Fillable Printable Best Offer Letter Format

Fillable Printable Best Offer Letter Format

Best Offer Letter Format

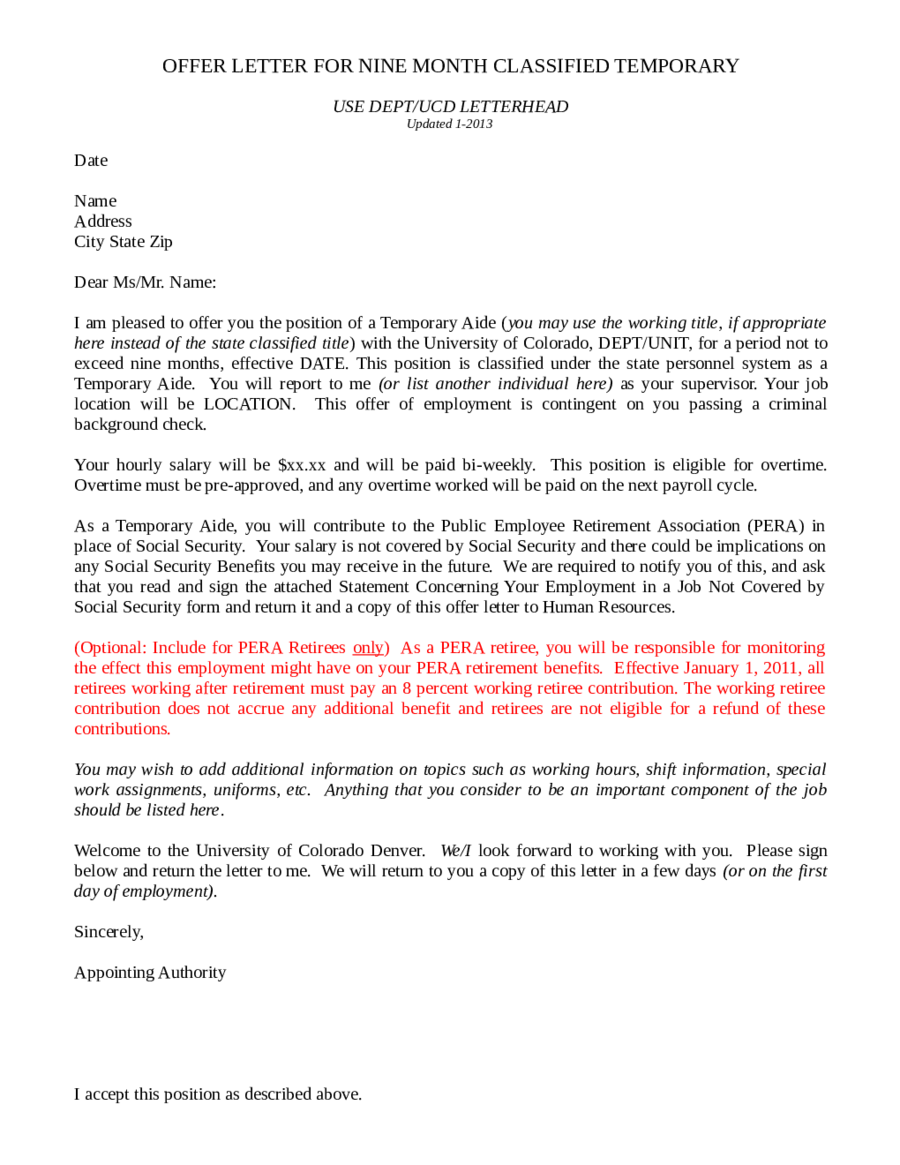

OFFER LETTER FOR NINE MONTH CLASSIFIED TEMPORARY

USE DEPT/UCD LETTERHEAD

Updated 1-2013

Date

Name

Address

City State Zip

Dear Ms/Mr. Name:

I am pleased to offer you the position of a Temporary Aide (you may use the working title, if appropriate

here instead of the state classified title) with the University of Colorado, DEPT/UNIT, for a period not to

exceed nine months, effective DATE. This position is classified under the state personnel system as a

Temporary Aide. You will report to me (or list another individual here) as your supervisor. Your job

location will be LOCATION. This offer of employment is contingent on you passing a criminal

background check.

Your hourly salary will be $xx.xx and will be paid bi-weekly. This position is eligible for overtime.

Overtime must be pre-approved, and any overtime worked will be paid on the next payroll cycle.

As a Temporary Aide, you will contribute to the Public Employee Retirement Association (PERA) in

place of Social Security. Your salary is not covered by Social Security and there could be implications on

any Social Security Benefits you may receive in the future. We are required to notify you of this, and ask

that you read and sign the attached Statement Concerning Your Employment in a Job Not Covered by

Social Security form and return it and a copy of this offer letter to Human Resources.

(Optional: Include for PERA Retirees only) As a PERA retiree, you will be responsible for monitoring

the effect this employment might have on your PERA retirement benefits. Effective January 1, 2011, all

retirees working after retirement must pay an 8 percent working retiree contribution. The working retiree

contribution does not accrue any additional benefit and retirees are not eligible for a refund of these

contributions.

You may wish to add additional information on topics such as working hours, shift information, special

work assignments, uniforms, etc. Anything that you consider to be an important component of the job

should be listed here.

Welcome to the University of Colorado Denver. We/I look forward to working with you. Please sign

below and return the letter to me. We will return to you a copy of this letter in a few days (or on the first

day of employment).

Sincerely,

Appointing Authority

I accept this position as described above.

Signature: ______________________________________ Date: ________________

Statement Concerning Your Employment in a Job

Not Covered by Social Security

Employee Name Employee ID#

Employer Name University of Colorado Employer ID# 84-6000555

Your earnings from this job are not covered under Social Security. When you retire, or if you become disabled, you

may receive a pension based on earnings from this job. If you do, and you are also entitled to a benefit from Social

Security based on either your own work or the work of your husband or wife, or former husband or wife, your

pension may affect the amount of the Social Security benefit you receive. Your Medicare benefits, however, will not

be affected. Under the Social Security law, there are two ways your Social Security benefit amount may be affected.

Windfall Elimination Provision

Under the Windfall Elimination Provision, your Social Security retirement or disability benefit is figured using a

modified formula when you are also entitled to a pension from a job where you did not pay Social Security tax. As

a result, you will receive a lower Social Security benefit than if you were not entitled to a pension from this job. For

example, if you are age 62 in 2005, the maximum monthly reduction in your Social Security benefit as a result of

this provision is $313.50. This amount is updated annually. This provision reduces, but does not totally eliminate,

your Social Security benefit. For additional information, please refer to Social Security Publication, “Windfall

Elimination Provision.”

Government Pension Offset Provision

Under the Government Pension Offset Provision, any Social Security spouse or widow(er) benefit to which you

become entitled will be offset if you also receive a Federal, State or local government pension based on work where

you did not pay Social Security tax. The offset reduces the amount of your Social Security spouse or widow(er)

benefit by two-thirds of the amount of your pension.

For example, if you get a monthly pension of $600 based on earnings that are not covered under Social Security,

two-thirds of that amount, $400, is used to offset your Social Security spouse or widow(er) benefit. If you are

eligible for a $500 widow(er) benefit, you will receive $100 per month from Social Security ($500- $400=$ 100).

Even if your pension is high enough to totally offset your spouse or widow(er) Social Security benefit, you are still

eligible for Medicare at age 65. For additional information, please refer to Social Security Publication,

“Government Pension Offset’

For More Information

Social Security publications and additional information, including information about exceptions to each provision,

are available at www.socialsecurity.gov. You may also call toll free 1-800-772-1213, or for the deaf or hard of

hearing call the TTY number 1-800-325-0778, or contact your local Social Security office.

I certify that I have received Form SSA-1945 that contains information about the possible effects of the

Windfall Elimination Provision and the Government Pension Offset Provision on my potential future Social

Security benefits.

Signature of Employee Date

Form SSA-1945 (12-2004)

Information about Social Security Form SSA-1945

Statement Concerning Your Employment in a Job Not Covered by Social Security

New legislation [Section 419(c) of Public Law 108-203, the Social Security Protection Act of 2004] requires State

and local government employers to provide a statement to employees hired January 1, 2005 or later in a job not

covered under Social Security. The statement explains how a pension from that job could affect future Social

Security benefits to which they may become entitled.

Form SSA-1945, Statement Concerning Your Employment in a Job Not Covered by Social Security, is the

document that employers should use to meet the requirements of the law. The SSA-1945 explains the potential

effects of two provisions in the Social Security law for workers who also receive a pension based on their work in a

job not covered by Social Security. The Windfall Elimination Provision can affect the amount of a worker’s Social

Security retirement or disability benefit. The Government Pension Offset Provision can affect a Social Security

benefit received as a spouse or an ex-spouse.

Employers must:

Give the statement to the employee prior to the start of employment;

Get the employee’s signature on the form; and

Submit a copy of the signed form to the pension paying agency.

Social Security will not be setting any additional guidelines for the use of this form.

Copies of the SSA-1945 are available online at the Social Security website, www.socialsecurity.gov/form1945/.

Paper copies can be requested by email at oplm.oswm.rqct[email protected] or by fax at 410-965-2037. The request

must include the name, complete address and telephone number of the employer. Forms will not be sent to a post

office box. Also, if appropriate, include the name of the person to whom the forms are to be delivered. The forms

are available in packages of 25. Please refer to Inventory Control Number (ICN) 276950 when ordering.

Form SSA-1945 (12-2004)