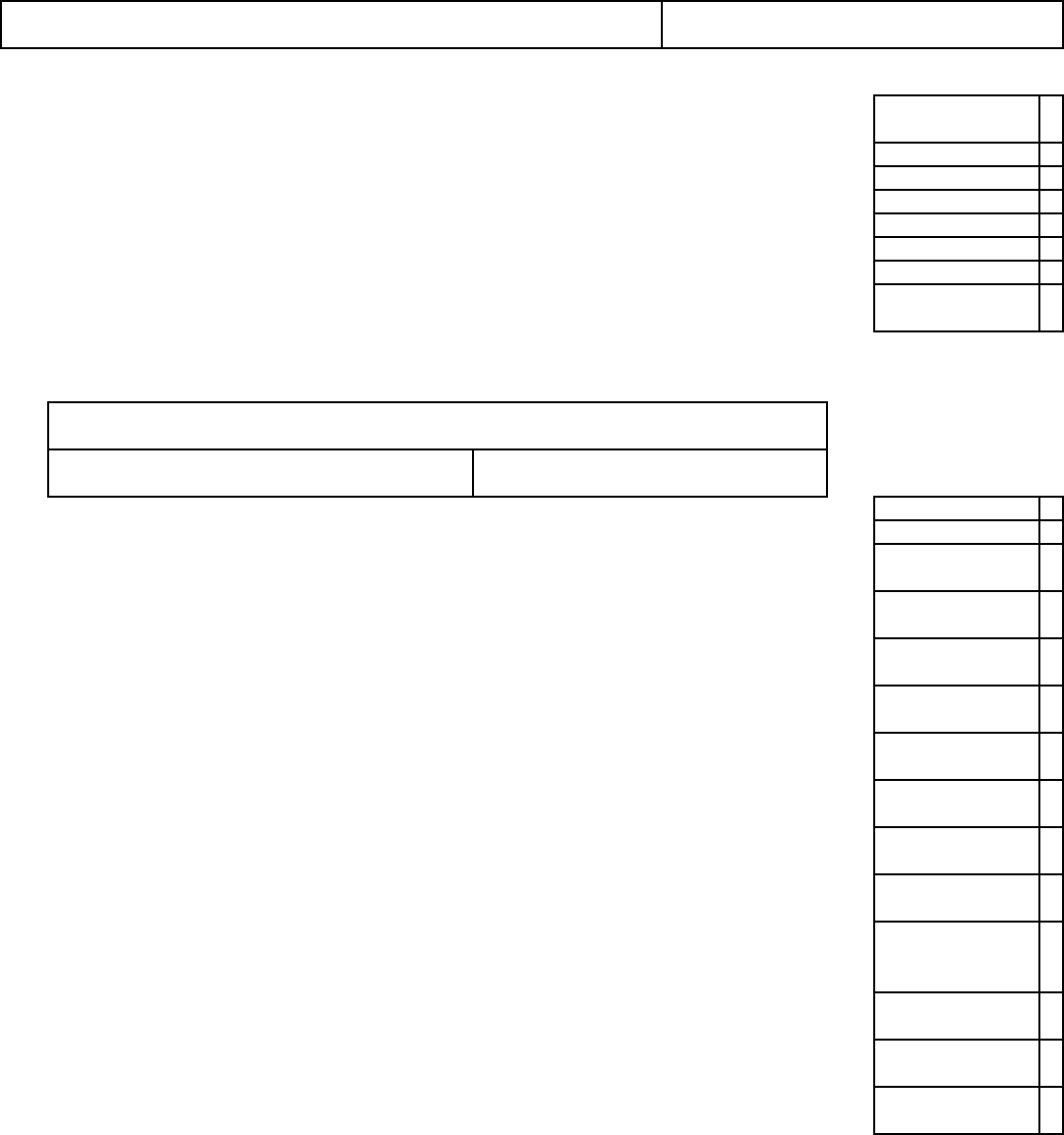

4574, Page 2

FEIN or TR Number

TOBACCO SELLER’S CREDIT. If not claiming this credit, skip to line 31.

NOTE: This credit allows the taxpayer to recalculate their modied gross receipts for 2008 and 2009 to exclude all of the tobacco excise tax included

in their gross receipts. You may not claim this credit for any excise tax paid to another company as part of the purchase price of the tobacco product.

You may claim this credit only on excise taxes you paid directly to the federal government or State of Michigan. In April 2009, a oor tax was included

in the calculation of gross receipts for all tobacco sellers. Therefore, to the extent you were required to include the oor tax in gross receipts, you may

compute the credit for 2009.

24. Modied gross receipts tax liability for 2008 tax year, from 2008 MBT Form 4567, line 20 .................................. 24. 00

25. Pro forma modied gross receipts tax liability for 2008 tax year, excluding 100% of tobacco excise taxes from

gross receipts ........................................................................................................................................................ 25. 00

26. Subtract line 25 from line 24 .................................................................................................................................. 26. 00

27. Modied gross receipts tax liability for 2009 tax year. (Fiscal years ending in 2009, from 2008 MBT Form 4567,

line 20. For 2009 calendar years, from 2009 MBT Form 4567, line 27.) ............................................................... 27. 00

28. Pro forma modied gross receipts tax liability for 2009 tax year, excluding 100% of tobacco excise taxes from

gross receipts ........................................................................................................................................................ 28. 00

29. Subtract line 28 from line 27 .................................................................................................................................. 29. 00

30. Tobacco Seller’s Credit. Add lines 26 and 29 ..................................................................................................... 30. 00

TOTAL REFUNDABLE CREDITS

00

31. Add lines 7, 8, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23 and 30. Enter total here and carry to Form

4567, line 61; Form 4583, line 25; or Form 4590, line 34 ...................................................................................... 31.

+ 0000 2011 39 02 27 4

Purpose

To allow standard taxpayers to claim certain credits. Unless

otherwise specied, if the amount of the credit exceeds the tax

liability of the taxpayer for the tax year, that excess is refunded.

NOTE: This form may also be used by nancial institutions to

claim a limited number of credits:

• Michigan Economic Growth Authority (MEGA) Employment

Tax Credit.

• Historic Preservation Credit.

• Assigned MEGA Photovoltaic Technology Credit.

• Browneld Redevelopment Credit.

• Assigned Film Production Credit.

Insurance companies use the Miscellaneous Credits for

Insurance Companies (Form 4596) to claim credits for which

they are eligible.

Fiscal Year Filers: See “Supplemental Instructions for

Standard Fiscal MBT Filers” on page 145.

Special Instructions for Unitary Business Groups

Credits are earned and calculated on either an entity-specic or

a group basis, as determined by relevant statutory provisions

for the respective credits. Inter-company transactions are not

eliminated for the calculation of most credits. Credits earned or

calculated on either an entity-specic or group basis by Unitary

Business Group (UBG) members are generally applied against

the tax liability of the UBG, unless otherwise specied by

statute or these instructions.

Entity-specic provisions are applied on a member-by-member

basis. In none of these cases does a taxpayer that is a UBG take

the organization type of its parent, Designated Member (DM), or

any member of the UBG. A UBG taxpayer will not be attributed

an organization type based on the composition of its members.

If any member of the UBG is eligible for an entity-specic

credit, a statement must be attached to the form identifying the

eligible member and any information requested for the credit.

If more than one member is eligible, requested information

should be provided in the statement on a per member basis.

The total amount from all eligible members will be entered on

each corresponding line on this form. Line-by-line instructions

indicate credits requiring entity-specic information.

Line-by-Line Instructions

Lines not listed here are explained on the form.

NOTE: Although qualication for certain credits is reviewed

and approved by MEGA, in many cases the certicates for such

credits are issued by the Michigan Economic Development

Corporation (MEDC).

Name and Account Number: Enter name and account

number as reported on page 1 of the applicable MBT annual

return (either the MBT Annual Return (Form 4567) or the MBT

Simplied Return (Form 4583) for standard taxpayers or the

MBT Annual Return for Financial Institutions (Form 4590)).

UBGs: Complete one form for the group. Enter the DM name

in the Taxpayer Name eld and the DM account number in the

Federal Employer Identication Number (FEIN) eld.

Personal Property Tax Credit

The Personal Property Tax Credit is available against personal

property taxes paid in the tax year on eligible industrial

personal property, eligible telephone personal property, and

eligible natural gas pipeline property. The Personal Property

Tax Credit is available only to the taxpayer who timely les the

required statements or reports, to whom an assessment or bill

is issued, and who pays the taxes in the tax year. A taxpayer

that disagrees with the assessor’s classication of property

must pursue a change of classication through the property

tax appeals process. Treasury will not revise a property

classication for purposes of these credits.

Line 1: Eligible industrial personal property is property

classied as industrial personal property under Section 34c of

the General Property Tax Act (Michigan Compiled Law (MCL)

211.34c). Under MCL 211.34c, the assessor is charged with the

responsibility of classifying property. The taxes must have

been levied after December 31, 2007.

Line 3: Eligible telephone personal property is dened as

personal property of a telephone company subject to the tax

levied under MCL 207.1 to 207.21.

Line 4: For eligible telephone personal property levied and

paid in the tax year the credit is equal to 13.5 percent of the

taxes paid.

Line 5: Eligible natural gas pipeline property is dened as

natural gas pipelines that are classied as utility personal

property under Section 34c of the General Property Tax Act

and are subject to regulation under the Natural Gas Act. The

taxes must have been levied after December 31, 2007.

Line 7: The taxpayer claiming a Personal Property Tax Credit

must attach to the MBT return copies of property tax bills

that properly identify “eligible” property and provide proof of

payment of the tax in the tax year.

UBGs: Add up the property tax bills for all members and enter

the total amount on the corresponding line. The requested

tax bills and proof of payment for each member claiming the

Personal Property Tax Credit should be attached to the group’s

annual return.

Workers’ Disability Supplemental Benet (WDSB) Credit

The WDSB Credit is available to self-insured taxpayers for

the amount authorized by the Department of Licensing and

Regulatory Affairs (LARA) during the tax year. The amount of

the credit is provided to taxpayers by LARA.

Instructions for Form 4574

Michigan Business Tax (MBT) Refundable Credits

Fiscal Year Filers: See “Supplemental Instructions for Standard Fiscal MBT Filers” on page 145.

For more information on WDSB credit eligibility,

contact LARA, Workers’ Compensation Agency at

(517) 322-1879 or 1-888-396-5041 or visit the LARA Web site

at www.michigan.gov/lara.

Line 8: Attach to the return a copy of the document provided

by LARA to substantiate a claim for this credit.

UBGs: Enter total amount authorized for all members on line 8

and attach LARA documentation for each member.

Next Energy Payroll Credit

Next Energy Payroll Credit provides a payroll-based credit to

a taxpayer located within an alternative energy Renaissance

Zone. The credit is equal to the payroll amount for the tax

year attributable to employees who are working on alternative

energy-related research, development, or manufacturing

and whose regular place of employment is within the Zone,

multiplied by the Michigan Individual Income Tax (IIT) rate

for that year. (The Michigan Individual Income Tax rate can be

found at www.michigan.gov/taxes.)

UBGs: If any member of a UBG is claiming the Next Energy

Payroll Credit, attach a statement identifying the member(s)

and providing information requested on the form. Enter the

total payroll amount for all eligible members on line 10.

MEGA Employment Tax Credit

The MEGA Employment Tax Credit promotes economic

growth and jobs in Michigan. For a period of time not to

exceed 20 years, a taxpayer that is an authorized business or

an eligible taxpayer may claim a credit equal to the amount

certied each year by MEGA.

MEGA may certify a credit based on an agreement entered into

prior to January 1, 2008, under the Single Business Tax (SBT).

The number of years for which the credit may be claimed under

MBT will be equal to the maximum number of years designated

in the resolution reduced by the number of years for which a

credit has been claimed or could have been claimed under SBT.

A taxpayer that claimed a credit under either SBT or MBT that

had an agreement with MEGA based on qualied new jobs as

dened in the MEGA Act, and that removes 51 percent or more

of those qualied new jobs from Michigan within three years

after the rst year in which the taxpayer claimed a credit, must

pay back an amount equal to the total of all credits claimed no

later than 12 months after those qualied new jobs are removed

from Michigan. Recapture is reported on Form 4587.

For more information, contact MEDC at (517) 373-9808 or visit

the MEDC Web site at http://www.michiganadvantage.org/.

Line 12: Approved businesses receive a certicate from

MEGA each year showing the total amount of tax credit

allowed. Attach the Annual Tax Credit Certicate to the return.

(If the certicate is not attached, the credit will be disallowed.)

UBGs: Enter the total amount of MEGA Employment Tax

Credits claimed by eligible members and provide the requested

MEGA certication for each eligible member.

Historic Preservation Credit

The Historic Preservation Credit provides tax incentives for

homeowners, commercial property owners, and businesses

to rehabilitate historic resources located in Michigan.

Rehabilitation projects must be certied by the State Historic

Preservation Ofce (SHPO). Questions may be directed to

SHPO at (517) 373-1630. For additional information, visit the

SHPO Web site at www.michigan.gov/shpo.

Line 13: Complete the MBT Election of Refund or

Carryforward of Credits (Form 4584) to claim this credit and

elect a refund of 90 percent of the balance or carryforward of

the resulting overpayment.

NOTE: Neither an assigned credit nor a credit carried forward

from a prior year is eligible to be refunded.

NASCAR Safety Credit

For the 2010 and subsequent tax years, this credit is equal

to the amount of necessary expenditures incurred in this

State by an eligible taxpayer including any professional fees,

additional police ofcers, and any trafc management devices

to ensure trafc and pedestrian safety while hosting the

requisite motorsports events each calendar year.

UBGs: An eligible taxpayer that is a member of a UBG should

enter the eligible expenditures of that member.

Hybrid Technology Research and Development Credit

The Hybrid Technology Research and Development Credit

is available for taxpayers who are engaged in research and

development of a qualied technology. The credit is equal to

3.9 percent of the compensation as dened in the MBT Act for

services performed in a qualied facility and paid to employees at

the qualied facility in the tax year. To be eligible for this credit,

the taxpayer must have entered into an agreement with MEGA

before April 1, 2007, agreeing to meet certain statutory conditions.

A taxpayer claiming this credit may also claim the

Research and Development Credit on the MBT Credits for

Compensation, Investment, and Research and Development

(Form 4570). However, a taxpayer may not claim both credits

for the same expenditures.

For more information, contact MEDC at (517) 373-9808 or visit

the MEDC Web site at http://www.michiganadvantage.org/.

Line 15: Eligible taxpayers receive a certicate from MEGA

each year showing the total amount of tax credit allowed.

Attach the Annual Tax Credit Certicate to the return. (If the

certicate is not attached, the credit will be disallowed.) The

credit amount cannot exceed $2,000,000.

UBGs: Enter the total amount for this credit claimed by

eligible members or $2,000,000, whichever is less, and provide

the requested MEGA certication for each eligible member.

Farmland Preservation Credit

Farmland Preservation Credit gives back to farmland owners

a portion of the property taxes paid on farmland. Farmland

owners qualify for the credit by agreeing to preserve the land

as farmland and not develop for another use.

To qualify for the credit, the taxpayer must meet the following

requirements:

• Taxpayer must own farmland,

• Taxpayer must have entered into a Farmland Development

Rights Agreement (FDRA) with the Michigan Department of

Agriculture (MDA), and

• Taxpayer must complete the Michigan Farmland

Preservation Tax Credit (Form 4594).

If agreements with MDA were entered into on or after

January 1, 1978, the gross receipts qualications in Part 1 of

Form 4594 must be satised.

UBGs: UBG members claiming this credit should total all

amounts from Form 4594, line 30, and enter on line 16 Each

eligible member should submit Form 4594, which would be

calculated based upon that member’s respective property tax

obligation and its respective MBT Business Income Tax base.

MEGA Federal Contract Credit

This credit is available for a qualied taxpayer or collective

group of taxpayers that have been awarded a federal

procurement contract from the United States Department of

Defense, Department of Energy or Department of Homeland

Security resulting in a minimum of 25 new full-time jobs.

Complete Form 4584 to claim this credit and elect a refund or

carryforward of the resulting overpayment.

For more information, contact MEDC at (517) 373-9808 or visit

the MEDC Web site at http://www.michiganadvantage.org/.

MEGA Photovoltaic Technology Credit

The MEGA Photovoltaic Technology Credit is available to a

qualied taxpayer that enters into an agreement with MEGA to

construct and operate a new facility in Michigan which serves

to develop and manufacture photovoltaic energy, photovoltaic

systems, or other photovoltaic technology. Photovoltaic energy,

systems, or technology rely on solar power. The credit is

available for 25 percent of the taxpayer’s capital investment in

the new facility during the tax year.

The credit generally must be taken in equal installments

over a two-year period beginning in the tax year in which

the certicate is issued. A taxpayer may make an irrevocable

assignment of all or a portion of the credit or may convey the

right to the assignment on a form provided by MEGA, which

will then issue assignment certicates to the assignee(s).

A taxpayer or assignee that claims a credit and subsequently

fails to meet the requirements of the act or any other

conditions established by MEGA in the agreement may, as

determined by MEGA, have its credit reduced or terminated

or have a percentage of the credit previously claimed added

back to the tax liability of the taxpayer in the tax year that the

taxpayer or assignee fails to comply. Recapture is reported on

Form 4587.

A taxpayer certied to take the polycrystalline silicon credit

under MCL 208.1432 is disqualied from taking this credit.

Line 18: Approved businesses receive a certicate from MEGA

each year showing the total amount of tax credit allowed. Attach

the Annual Tax Credit Certicate to the return. A taxpayer

claiming an assigned MEGA Photovoltaic Technology Credit

must attach the assignment certicate to the return. (If the

certicate is not attached, the credit will be disallowed.)

Browneld Redevelopment Credit

The Browneld Redevelopment Credit encourages businesses

to make investment on eligible Michigan property that was

used or is currently used for commercial, industrial, public, or

residential purposes and is either a facility (environmentally

contaminated property), functionally obsolete, or blighted.

Prior to April 8, 2008, the credit amount and any unused

carryforward of the credit that exceeded the tax liability for

the tax year was not refunded, but could be carried forward

to offset tax liability in subsequent tax years for ten years

or until used up, whichever occurs rst. Beginning on and

after April 8, 2008, if this credit for the tax year exceeds the

qualied taxpayer’s tax liability for that tax year, the qualied

taxpayer can elect to have the excess refunded at the rate of 85

percent of the excess for the tax year and forgo the remaining

15 percent of the credit and any carryforward.

Complete Form 4584 to claim this credit and elect a refund or

carryforward of the resulting overpayment.

NOTE: Neither an assigned credit nor a credit carried forward

from a prior year is eligible to be refunded.

The administration of the Browneld Redevelopment Credit

program is assigned to MEGA. For more information on the

approval process, contact MEDC at (517) 373-9808.

Film Production Credit

The Michigan Film Ofce, with the concurrence of the State

Treasurer, may enter into an agreement with an eligible

production company providing the company with a refundable

credit against MBT tax liability or against taxes withheld under

Chapter 7 of the Michigan Individual Income Tax Act.

To qualify for the credit, an eligible production company

must spend at least $50,000 in Michigan for the development,

preproduction, production, or postproduction costs of a

State-certied qualied production and must not be delinquent

in a tax or other obligation owed to Michigan nor be owned or

under common control of an entity that is delinquent.

A Post-Production Certicate will be issued verifying the

amount of the credit to be claimed once the Michigan Film

Ofce is satised that expenditure and eligibility requirements

are met.

The credit may be assigned in the tax year in which the

Post-Production Certicate is issued but such assignment is

irrevocable.

For more information, contact the Michigan Film

Ofce at 1-800-477-3456 or visit the Web site at

www.michiganlmofce.org.

Line 20: A taxpayer claiming a Film Production Credit must

attach the Post-Production Certicate to the return. A taxpayer

claiming an assigned Film Production Credit must attach to the

return an MBT Film Credit Assignment (Form 4589) approved

by Treasury. (If the certicate or approved assignment form is

not attached, the credit will be disallowed.)

UBGs: Enter the total amount for this credit claimed by all

eligible members and provide the requested post-production

certication or Form 4589 for each eligible member.

MEGA Plug-In Traction Battery Manufacturing Credit

The MEGA Plug-In Traction Battery Manufacturing Credit

encourages investment in the development, manufacture,

commercialization, and affordability of advanced automotive

high-power energy batteries. The credit is available only to a

taxpayer that has entered into an agreement with MEGA that

provides that the taxpayer will manufacture plug-in traction

battery packs in Michigan. The taxpayer must attach the

MEGA certicate to the MBT annual return on which the

credit is claimed.

For more information, contact MEDC at (517) 373-9808 or

visit the MEDC Web site at www.michiganadvantage.org

/MIAdvantage/Taxes-and-Incentives.

Line 21: Complete Form 4584 to claim this credit and elect a

refund or carryforward of the resulting overpayment.

Anchor Company Payroll Credit

This credit is available for a qualied taxpayer that was

designated by MEGA as an anchor company within the last

ve years and that has inuenced a new qualied supplier or

customer to open, locate, or expand in Michigan.

Complete Form 4584 to claim this credit and elect a refund or

carryforward of the resulting overpayment.

For more information, contact MEDC at (517) 373-9808 or visit

the MEDC Web site at http://www.michiganadvantage.org/.

Anchor Company Taxable Value Credit

This credit is available for a qualied taxpayer that was

designated by MEGA as an anchor company within the last

ve years and that has inuenced a new qualied supplier or

customer to open, locate, or expand in Michigan.

Complete Form 4584 to claim this credit and elect a refund or

carryforward of the resulting overpayment.

For more information, contact MEDC at (517) 373-9808 or visit

the MEDC Web site at http://www.michiganadvantage.org/.

Tobacco Seller’s Credit

This credit is available to a taxpayer that is a wholesale dealer,

retail dealer, distributor, manufacturer, or seller that had receipts

from the sale of cigarettes or tobacco products and paid the

federal and state excise taxes directly to the federal government

or State of Michigan on such cigarettes or tobacco products

during the 2008 and 2009 tax years. To calculate the credit:

UBGs: For UBGs with members that are entitled to this credit,

calculate the total credit at the member level. If in 2008 or

2009 the UBG contained a member that was entitled to this

credit but that member has since left the UBG, the right to

claim the credit will remain with that departed member. Only

the departed member may claim this credit. The departed

member will calculate its proper amount of credit based on the

information contained on its UBG Combined Filing Schedule

for Standard Members (Form 4580) for the year at issue.

Line 24: Enter the 2008 modied gross receipts tax liability

entered on line 20 of the 2008 MBT Form 4567.

Line 25: Calculate a “pro forma modied gross receipts tax

liability” for the 2008 tax year. When calculating this amount,

subtract from gross receipts the amount of federal and state

tobacco excise credits that were included when calculating the

2008 modied gross receipts tax liability.

Line 27: Enter the 2009 modied gross receipts tax liability.

For scal years ending in 2009, enter the amount on line 20 of

the 2008 MBT Form 4567. For 2009 calendar year taxpayers,

enter the amount on line 27 of the 2009 MBT Form 4567.

Line 28: Calculate a “pro forma modied gross receipts tax

liability” for the 2009 tax year. When calculating this amount

subtract from gross receipts the amount of federal and state

tobacco excise credits that were included when calculating the

2009 modied gross receipts tax liability.

Include completed Form 4574 as part of the tax return ling.